【CPC】Prices Rise Again, Medium- and High-Sulfur Grades in Focus! Full July Market Analysis!

【Calcined Petroleum Coke】Prices Rise Again, Medium- and High-Sulfur Grades in Focus! Full July Market Analysis!

On July 24, the average market price of calcined petroleum coke reached 2,871 RMB/ton, up 15 RMB/ton from the previous working day, a 0.53% increase. At present, the low-sulfur calcined petroleum coke market is operating steadily. Inquiries in the market have declined, raw material prices are stabilizing, and downstream buyers are adopting a wait-and-see attitude. Low-sulfur calcined petroleum coke is mainly sold at stable prices. Medium- and high-sulfur calcined petroleum coke has relatively good transaction performance. Due to continued price increases in raw materials, shipments of medium- and high-sulfur calcined petroleum coke are active, and companies are strongly inclined to hold firm on prices, raising their offers by 30–50 RMB/ton.

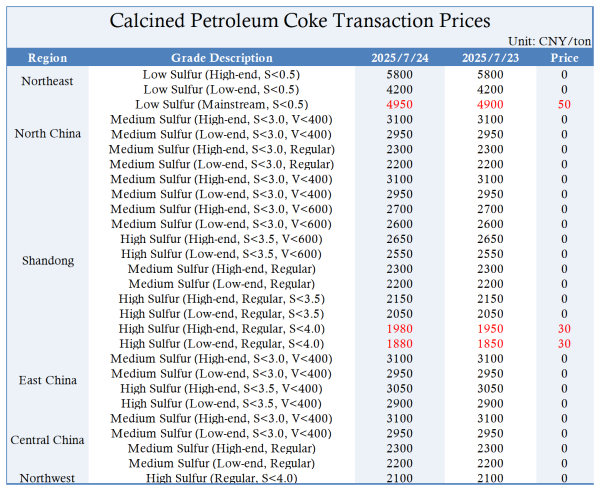

Major Regional Market Transaction Prices

Market Prices

1. Low-sulfur calcined petroleum coke (using Jinxi and Jinzhou petroleum coke as raw materials): mainstream transaction prices range from 4,700–5,100 RMB/ton.

2. Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material): mainstream ex-factory prices range from 5,800–6,100 RMB/ton.

3. Low-sulfur calcined petroleum coke (using Liaohua and Binzhou CNOOC petroleum coke as raw materials): mainstream transaction prices range from 4,200–5,000 RMB/ton.

4. Medium- and high-sulfur calcined petroleum coke (S 3.0%, no trace element requirements): previous mainstream ex-factory contract price was 2,200–2,300 RMB/ton (cash), and currently negotiated ex-factory price remains 2,200–2,300 RMB/ton (cash).

5. Medium- and high-sulfur calcined petroleum coke (S 3.5%, no trace element requirements): previous mainstream ex-factory contract price was 2,050–2,100 RMB/ton (cash), and currently negotiated ex-factory price remains 2,050–2,100 RMB/ton (cash).

6. Medium- and high-sulfur calcined petroleum coke (S 3.0%, V 400): previous contract price was 2,950–3,100 RMB/ton (cash), and currently negotiated ex-factory price is 2,950–3,100 RMB/ton (cash).

Supply

Currently, China's daily commercial supply of calcined petroleum coke is 26,398 tons, with an operating rate of 55.84%. The supply has increased by 0.28% compared with the previous working day.

Upstream Market

Petroleum coke:

1. Sinopec refineries are shipping on demand. In the Yangtze River area, Anqing Petrochemical is mainly shipping for anode material use, with good orders and no inventory pressure. Other refineries are also actively trading anode-grade coke.

2. In East China, medium- and high-sulfur coke is selling steadily.

3. In Northwest China, Tarim Petrochemical mainly supplies aluminum carbon, with increased shipments outside Xinjiang.

4. PetroChina refineries in Northeast China are shipping on demand. Fushun Petrochemical is approaching maintenance, and downstream stocking continues. Daqing Petrochemical, having similar specifications, is shipping actively.

5. In the Northwest region, refineries are mainly supplying aluminum carbon.

6. In Southwest China, demand from Yunnan Petrochemical is stable.

7. CNOOC refineries are mainly shipping to order. Due to increased production capacity at the coking units of CNOOC Asphalt, a small volume is auctioned at stable prices.

Downstream Market

Graphite electrodes: Downstream procurement remains relatively stable, with phased rigid demand through tenders. Most graphite electrode producers remain cautious. Based on downstream demand and their own production conditions, output fluctuates. Most are fulfilling existing orders, with mainstream firms holding prices steady. The graphite electrode market is currently stable.

Electrolytic aluminum: Aluminum ingot social inventory has increased. Combined with resistance to high aluminum prices in the market, procurement is difficult, and transaction sentiment is weak. Spot aluminum prices are declining.

Anode materials: The anode materials market is currently stable. Market feedback suggests that current capacity utilization rates are still below expectations. In the context of overcapacity, some companies continue to promote expansion and new project construction to capture market share. Competition is intense, and anode material companies are still under survival pressure.

Market Outlook

Low-sulfur calcined petroleum coke transactions are temporarily stable. It is expected that prices from low-sulfur calcined petroleum coke producers will mainly remain stable. With favorable raw material support, prices for medium- and high-sulfur calcined petroleum coke are expected to continue to rise. However, actual transaction prices will still be subject to bargaining with downstream buyers.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies