【Petroleum Coke】Quarterly Outlook: Q1 Surged and Then Declined, Q2 May Fluctuate Upward

Petroleum coke is mainly used to make graphite electrodes, with key downstream applications in aluminum electrolysis, electric vehicles, and steelmaking. Due to its high carbon content, petroleum coke is widely used as electrode material in electric arc furnace (EAF) steel production.

【Petroleum Coke】Quarterly Outlook: Q1 Surged and Then Declined, Q2 May Fluctuate Upward

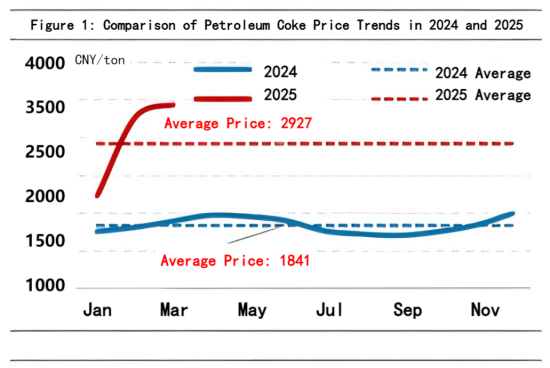

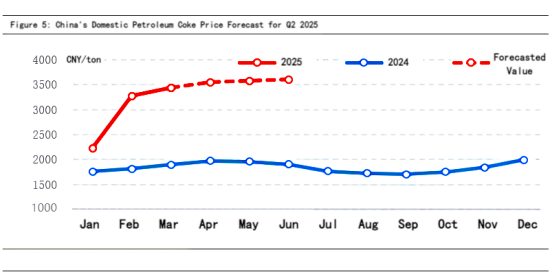

In Q1 2025, the petroleum coke market experienced a brief surge before declining. The primary influencing factor was the combined effect of limited domestic supply and strong demand, which drove trading prices higher. However, as the bullish factors were gradually digested and downstream profit margins were squeezed, demand weakened, leading to downward pressure on petroleum coke prices from mid-to-late February. In Q2, supply tightness is expected to remain a bullish factor, while demand remains stable, suggesting that domestic petroleum coke prices may fluctuate upward.

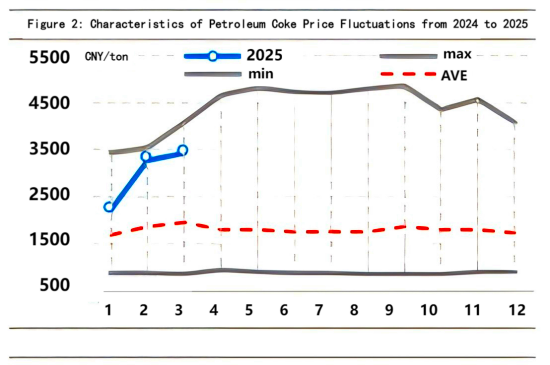

In Q1 2025, the domestic petroleum coke market peaked and then retreated. As of March 24, the national average price of petroleum coke in Q1 stood at RMB 2,927/ton, up 57.11% quarter-on-quarter and 60.47% year-on-year. Throughout the quarter, the monthly average prices were at a mid-to-high level compared to the past five years. The main reasons include tight supply and increased pre-holiday stockpiling demand from the anode material and aluminum carbon sectors in January and February, which pushed petroleum coke prices to their highest levels in nearly three years. However, as the bullish factors were gradually absorbed and downstream demand weakened, petroleum coke prices began to face downward pressure from mid-to-late February.

Q1: Limited Supply Tightened Market, Driving Early Price Surge

Supply Side

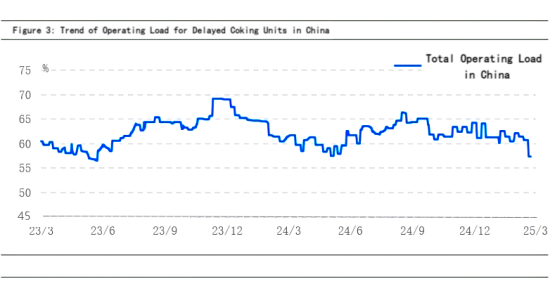

The decline in refinery coking unit operating rates provided support for petroleum coke prices in early Q1, but as refining margins improved, downward pressure on prices intensified. As the only production unit for petroleum coke, changes in the operating rates of delayed coking units directly determine its supply levels. As of March 24, the total operating load of domestic coking units in Q1 was 61.52%, down 1.45 percentage points from Q4 2024. The average operating load of coking units in Shandong independent refineries was 49.34%, down 7.09 percentage points from Q4 2024.

The main reasons were:

1. In January and February, falling fuel oil processing margins and restrictions on crude oil imports at ports led to increased raw material costs, resulting in reduced production and maintenance shutdowns at independent refineries.

2. The rise in low-sulfur fuel oil production led to a decline in low-sulfur petroleum coke output from PetroChina, while Sinopec's supply remained stable. As a result, overall petroleum coke supply decreased.

3. In February, the strong rally in petroleum coke prices boosted refinery profits from delayed coking units. With multiple factors driving the market, some previously shut-down refineries resumed operations, while some active refineries increased their operating rates, leading to a slight increase in petroleum coke supply.

Demand Side

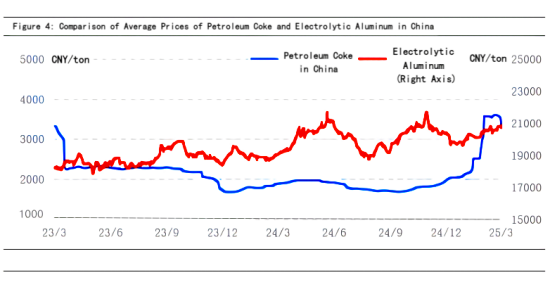

The significant petroleum coke price increase in Q1 was primarily supported by strong demand from leading anode material manufacturers, who maintained high production levels. These companies had ample orders and increased post-holiday restocking of petroleum coke, driving prices higher. However, as petroleum coke prices reached a certain high level, losses in the downstream carbon industry expanded, overall demand weakened, and the market shifted from rising to declining.

In terms of price stability, the aluminum electrolysis sector, which accounts for 65% of demand, maintained relatively strong profitability in Q1. Current adjustments to export tariffs have not had a significant impact on aluminum smelters. Downstream processing plants continued stable aluminum liquid consumption, prompting smelters to maintain high production loads, ensuring stable raw material procurement demand. Due to capacity constraints, aluminum smelting supply has nearly reached its ceiling. The expected capacity increase in 2025 is less than 500,000 tons, with output growth below 1 million tons. Additionally, attention should be paid to potential production cuts triggered by seasonal fluctuations in hydropower resources in Yunnan.

Q2: Supply and Demand Fundamentals to Drive Petroleum Coke Prices, With Supply as the Key Factor

Supply Side

Entering Q2, refineries will enter the traditional maintenance season, potentially reducing domestic petroleum coke supply. Additionally, various developments in Shandong independent refineries indicate a possible decline in operating rates. Market participants have strong bullish expectations for the future, which could drive an increase in import demand, though the growth may be limited. Overall, domestic petroleum coke supply in Q2 is expected to tighten gradually, providing upward support for prices.

Demand Side

Currently, downstream demand remains stable, and market participants continue to follow a just-in-time procurement approach. In Q2, calcination capacity adjustments for downstream calcined coke products are expected to be limited, while demand for raw materials in the anode materials sector is projected to increase steadily. This may shift the trading focus of the petroleum coke market upward.

Market Outlook

Overall, with supply remaining a bullish factor and demand maintaining steady procurement operations, the domestic petroleum coke market is expected to experience fluctuating upward trends in Q2. The projected price increase range is approximately RMB 50-200/ton, with average price fluctuations anticipated between RMB 3,350-3,600/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies