【Calcined Petroleum Coke】Prices Remain Stable Amid Market Caution

【Calcined Petroleum Coke】Prices Remain Stable Amid Market Caution

Market Overview

On April 22, the average price of calcined petroleum coke stood at RMB 3,263/ton, remaining flat from the previous working day. Currently, the low-sulfur calcined petroleum coke market is largely stable in pricing, though low-priced resources are still present. Downstream electrode manufacturers, aiming to control costs, show limited acceptance of current low-sulfur prices, leading to weak purchasing sentiment. The mid-to-high sulfur calcined petroleum coke market sees lukewarm trading, with downstream demand generally described as moderate; some enterprises have slightly reduced their transaction prices.

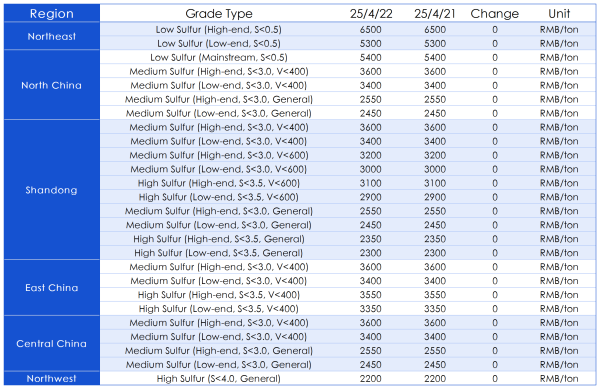

Main Regional Market Transaction Prices

Market Prices

Low-sulfur calcined petroleum coke (produced with Jinxi and Jinzhou petroleum coke) is mainly traded at RMB 5,200–5,500/ton.

Low-sulfur calcined petroleum coke (produced with Fushun petroleum coke) is sold at RMB 6,200–6,500/ton ex-works.

Low-sulfur calcined petroleum coke (produced with Liaohe and Binzhou CNOOC petroleum coke) is mainly priced at RMB 5,300–5,600/ton.

Mid-to-high sulfur calcined petroleum coke (S 3.0%, with no trace element requirements) previously had contract ex-works prices of RMB 2,450–2,550/ton in cash, with current negotiations still around RMB 2,450–2,550/ton.

Mid-to-high sulfur calcined petroleum coke (S 3.5%, no trace element requirements) previously had contract ex-works prices of RMB 2,300–2,350/ton, which remain unchanged in current discussions.

Mid-to-high sulfur calcined petroleum coke (S 3.0%, V 400) previously had contract cash prices of RMB 3,400–3,600/ton, with current ex-works discussions still at RMB 3,400–3,600/ton.

Supply

China's current daily commercial calcined petroleum coke supply is 27,638 tons, with an operating rate of 59.57%. Supply has remained stable compared to the previous working day.

Upstream Market

Petroleum Coke:

Trading remains stable at Sinopec-affiliated refineries, with some price adjustments since the previous day. In North China, Yanshan Petrochemical’s anode-grade coke (Type -2) was raised by RMB 50/ton, while low-sulfur coke from Shijiazhuang Refinery increased by RMB 180/ton. In Shandong, Qingdao Refining’s vanadium content rose above 500 PPM, leading to a price cut of RMB 30/ton, while some Qingdao Petrochemical grades were increased by RMB 30/ton. Other refineries maintained stable pricing and shipments. CNPC-affiliated refineries saw stable pricing, with low-sulfur coke purchases mainly based on rigid demand and downstream demand remaining weak. In the northwest, trading was steady and focused on order execution.

At CNOOC-affiliated refineries, Taizhou Petrochemical prices dropped by RMB 200/ton, while the Zhoushan Petrochemical auction was canceled this week. Final prices for other refineries have not yet been published.

Downstream Market

Graphite Electrodes:

Raw material prices for graphite electrodes have stabilized, weakening cost support. Combined with limited real demand, negotiations remain weak and actual transaction prices are largely constrained by rigid downstream demand. Many graphite electrode manufacturers are operating at a loss, reducing willingness to ship. The overall graphite electrode market remains weak and range-bound.

Aluminum:

Subject to both domestic and international policy constraints, future overall demand is expected to weaken. Combined with limited macroeconomic stimulus, market sentiment has declined and spot aluminum prices have dropped.

Anode Materials:

According to market feedback, trading in the anode materials market is currently stable. There is no significant positive news, and downstream demand remains relatively flat. Anode material enterprises continue to adopt production based on sales. Given the oversupply in the anode materials market, prices remain at a low level.

Market Outlook

Due to weak downstream demand and cautious procurement, low-sulfur calcined coke prices are expected to remain stable. Mid-to-high sulfur calcined coke shows balanced supply and demand, and prices are projected to stay steady in the near term.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies