【Calcined Petroleum Coke】Market Snapshot: Prices Plunge by 200 CNY/ton – What Lies Ahead?

【Calcined Petroleum Coke】Market Snapshot: Prices Plunge by 200 CNY/ton – What Lies Ahead?

Market Overview

As of May 6, the average market price of calcined petroleum coke was 3,159 CNY/ton, down 18 CNY/ton from the previous trading day, a decrease of 0.57%. Prices of low-sulfur calcined petroleum coke declined significantly due to falling prices of upstream green petroleum coke, coupled with insufficient downstream demand support. Sales performance among calcined petroleum coke producers was weak, and prices generally dropped by around 200 CNY/ton. For mid- and high-sulfur calcined petroleum coke, market activity during the May Day holiday was average, with most producers maintaining current prices for existing contracts, although a few enterprises under shipment pressure slightly lowered prices.

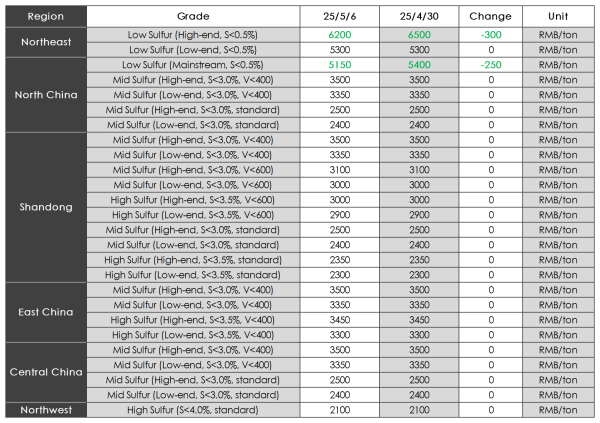

Main Regional Transaction Prices

Low-sulfur CPC (using Jinxi and Jinzhou GPC): 5,150–5,300 CNY/ton

Low-sulfur CPC (using Fushun GPC): 6,100–6,200 CNY/ton (ex-works)

Low-sulfur CPC (using Liaohe and Binzhou CNOOC GPC): 5,200–5,300 CNY/ton

Mid-high sulfur CPC (S 3.0%, no requirement on trace elements): Previously contracted ex-works cash price at 2,400–2,500 CNY/ton; current negotiation range remains 2,400–2,500 CNY/ton

Mid-high sulfur CPC (S 3.5%, no requirement on trace elements): Previously contracted ex-works cash price at 2,300–2,350 CNY/ton; current negotiation range remains 2,300–2,350 CNY/ton

Mid-high sulfur CPC (S 3.0%, V 400ppm): Previously contracted price at 3,350–3,500 CNY/ton; current negotiation price unchanged at 3,350–3,500 CNY/ton

Supply Situation

As of now, daily commercial supply of calcined petroleum coke in China is approximately 27,198 tons, with an operating rate of 57.77%, remaining stable compared to the previous working day.

Upstream Market

Green Petroleum Coke: Refineries under Sinopec are maintaining stable pricing and shipments. In the Yangtze River region, Anqing Petrochemical focuses on anode-grade shipments. Hunan Petrochemical and Jiujiang Petrochemical are shut down for maintenance, while Wuhan and Jingmen Petrochemical supply to carbon plants. In East China, mid- and high-sulfur GPC shipment is steady. In Northwest China, Tarim Petrochemical primarily supplies aluminum carbon producers, with increased outbound shipments and reduced inventory. PetroChina's refineries in Northeast China are selling based on demand. May prices have dropped by 200–300 CNY/ton. Jinxi Petrochemical remains offline for maintenance, with overall downstream demand still weak. In the Southwest, Yunnan Petrochemical demand remains stable. Under CNOOC, Huizhou Petrochemical is operating normally via auction; other refineries are fulfilling orders. CNOOC Asphalt plans to shut down for maintenance starting May 9.

Downstream Market

Graphite Electrodes: Upstream low-sulfur GPC prices saw slight declines at the beginning of May, easing production pressure for electrode producers. However, cost support has weakened. Market discussions are constrained by weak demand. Most electrode producers remain cautious after the holiday, mainly executing previous orders, and mainstream prices are holding steady.

Primary Aluminum: Previously anticipated negative impacts from tariffs may begin to materialize this month. Along with slow negotiation progress and rising recession concerns, spot aluminum prices are falling.

Anode Materials: The market remains stable for now. According to market feedback, supply is currently sufficient. Leading anode material producers are operating at high capacity utilization. Small and mid-sized firms continue to produce based on sales orders. Amid overall overcapacity in the anode market, downstream buyers continue to push for lower prices. The industry still faces strong pressure to reduce costs and improve efficiency.

Outlook

Low-sulfur calcined petroleum coke sales have not improved, and prices are expected to stabilize temporarily after the recent reduction. Mid- and high-sulfur calcined petroleum coke trading activity remains average. With persistent downstream price suppression, calcined petroleum coke producers continue to face shipment pressure.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies