【Anode Materials】Preliminary Tariff Rate Cut from 920% to 6.55% ...

With the rapid growth of electric vehicles and energy storage systems, the demand for high-performance lithium batteries is increasing, driving the need for high-quality petroleum coke and artificial graphite. The quality and specifications of calcined petroleum coke directly affect the performance of artificial graphite, making high-quality petroleum coke crucial for lithium battery anode production.

【Anode Materials】Preliminary Tariff Rate Cut from 920% to 6.55%, U.S. Market Still Dependent on Chinese Anode Materials

The U.S. Department of Commerce recently issued a preliminary countervailing duty ruling on anode materials imported from China. Huzhou Kaijin New Energy Technology Co., Ltd. and Shanghai Shaosheng Knitted Sweat, for not responding to the investigation, were preliminarily assigned duties of 712.03% and 721.03%, respectively. All other Chinese producers and exporters of anode materials received a preliminary duty rate of 6.55%. A final ruling is expected by September 29, 2025.

Contrary to earlier rumors, Huzhou Kaijin is not shut down. According to China News Service, the company is operating at full capacity, with Q1 orders up by an estimated 30% year-on-year. Daily shipments have reached around 300 tons, and the company is planning technical upgrades to further boost capacity.

As for Shanghai Shaosheng Knitted Sweat, no records of involvement in anode material production have been found according to Qichacha.

Anode materials, one of the four key components of lithium-ion batteries, are primarily made from natural and synthetic graphite. The preliminary ruling stems from a petition submitted in late 2023 by the American Alliance for Anode Material Producers (AAAMP), which includes Syrah Technologies LLC (Australia), NOVONIX Anode Materials LLC, and Epsilon Advanced Materials (India). Companies named in the petition include BTR (835185.BJ), China Baoan (000009.SZ), and major importers such as Ford, Tesla, LG Energy Solution, and Panasonic.

AAAMP alleged that China, through state subsidies and industrial support, has dumped low-cost graphite into the global market, damaging U.S. producers. They initially requested a 920% duty on Chinese anode materials.

The final preliminary duty rate is much lower, a result of multi-party negotiations. According to Liu Yanlong, former Secretary-General of the China Industrial Association of Power Sources, U.S.-based anode producers initiated the petition to reduce competition. However, for American battery manufacturers, Chinese anode materials remain superior in both price and quality, making high tariffs unfavorable.

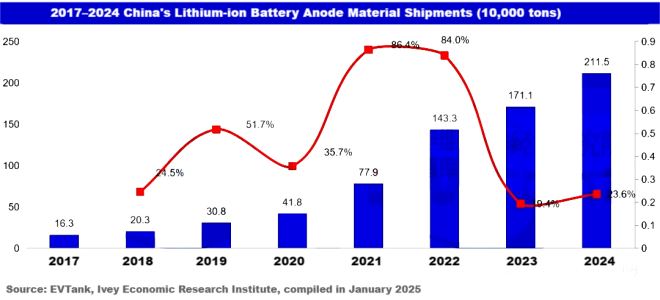

China is currently the world's largest producer and exporter of anode materials, benefiting from cost-effective manufacturing and a complete industrial chain. According to the 2025 White Paper on China's Lithium-Ion Battery Anode Materials Industry by EVTank, the Institute of Ivey Economic Research, and the China Battery Industry Research Institute, global anode material shipments in 2024 reached 2.206 million tons, up 21.3% YoY. China accounted for 2.115 million tons, representing 95.9% of the global market.

Global Times cited experts stating that the U.S. accusation of subsidies is politically motivated. In reality, China has significantly reduced export rebates, and battery materials now receive little to no government subsidies. The U.S. may be acting out of concern that, in the event of conflict, it would be vulnerable to Chinese supply restrictions.

Two main reasons explain the lower preliminary duty: easing U.S.-China trade tensions, and the fact that U.S. domestic anode capacity is insufficient and technically underdeveloped, reinforcing dependence on Chinese imports.

According to Chinese commodity information provider Baichuan Yingfu, around 60% of the U.S.'s anode material imports come from China. High tariffs would inevitably increase costs for American clients. Moreover, escalating trade barriers could raise the production costs of U.S. batteries and end-use products, and disrupt global new energy supply chains.

Liu Yanlong noted that the 6.55% duty is unlikely to significantly impact Chinese exports, stating: “Even with this tariff, Chinese anode materials remain competitive.”

The U.S. continues to impose measures to build its domestic anode supply chain. Last year, it raised tariffs on natural graphite under the Section 301 review. In response, China has also tightened export controls on graphite and other critical dual-use materials. As of December 3, the Chinese Ministry of Commerce imposed strict export restrictions on materials like gallium, germanium, antimony, superhard materials, and graphite, prohibiting exports for U.S. military use or users.

(Sources: Jiemian News, China News Service, Global Times)

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies