【EAF Steel】Analysis of the Reasons Behind the Continued Low Capacity Utilization Rate

Graphite electrodes are key materials for EAF steelmaking, mainly used for arc heating. With excellent conductivity

and high-temperature resistance, they are crucial for improving EAF production efficiency and quality.

【EAF Steel】Analysis of the Reasons Behind the Continued Low Capacity Utilization Rate of Independent EAF Enterprises

As of this week, the capacity utilization rate of independent EAF enterprises in China stands at 56.57%, an increase of 1.49 percentage points compared to the previous week. Although the weekly utilization rate has shown a certain increase, it remains basically flat year-on-year. However, based on data from recent years, the utilization rate has remained below 60% for an extended period. This is closely related to the challenges currently faced by EAF enterprises. Below, we will analyze from multiple dimensions why capacity utilization has remained at a low level in recent years.

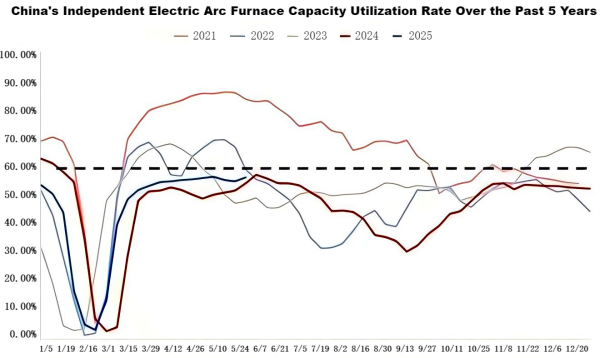

I. Over 70% of the Time, Capacity Utilization Has Been Below 60

According to data compiled by our platform over the past five years (on a weekly basis), only 25.22% of the weekly capacity utilization rates exceeded 60%, mostly concentrated in 2021. In that year, 59.65% of the weeks had utilization rates over 60%. Since 2022, this percentage has sharply declined. Looking at specific figures, capacity utilization in 2021 was generally high, with a peak of 86.35% in May. From March to July, utilization rates remained above 70%. However, in 2022 and 2023, the peak utilization rate failed to exceed 70%, reaching only 69.61%. In 2024 and 2025, only the first two weeks of 2024, following the trend from the end of 2023, surpassed 60%. After that, there has not been a single week above 60% as of this week. This data clearly shows that 2021 was a small peak in EAF enterprise development, but progress has since stagnated. Production enthusiasm has weakened, resulting in the share of EAF steel in total crude steel output remaining stagnant. According to the development goals set by various provinces and national-level steel industry plans, most targets aim for short-process steelmaking to account for 10%–15% of total output by 2025. Based on the current situation, achieving this goal will be challenging.

II. Tight Scrap Supply and Relatively Firm Prices

China's accumulated scrap steel reserves have reached approximately 13 billion tons. However, the underdeveloped scrap recycling system has somewhat affected supply. In recent years, scrap supply has not seen a significant increase, with annual supply remaining around 250 million tons. Every year, many steel mills report difficulties in sourcing scrap, mainly due to mismatches in depreciation timelines. Considering depreciation of buildings and equipment, a large-scale wave of scrapping may not occur until after 2030. Only then might the issue of insufficient scrap supply be alleviated. Another reality is that blast furnace mills also need to procure scrap for converter steelmaking. Meanwhile, independent EAF steel mills are accelerating commissioning under policy support, leading to competition for the same raw material pool. Obviously, blast furnace mills have greater pricing power in scrap procurement compared to independent EAF mills. As a result, more integrated blast furnace mills are building EAF facilities, further eroding the price competitiveness of independent EAF mills. Cost control challenges continue to restrict their profit margins.

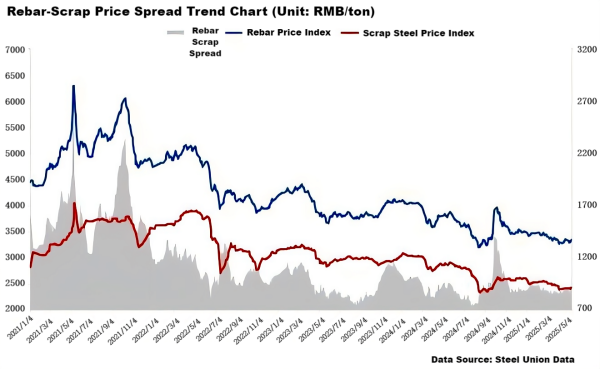

The trend of the rebar-scrap spread also supports the above conclusions: Over the past five years, the spread has narrowed from a high of RMB 2,600/ton in 2021 to the current level of RMB 900/ton. The change is mainly due to a sharp increase in rebar prices in 2021, followed by a continuous decline. Since 2023, the spread has remained below RMB 1,000/ton for an extended period, at times narrowing to around RMB 750/ton. The chart shows that the price trends of rebar and scrap are broadly aligned, but the persistent weakness in rebar prices and limited rebound strength have prevented a significant expansion of the spread. This has, to some extent, dampened steel mills' production enthusiasm and squeezed profit margins. Particularly for mills with finished product prices around RMB 3,000/ton, profitability is becoming increasingly fragile.

III. Power Costs Squeeze Profit Margins

In most regions today, electricity pricing follows a time-of-use model. Under this system, independent EAF mills can remain profitable during off-peak hours, but incur small losses during normal pricing periods. According to current research, few steel mills extend production into peak electricity hours, and even if they remain profitable during normal hours, they quickly scale back production during peak pricing periods. This is in ordinary seasons. During summer peak electricity demand periods, production hours are further shortened—an increasingly obvious trend over the past three years. Consequently, capacity utilization remains low and difficult to improve.

IV. Product Mix Remains Limited

The scrap steel recycling system is complex, and its quality is difficult to guarantee. Impurities in scrap cannot be effectively controlled through EAF processes. Therefore, if producing items like coils, quality issues such as breakage may arise. Due to this, EAF systems do not hold a significant advantage when producing anything other than construction materials and are currently focused mainly on this category. According to our research, about 80% of independent EAF mills mainly produce construction steel, with only a few also producing special steel and other varieties.The slump in demand for construction steel is a well-known fact, which has also led to depressed prices—recently reaching multi-year lows. This undoubtedly suppresses steel mills’ production enthusiasm.

V. Furnace Capacity Limits Utilization Rate Improvement

Although EAF furnace sizes have been increasing, among steel mills with existing EAF equipment, only a small proportion have furnaces larger than 100 tons. These are mainly located in East, South, and Southwest China. In most other regions, furnace sizes are around 70 tons. Smaller furnaces do not necessarily consume less power than larger ones and are significantly less efficient, thus limiting improvements in capacity utilization.

Conclusion

The continued low capacity utilization rate of independent EAF enterprises in recent years is mainly due to high costs squeezing profit margins, limited product variety, and smaller furnace sizes. To improve EAF utilization and increase the share of EAF steel in total production, efforts must be made in the following areas: enhance scrap supply and continue electricity subsidies to reduce costs; eliminate small furnaces and promote larger EAF equipment; and diversify product lines to broaden production capabilities.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies