【Graphite Electrode】Significant Fluctuations in Costs, Market First Rise then Fall

【Graphite Electrode】Significant Fluctuations in Costs, Market First Rise then Fall

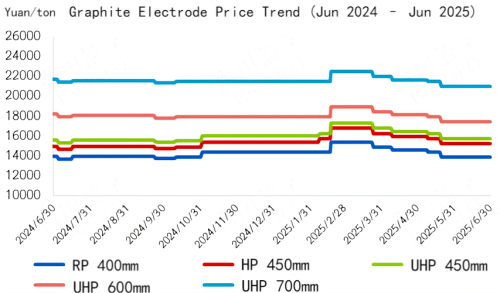

The overall trend of the graphite electrode market in the first half of 2025 showed an initial increase followed by a decline. By the end of June, main market prices had experienced slight decreases compared to the beginning of the year. The fluctuations in graphite electrode prices during the first half were mainly influenced by upstream raw material prices. However, due to weakening costs and demand in the later part, the market declined under negative guidance.

As of the end of June 2025, the mainstream prices for graphite electrodes with diameters of 300-600mm are as follows:

1. General-purpose: 13,500-15,200 RMB/ton

2. High-power: 14,500-17,000 RMB/ton

3. Ultra-high-power: 15,000-17,900 RMB/ton

4. Ultra-high-power (700mm): 20,500-21,400 RMB/ton

The average market price for graphite electrodes was 15,421 RMB/ton, down 1.6% compared to the beginning of the year.

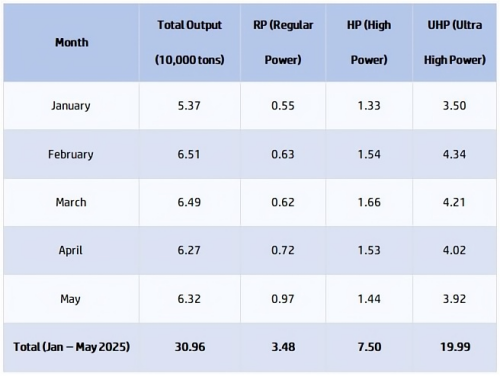

From January to June 2025, China's total graphite electrode production was approximately 374,600 tons, a decrease of 82,000 tons or 17.96% year-over-year.

Throughout the first half, China's overall graphite electrode supply remained low. Although capacity saw slight growth compared to last year, actual output declined modestly.

Table: Graphite Electrode Production from Jan to May 2025 (in million tons)

According to customs data, the total export volume of China's graphite electrodes from January to May 2025 was about 149,100 tons, an increase of 5.7% year-over-year.

Major export destinations during this period included Russia, the UAE, and South Korea. Provinces with significant import/export activity were Liaoning, Gansu, and Jiangsu.

In the second half of 2025, the market price trend for graphite electrodes is expected to slightly upward.

In terms of demand, steel plant operations in the second half are not expected to see significant boost factors, so overall demand will likely continue with rigid needs. However, there might be some phased replenishment demand from domestic steel mills and export markets in September, which could briefly lift demand.

On the cost side, upstream raw material prices are expected to slightly rise overall, keeping some cost pressure on graphite electrodes, though this will also provide some support in negotiations.

Supply-wise, graphite electrode production largely follows demand fluctuations. The market will remain subdued in the second half but may show upward movement around November, largely driven by phased inventory accumulation by enterprises. Afterward, during the Spring Festival period, activity levels are expected to decline.

In summary, the second-half market for graphite electrodes has certain positive supports. The mainstream market could see a modest stage-driven increase of roughly 300 RMB/ton, driven by short-term demand upticks.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies