【Calcined Petroleum Coke】Supply is Adequate, Enterprises Maintain Price Stability for Sales

【Calcined Petroleum Coke】Supply is Adequate, Enterprises Maintain Price Stability for Sales

Market Overview

On June 23, the average price of calcined petroleum coke was 2,857 RMB/ton, holding steady compared to the previous trading day. The market for low-sulfur calcined petroleum coke remains stable, with raw material prices also stable at present. The downstream electrode market shows no clear signs of improvement, so prices for low-sulfur calcined petroleum coke orders are maintained. The market for medium- and high-sulfur calcined petroleum coke is somewhat improving regarding raw material prices; however, the downstream demand is insufficient, leading to limited acceptance of higher prices. Coupled with ample supply in the market, most calcined petroleum coke producers are stabilizing prices and maintaining steady shipments.

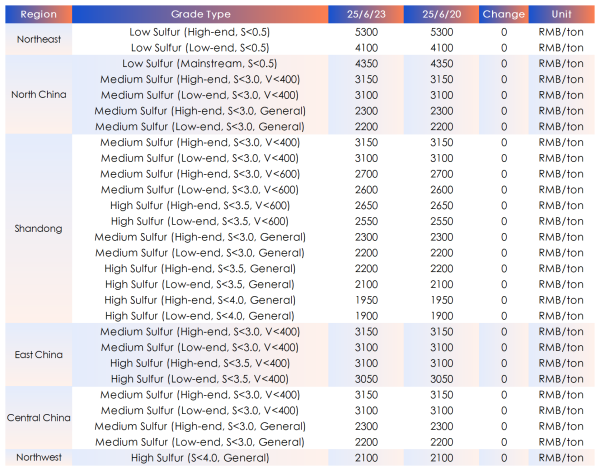

Key Regional Market Transaction Prices

1. Low-sulfur calcined petroleum coke (raw materials from Jinxi and Jinzhou petroleum coke): Main transaction prices range from 4,350 to 4,500 RMB/ton.

2. Low-sulfur calcined petroleum coke (raw materials from Fushun petroleum coke): Main ex-plant transaction prices range from 5,200 to 5,350 RMB/ton.

3. Low-sulfur calcined petroleum coke (raw materials from Liaohe and Binhzhou China National Petroleum): Main transaction prices range from 4,100 to 4,300 RMB/ton.

4. Medium-High sulfur calcined petroleum coke (with sulfur content of 3.0%, no trace element requirements): Previously contracted main price was cash 2,200-2,300 RMB/ton, now generally negotiated at ex-works cash price within this range.

5. MHS (sulfur 3.5%, no trace element requirements): Previously contracted main price was cash 2,100-2,200 RMB/ton, currently under negotiation at ex-works cash price within this range.

6. MHS (sulfur 3.0%, vanadium 400): Previously contracted main price was cash 3,100-3,150 RMB/ton, now under negotiation at ex-works cash price within this range.

Supply

Currently, the daily supply of commercial calcined petroleum coke nationwide is about 26,112 tons, with an operational rate of 55.24%. The overall supply in the market has increased slightly by 0.03% compared to the previous working day.

Upstream Market

· Petroleum coke: Refineries under Sinopec are maintaining stable prices and shipments.

1. Qilu Petrochemical South Plant has completed coke clearing and has resumed production.

2. Qingdao Petrochemical has scheduled inspections until the end of the month, lasting 50 days.

3. For the Jiangsu region, Hunan Petrochemical plans to restart before the month's end, and Anqing Petrochemical's negative electrode coke shipments are stable.

4. In South China, Guangzhou Petrochemical maintains stable shipments; Beihai refinery primarily supplies general coke, with no supplies of anode or energy storage coke.

5. Northeast under CNPC shows divergent shipments: Daqing Petrochemical and Fushun Petrochemical have strong demand and no pressure on shipments, while Jinxi Petrochemical has accumulated stock and limited shipments.

6. Northwest refiners are shipping as needed, with stable aluminum carbon procurement.

7. CNOOC's refineries are aligning shipments with demand, and their asphalt coke units are expected to start within this week.

Downstream Market

· Graphite electrodes: Upstream raw material prices remain stable. Slight upward pressure on low-sulfur petroleum coke prices is expected, driven by cost support. However, due to weak downstream demand, price increases are limited, and most enterprises are fulfilling existing orders. Mainstream报价 (quotations) for graphite electrodes remain steady, maintaining a stable market trend from last week.

· Electrolytic aluminum: Aluminum ingot inventories have increased, diminishing concerns about shortages. Coupled with a slowdown in macro-policy release, spot aluminum prices have declined.

· Negative electrode materials: The market is currently steady. Feedback from providers suggests overall order volumes are stable but turning weaker; most companies fulfill previous orders, with subdued trading sentiment.

Market Outlook

The price of low-sulfur calcined petroleum coke is expected to remain stable, though downstream demand remains weak. The market for medium- and high-sulfur calcined petroleum coke is also stable, supported by raw material prices, but due to ample supply and high inventory levels, most producers will stabilize prices and maintain steady shipments.

Source: Baiinfo

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies