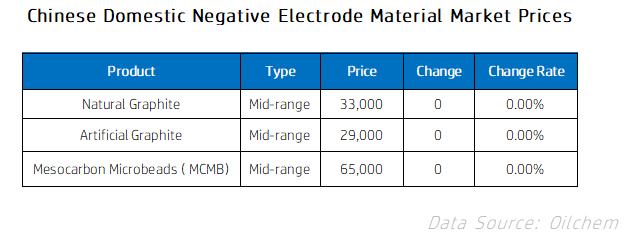

【Negative Electrode】Artificial graphite at 24,000-39,000 RMB/ton

【Negative Electrode Materials】Natural graphite at 33,000-37,000 RMB/ton,

artificial graphite at 24,000-39,000 RMB/ton

1.Current Focus:

1)Shanshan Co. has validated the sample of its consumer fast-charging negative electrode 6C product, further solidifying its global leading advantage; the discharge rate of power negative electrode materials has been increased from 3C to 4C and 5C, making it a reality to achieve a range of 400 kilometers with a 10-minute charge, pioneering the industrialization of hard carbon technology. The first thousand-ton-level hard carbon production line in the industry has been completed and put into operation, achieving batch application of related products in sodium batteries, lithium batteries, and semi-solid-state batteries. Pay attention to the negative electrode material graphitized petroleum coke (gpc).

2)On April 8th, at the construction site of the first-phase 3,000-ton project of Shanghai Morley Natural Graphite Negative Electrode Material Precursor in Jikou Emerging Industrial Park, Yanzhuang Town, Sanyuan District, workers were conducting final checks and adjustments on the installed pretreatment equipment, making final preparations for the official production at the end of this month.

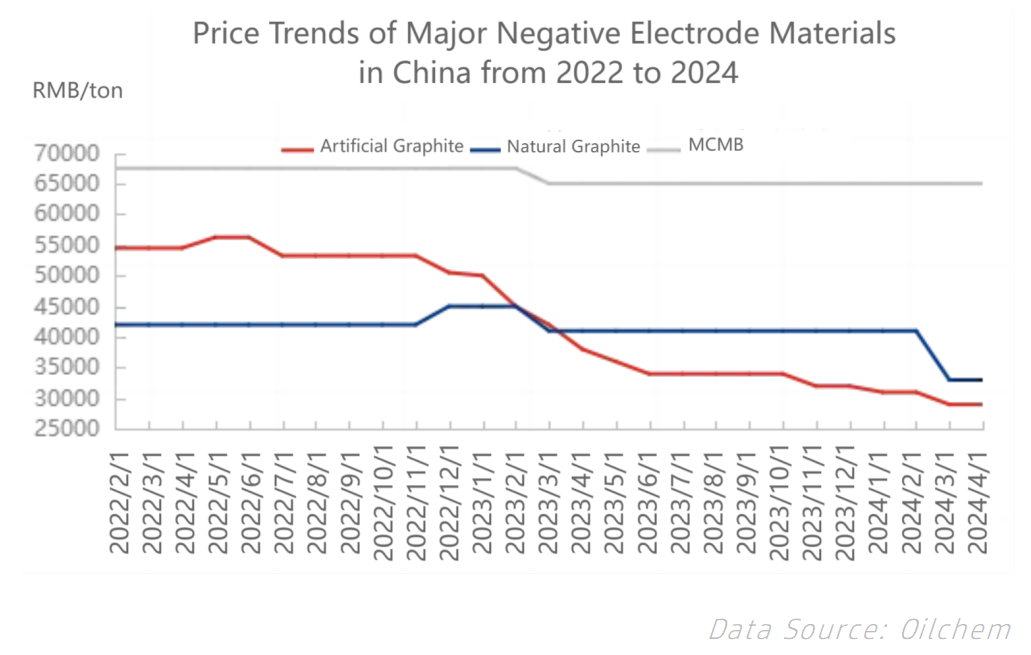

2.Current Market:

Mainstream negative electrode materials, with natural graphite at 33,000-37,000 RMB/ton, artificial graphite at 24,000-39,000 RMB/ton, and intermediate carbon microspheres at 65,000-70,000 RMB/ton.

3.Production and Sales Dynamics:

1)Supply: Major negative electrode material enterprises are operating at full capacity, while small and medium-sized enterprises maintain stability with lower capacity.

2)Demand: Downstream demand has increased slightly, and negative electrode materials are executing new orders.

4.Related Product Market:

1)Petroleum Coke: At present, the overall trading performance of the domestic petroleum coke market is relatively stable, with refineries actively signing contracts and sporadic price adjustments. The mainstream market maintains low inventory operation, with refineries mainly executing order contracts. The low-sulfur petroleum coke market still lacks significant positive catalysts, while the medium-to-high sulfur market has seen an increase in signed contracts, with transaction prices maintaining stable transition.

2)Needle Coke: Influenced by the rebound in downstream negative electrode demand, the sales volume of needle coke for carbonization has increased, with mainstream enterprises maintaining stable production and executing order contracts. The mainstream prices for raw coke are 4,800-5,500 RMB/ton, and for calcined coke, 6,500-7,800 RMB/ton.

5.Future Forecast:

Negative electrode enterprises are currently operating at full capacity, especially major enterprises with large production volumes. The previous high-priced inventory has been basically digested, with no pressure on inventory, and overall market prices are stable. Contact us for more information on the negative electrode material industry.

No related results found

0 Replies