【Graphite Electrode】Rising Costs Push Prices Up!

【Graphite Electrode】Rising Costs Push Prices Up!

Recently, the domestic petroleum coke market has shown a volatile upward trend. The cost of ultra-high-power (UHP) graphite electrodes has increased, with suppliers raising their quotes and showing a reluctance to sell. However, transaction prices have not yet met expectations. As steel mills downstream increase production cuts, market demand is shrinking. How will the UHP graphite electrode market develop?

1. Prices Showing a Steady Upward Trend

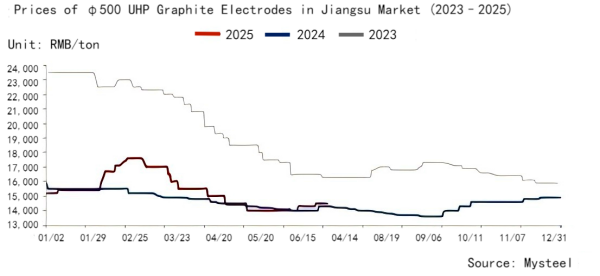

From late June to mid-July, the price of UHP graphite electrodes showed a steady upward trend. Among them, the prices of φ450 and φ500 UHP graphite electrodes increased by 500 yuan/ton. For φ600 and φ700 UHP graphite electrodes, due to less market competition, prices remained relatively stable.

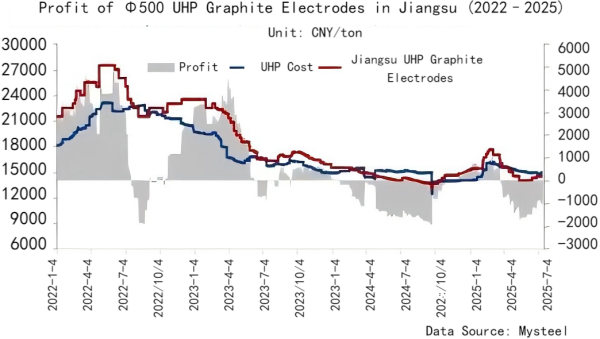

Profit of Φ500 UHP Graphite Electrodes in Jiangsu (2022–2025)

Figure 1: Jiangsu φ500 UHP Graphite Electrode Price

2. Rising Raw Material Prices Increase Cost Pressure

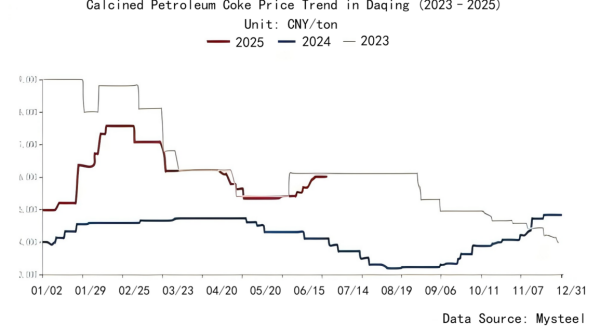

Looking at electrode raw materials, taking Daqing calcined petroleum coke as an example, its price rose by 170 yuan/ton in June, and by July 18, had increased by another 330 yuan/ton in July—an overall increase of 500 yuan/ton in two months. Taking Jiangsu φ500 UHP graphite electrode prices as an example, theoretical calculations indicate that profits have turned negative, placing the industry in a loss-making state. Moreover, despite the rise in raw material prices, graphite electrode prices have increased only slightly and have not met the expectation of turning losses into gains. Supplier intention to raise prices is strengthening.

Calcined Petroleum Coke Price Trend in Daqing (2023–2025)

Figure 2: Calcined Petroleum Coke Price Trend

Figure 3: Jiangsu φ500 UHP Electrode Profit

3. Weakened Demand Restrains Graphite Electrode Price Increase

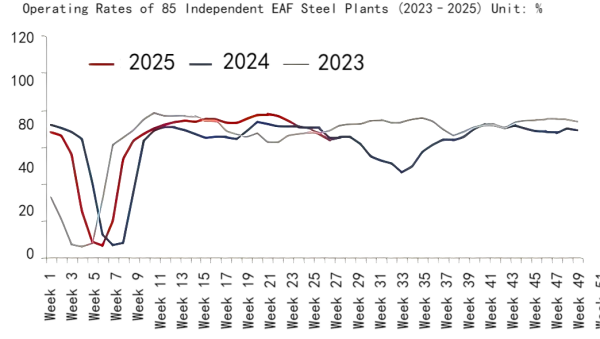

According to research on the operating conditions of 85 independent electric arc furnace (EAF) mills in China, the average EAF operating rate in June–July was higher than the same period in 2024, indicating demand may exceed that of last year. However, in the past two months, the EAF operating rate has shown a downward trend, which has to some extent constrained the release of graphite electrode demand and hindered further price increases.

Figure 4: Operating Rates of 85 Independent EAF Steel Plants Nationwide

4. Summary

As we enter late July and a new round of steel bidding begins, suppliers are highly motivated to raise prices. Most suppliers are adopting a minimum price limit strategy. At the same time, petroleum coke prices continue to show a steady to strong trend, providing cost support. It is expected that UHP graphite electrode prices may come under pressure while moving upward amid intense price competition.

(Source: Mysteel.com)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies