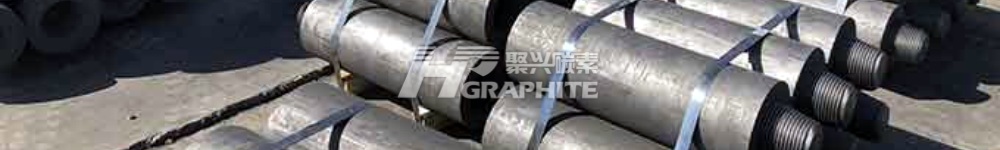

【Graphite Electrodes】Are Exports More Stable Than Domestic Sales?

【Graphite Electrodes】Are Exports More Stable Than Domestic Sales?

According to statistics, China's graphite electrode exports showed a year-on-year growth trend in January and February 2024. In January 2024, China's graphite electrode exports reached 29,500 tons, representing a 14.91% increase compared to the previous month and a 12.05% increase year-on-year. The top three export destinations were Russia (5,070 tons), Turkey (2,210 tons), and South Korea (1,750 tons).

In February, despite a 19.34% month-on-month decrease due to the Chinese New Year holiday, exports still increased by 10.05% year-on-year, reaching 23,800 tons. The top three export destinations were Russia (3,470 tons), the United Arab Emirates (2,250 tons), and the United States (1,780 tons).

Additionally, Russia emerged as the largest importer of Chinese graphite electrodes for two consecutive months, with the highest export volume and value. This further demonstrates Russia's growing demand for graphite electrodes. Feedback from a leading graphite electrode manufacturer indicates that since the beginning of 2024, the export situation for graphite electrodes has shown a more stable trend compared to domestic sales. Specifically, the export proportion has increased, occupying at least half of the total sales. In contrast, domestic market demand appears more unstable due to fluctuations in demand from domestic steel mills, which operate intermittently.

This indicates that, firstly, overseas demand for graphite electrodes remains relatively stable. Secondly, the influx of low-priced excess graphite electrodes from China into overseas markets is a significant phenomenon.

From a production perspective, graphite electrode companies with export channels can maintain relatively stable production levels. However, for companies primarily reliant on domestic sales, the situation is more challenging, leading to significant sales pressure. To address this pressure, many companies resort to price wars or production cuts, resulting in a decline in graphite electrode prices.

In this market environment, companies with export capabilities should continue to explore international markets to stabilize export sales and alleviate pressure on the domestic market. Meanwhile, companies focused on domestic sales should actively seek new market demand and adjust production strategies accordingly. Follow us to stay updated on short-process electric furnace steel news.

No related results found

0 Replies