【Petroleum Coke】Q2: Supply-Demand Game and Policy Impact; Market May Rise Before Falling

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Q2: Supply-Demand Game and Policy Impact; Market May Rise Before Falling

Q2 2025 Market Overview

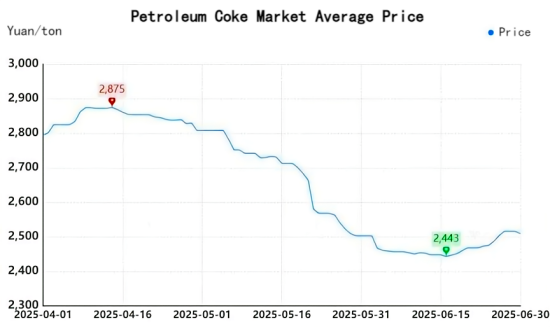

In Q2 2025, petroleum coke prices showed a slight rise, followed by a continuous decline and a slight rebound. As of June 30, 2025, the average market price for petroleum coke was RMB 2,509/ton, down RMB 266/ton compared to the end of the previous quarter, a decline of 9.59%.

Detailed Analysis:

Early in Q2, plant shutdowns, maintenance, and production reduction increased, strengthening supply-side support. Combined with downstream restocking demand and the impact of Sino-U.S. tariffs, domestic and imported coke prices slightly rose. From mid-to-late April through May, downstream restocking ended, purchases slowed, and imported coke arrivals increased. Inventory accumulation at domestic refineries caused bearish sentiment on the supply side, dragging coke prices down. In June, repair plans for some low-sulfur coke units were announced, and downstream carbon and anode material plants began depleting raw materials and restocking. High port inventory costs and slow shipments supported domestic coke sales and triggered a slight price rebound.

Q2 2025 Price Trend Analysis

1) Sinopec: Prices fell by RMB 30–940/ton

2) CNPC: Prices cumulatively fell by RMB 200–620/ton

3) CNOOC: Prices fell by RMB 220–900/ton

4) Local refineries: Prices fell by RMB 20–850/ton compared to Q1

Market average price declines by coke grade:

1) #1 Coke: -507 RMB/ton

2) #2 Coke: -366 RMB/ton

3) #3 Coke: -576 RMB/ton

4) #4-5 Coke: -146 RMB/ton

Major Refinery Operations

11 cokers shut down for maintenance in Q2, more than in Q1. Specific refinery maintenance periods include:

1) Jinxi Petrochemical: Apr 10–May 26

2) Jinan Refinery: Apr 12–Jun 15

3) Tianjin Petrochemical: Apr 14–Jun 15

4) Daqing Petrochemical: Apr 14–24 (temporary)

5) Hunan Petrochemical: Apr 21–Jun 29

6) CNOOC Asphalt: from May 9, plan to resume early July

7) Liaohe Petrochemical: May 18–Jun 4

8) Yanshan Petrochemical: from May 20, plan to resume Jul 19

9) Lanzhou Petrochemical: from Jun 5, plan to resume early July

10) Qilu Petrochemical South Plant: Jun 10–22

11) Qingdao Petrochemical: from Jun 26, plan to resume Aug 1

CNPC Trend:

Prices rose briefly in early April due to maintenance at Daqing and Jinxi, but weak downstream demand dragged prices down until Fushun Petrochemical announced repairs in June, triggering active restocking. In Northwest China, prices generally fell. Karamay Petrochemical increased out-of-province shipments, and Urumqi Petrochemical saw improved product specs. However, May saw price reductions across the board. Lanzhou Petrochemical started maintenance in June, others stabilized pricing.

CNOOC Trend:

Prices generally fell. Frequent production fluctuations. Prices rose slightly in April-May, then declined. Ship fuel output from Zhoushan Petrochemical decreased due to weak demand. In late June, low-sulfur coke sales improved. Maintenance at CNOOC Asphalt and Taizhou Petrochemical boosted supply-side sentiment, aiding price rebound.

Sinopec Trend (High & Medium Sulfur):

Similar price trends to low-sulfur coke. Maintenance increased.Some high-sulfur refineries switched to medium-sulfur production, tightening overall supply.

1) Yangtze River region: Jiujiang and Hunan Petrochemical shut down.

2) North China: Yanshan and Tianjin Petrochemical switched to medium-sulfur coke.

3) East China: Increased medium-sulfur output from Yangzi and Gaoqiao Petrochemical; others stable.

4) South China: Beihai resumed production May 25, frequent quality fluctuation at Guangzhou Petrochemical, Maoming Petrochemical produced needle coke.

Q2 Market Phases

Prices rose slightly at the start, then fell broadly. When prices hit psychological support levels, they rebounded slightly.

Local Refinery Trend:

Prices showed an "N-shaped" fluctuation. April: more shutdowns, tighter supply, prices up. May: leading low-sulfur coke prices fell, downstream turned cautious, increasing supply and pressure on local refineries. Most followed the trend down. June: demand improved, low-sulfur prices rose, mid-low sulfur coke sales improved, market turned active.

Q2 Supply Overview

Q3 forecast output: ~7.05 million tons, ~5.84 million tons for sale, -10.49% QoQ.

1) Sinopec: ~2.40 million tons (-14.12%)

2) CNPC: ~1.25 million tons (-7.88%)

3) CNOOC: ~0.45 million tons (-9.57%)

Local refineries: ~2.95 million tons (-10.49%) Average coker operating rate: 63.37%, -7.43% QoQ

Q2 Demand Overview

Demand showed weak-then-strong trend.

1) Electrolytic aluminum: stable with slight growth

2) Calcined petroleum coke: poor sales, high inventory

3) Graphite electrodes: low ops, just-in-time procurement, picked up in June

4) Metal silicon, silicon carbide: weak demand, just-in-time buying

5) Anode materials: April-May demand flat, low procurement; June restocking triggered price support

6) Aluminum carbon market: just-in-time buying, light restocking amid maintenance

Q2 Local Refinery Profitability

Overall coking profits trended downward. Crude oil price volatility, weak terminal market.

1) Gasoline: weak price due to slow stock depletion

2) Diesel: weak prices due to ample inventory and cautious buying

3) By-products: mostly declining Q2 average profit: ~RMB 35/ton, significantly lower than Q1.

Q2 Import Analysis

Apr-May imports: 3.55 million tons; June est. ~900,000 tons

1) Inventory rose as imports outpaced port deliveries

2) April: both low- and high-sulfur imports rose through mid-May

3) Late May: imports declined, esp. from U.S. (tariffs)

High import costs and domestic price declines pressured port shipments. Port coke traded below cost, high-cost cargoes held.

1) High-sulfur coke: losses, some sold at loss until late June price rebound

2) External prices held firm, supporting import prices

3) Fuel-grade coke: weak demand due to low coal prices and high import costs

4) Formosa coke: poor sales amid weak metal silicon market, tender prices down

5) Aluminum carbon demand okay, but port sales limited by no margin

6) Late Q2: slight rebound in port prices, especially for spec coke

7) Russian coke: low prices due to contamination, pressured local refineries

Q3 Market Forecast Supply:

1) Q3 expected output: ~7.57 million tons

2) 3 refineries to undergo maintenance, 9 to resume production

3) Overall supply to rise

4) Sinopec to shift some plants to medium-sulfur coke

5) High-sulfur coke supply to tighten

6) Import forecast: 2.8–3.0 million tons

Demand:

1) Demand to increase slightly

2) 2.49 million tons of prebaked anode capacity to come online

3) EV demand rising, boosting anode material sales

4) Graphite & carbon electrodes: steady demand

5) Metal silicon to improve slightly during wet season

6) Silicon carbide: weak

7) Glass: steady

8) Fuel-grade coke demand to decline amid cheap coal

Summary:

Q3 petroleum coke prices expected to rise first, then fall. Early demand for restocking from anode & carbon plants plus high import costs support domestic prices. But once restocking ends and repairs are over, prices may retreat. Expected price fluctuation: RMB 10–200/ton.

Main Price Ranges:

1) Low sulfur (~0.5% S): RMB 3,400–3,700/ton

2) Medium sulfur (≤3.0% S): RMB 2,000–3,300/ton

3) High sulfur (~5.0% S): RMB 1,000–1,650/ton

Pellet coke prices weak short-term; coal price recovery could support slight rebound later.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies