【Weekly Downstream Steel Industry Report】H1 Output and Export Data of Automobiles,...

Graphite electrodes are vital consumables in EAF steelmaking, mainly used for arc heating. With superior electrical conductivity and high-temperature resistance, they are key to improving both the output and quality of EAF steel.

【Weekly Downstream Steel Industry Report】H1 Output and Export Data of Automobiles, Home Appliances Released

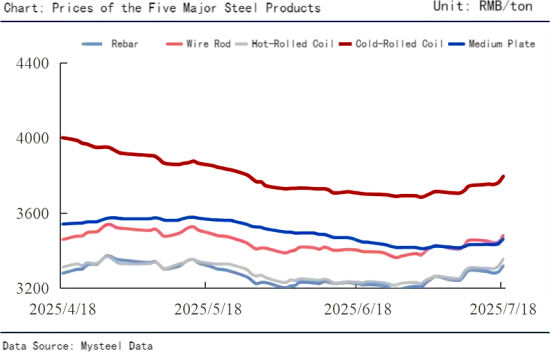

This week, the average prices of the five major steel products in major Chinese markets all increased compared to last week. Specifically, rebar, high-speed wire rod, hot-rolled coil, cold-rolled coil, and medium-thick plate rose by 24 yuan/ton, 25 yuan/ton, 46 yuan/ton, 51 yuan/ton, and 29 yuan/ton respectively.

Industry Data

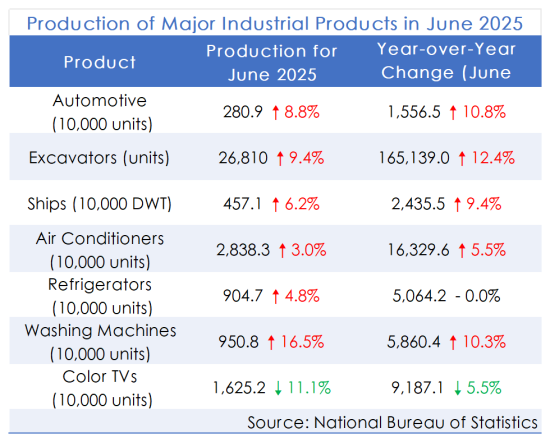

According to the latest data from the National Bureau of Statistics, from January to June, China's infrastructure investment increased by 4.6% year-on-year. Real estate development investment reached 4.6658 trillion yuan, down 11.2% YoY; the area of newly started housing was 303.64 million m², down 20% YoY; and the completed housing area was 225.67 million m², down 14.8% YoY. Other major industrial product output data are as follows:

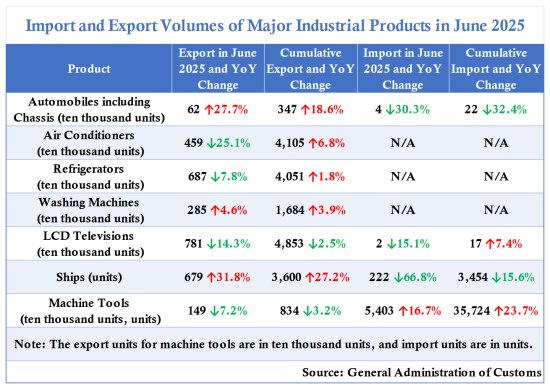

According to the General Administration of Customs, from January to June, China exported a total of 3.47 million vehicles, an increase of 18.6% YoY. The import and export data of major industrial products are as follows:

China State Railway Group: From January to June, China's railway fixed asset investment reached 355.9 billion yuan, up 5.5% YoY.

During the week of July 7 to July 13, the total contracted area of new commercial housing in 10 key cities was 1.1737 million m², down 40.5% WoW and 24.2% YoY. In the same period, the contracted area of second-hand housing was 2.0125 million m², up 2.2% WoW but down 2.9% YoY.

The total sales of 16 key real estate companies from January to June 2025 were 701.61 billion yuan, down 14.7% YoY. Among them, sales in June totaled 154.81 billion yuan, down 21% YoY but up 13.1% MoM.

According to the China Passenger Car Association, retail sales of passenger cars reached 571,000 units from July 1 to 13, up 7% YoY but down 5% MoM. Cumulative retail sales this year reached 11.473 million units, up 11% YoY.

According to the China Construction Machinery Association, from January to June, 739,334 forklifts were sold, up 11.7% YoY. Of these, 476,382 units were sold domestically (up 9.79% YoY), and 262,952 were exported (up 15.2% YoY).

According to International Ship Network, from July 7 to 13, global shipyards received 14+2 new ship orders. Among them, Chinese shipyards received 6+2 orders, Korean shipyards 5 orders, and American shipyards also received relevant orders.

Industry News

On July 15, Sheng Laiyun, Deputy Director of the National Bureau of Statistics, emphasized at a press conference that although real estate sales and prices are still declining YoY, the bottoming-out and transformation of the sector is a process and normal phenomenon. Greater efforts are needed to stabilize the real estate market.

The Party Committee of the Ministry of Housing and Urban-Rural Development held a study session to implement the central urban work conference spirit, stressing the importance of urban renewal and coordinated implementation of livelihood, safety, and development projects. It also called for accelerating the establishment of a new real estate development model and promoting the transformation of urban villages and dilapidated housing.

On July 18, a report by CRIC showed a dual trend in real estate enterprise operations: while defaults continue, debt restructuring is accelerating. In June alone, 65 typical real estate companies raised 46.442 billion yuan, a new high for 2025, with both YoY and MoM increases.

It is reported that the Trump administration quietly shut down the White House Shipbuilding Office under the National Security Council (NSC), signaling a systemic pause or reversal in the U.S. shipbuilding and maritime revival strategy.

On July 16, the Shanghai Municipal People's Government Office issued the "Implementation Plan for Building a World-Class Modern Shipbuilding Base on Changxing Island (2025–2027)". The plan aims for the ship and marine engineering equipment industry on Changxing Island to exceed 120 billion yuan in scale by 2027, with high-tech ship types like LNG carriers and dual-fuel container ships accounting for 80%, forming a world-class advanced manufacturing cluster.

Listed Company H1 Performance Forecasts

(1) Real Estate: As of July 17, 20 listed real estate companies released H1 2025 performance forecasts. Seven companies were profitable; 13 incurred losses. Vanke had the largest expected loss, between 10–12 billion yuan.

(2) Automobiles: As of July 15, 14 listed auto companies released forecasts. Seven were profitable. Compared YoY: five saw net profit growth, four narrowed losses, two turned from profit to loss, and one reversed a loss.

(3) Shipbuilding: As of July 18, five listed shipbuilding companies released forecasts. Four were profitable, one reported a loss.

Corporate Developments

China Railway Group: In H1, newly signed contracts totaled approximately 1.10869 trillion yuan, up 2.8% YoY.

China Energy Engineering Group: In H1, the company signed 20,273 new projects, with total new contracts amounting to 775.357 billion yuan, up 4.98% YoY.

On July 14, Vanke issued its H1 2025 performance forecast, estimating sales revenue of 69.1 billion yuan and a loss of 10–12 billion yuan. Vanke attributed the loss mainly to a significant decrease in project settlement scale and continued low gross margin. Additionally, due to rising business risk exposure, further asset impairment provisions were made.

On July 16, Shantui Construction Machinery announced that its board had approved the proposal to issue H shares and list on the Main Board of the Hong Kong Stock Exchange. The H-share issuance price will be determined through market-based pricing.

On July 15, China Marine Bunker (PetroChina) successfully refueled the nation's first methanol dual-fuel container ship "COSCO SHIPPING Yangpu" with 500 tons of domestically produced bonded green methanol at Dalian Port. This marked the launch of bonded green methanol bunkering for international vessels in Dalian and completed the full connectivity of the green marine fuel supply chain in Northeast Asia.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies