【Petroleum Coke】Maintenance Season Approaches, Can the Petroleum Coke Market Seize the Opportunity?

【Petroleum Coke】Maintenance Season Approaches,

Can the Petroleum Coke Market Seize the Opportunity?

In March, some refineries began planned shutdowns for maintenance, resulting in a slight decrease in domestic resource supply. With a slight uptick in market entry enthusiasm on the demand side, can the petroleum coke market be propelled into an upward trend by dual-directional demand and supply?

I. Supply-Side Analysis

Data Source: Oilchem

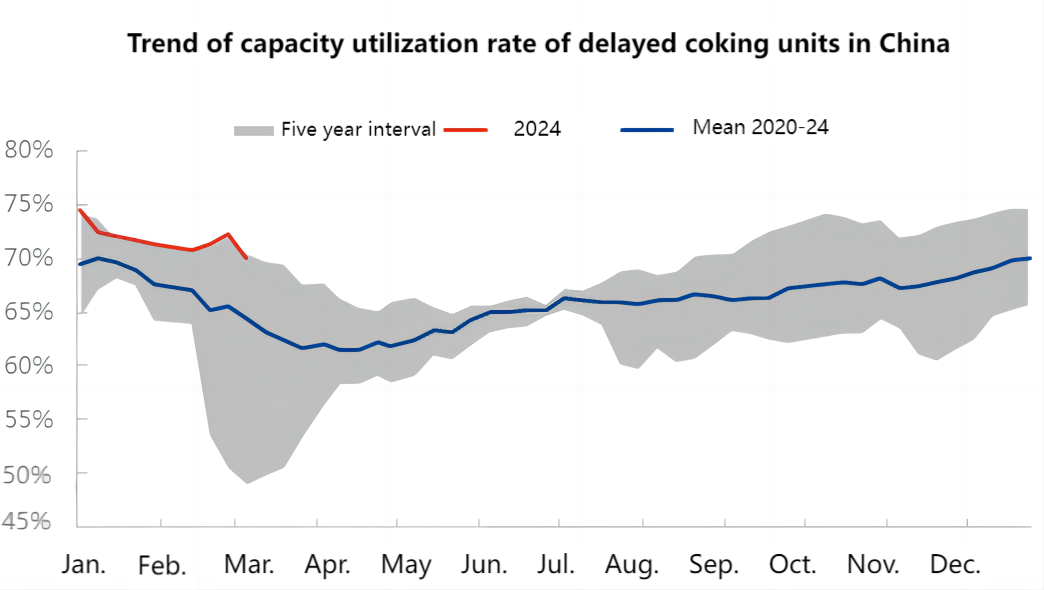

According to statistical analysis of petroleum coke data, the utilization rate of delayed coking units in China has remained at a high level in recent years. As of the first week of March, the average capacity utilization rate of delayed coking units in China reached 70.04%. Although it decreased by 0.56 percentage points year-on-year, it still remained at a high level.

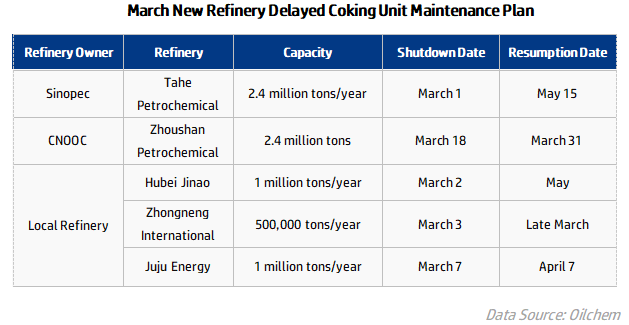

According to market research statistics, in March, five refineries with a total of 7.3 million tons/year of delayed coking unit capacity will undergo shutdown maintenance, with a loss of 102,700 tons by the end of the month. Among them, the loss of low-sulfur petroleum coke due to maintenance reached 16,300 tons, and the loss of medium-sulfur petroleum coke was 18,200 tons.

II. Demand-Side Analysis

Data Source: Oilchem

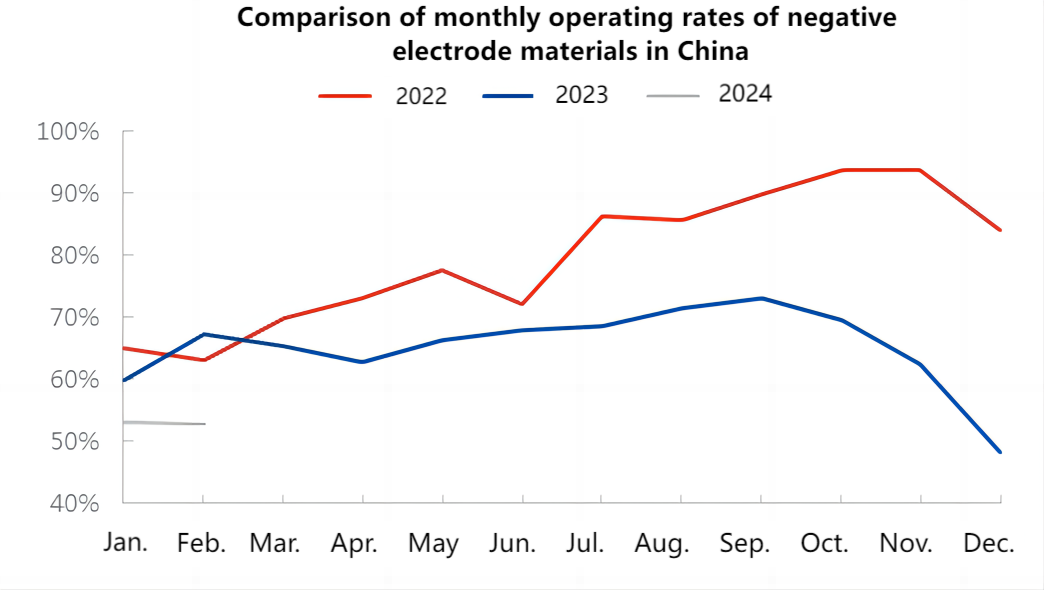

It is learned that the average capacity utilization rate of negative electrode materials in January-February 2024 was 52.97%, a decrease of 10.79% year-on-year. In early March, some enterprises actively stocked up, resulting in an increase in demand for raw materials and auxiliary materials, providing strong support for the petroleum coke and general calcined petroleum coke markets. It was also found through market research that the number of new orders signed by some negative electrode companies in March increased, and leading companies showed a positive purchasing attitude, which still had a positive impact on the petroleum coke market.

Data Source: Oilchem

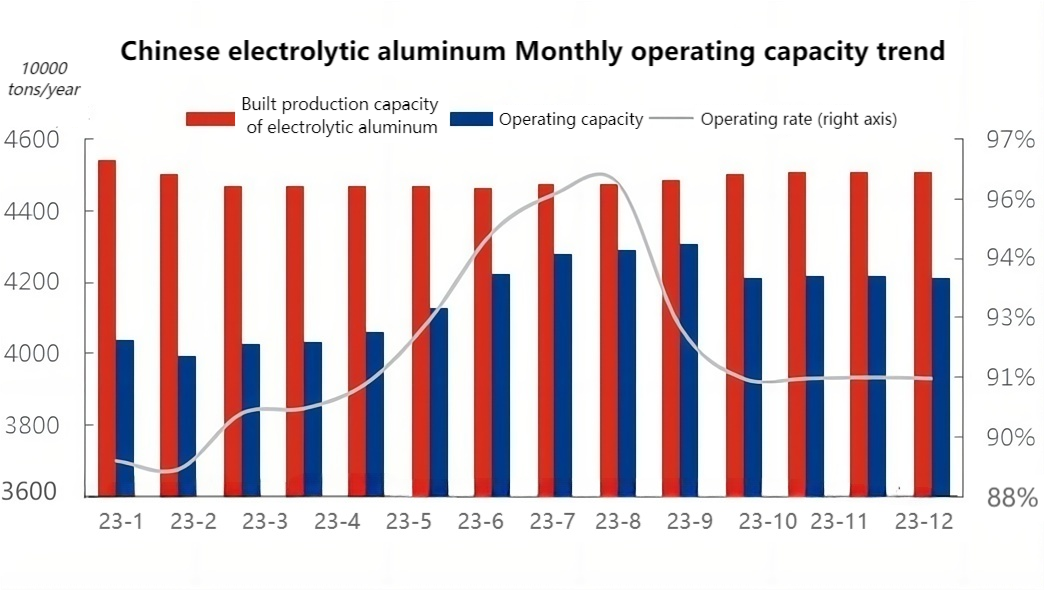

Market research revealed that the current electrolytic aluminum enterprises maintain a stable production state, with a market operation capacity of about 45.0885 million tons and an operating rate of around 91%. There is a possibility of future resumption of production for Yunnan electrolytic aluminum, and the demand for prebaked anodes is good.

Prebaked anode production enterprises maintain a basically stable operating load, with some companies that underwent maintenance in the early stage still not fully recovering to full production operation. Recently, Henan Jiaozuo lifted the orange warning for heavy pollution weather, and enterprises in the region are producing orders according to plan. Enterprises in the southwest region operate well, and the overall market still has a just-in-time support for petroleum coke shipments.

III. Future Forecast:

In March, domestic petroleum coke supply will continue to decrease, while imported coke will partially serve as a supplement, but the price advantage over domestic coke is not yet apparent. The demand side market is slowly recovering, with terminal benefits gradually becoming apparent. With dual-directional influences from supply and demand, it is expected that the domestic petroleum coke market in March will mainly operate in a consolidating manner, with the possibility of slight upward movement in the coke prices of some refineries. Contact us for more information on policy analysis of the petroleum coke market.

No related results found

0 Replies