【Calcined Petroleum Coke】Low-Sulfur Market Cautious, Medium-to-High Sulfur Output Expanding...

【Calcined Petroleum Coke】Low-Sulfur Market Cautious, Medium-to-High Sulfur Output Expanding! A Supply-Demand Turning Point Emerges, Prices May Rise Slightly Next Week

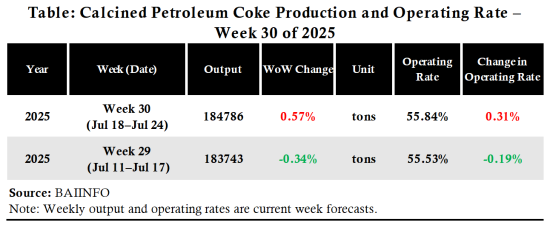

Supply Situation of Calcined Petroleum Coke This Week

Low-Sulfur CPC:

This week, the supply of low-sulfur calcined petroleum coke increased slightly. Trading was moderate, and inventories at enterprises remained low. A few enterprises slightly raised output, but most maintained a wait-and-see attitude and continued their current production pace.

Medium-to-High Sulfur CPC:

Compared with last week, the supply of medium-to-high sulfur calcined petroleum coke increased. One enterprise in Southwest China increased its daily output by around 130 tons. In addition, a Shandong-based enterprise with an annual capacity of 50,000 tons plans to ignite production in early August. Another enterprise is expected to increase production to 15,000 tons in August.

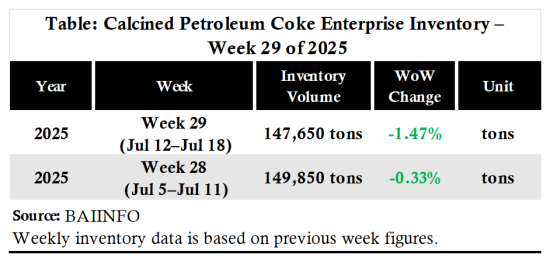

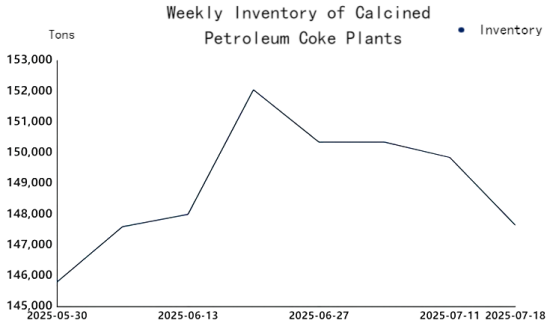

Inventory Situation of Calcined Petroleum Coke This Week

Overall shipments of calcined petroleum coke were steady this week, and inventories decreased compared with last week.

Demand Situation of Calcined Petroleum Coke This Week

Low-Sulfur CPC:

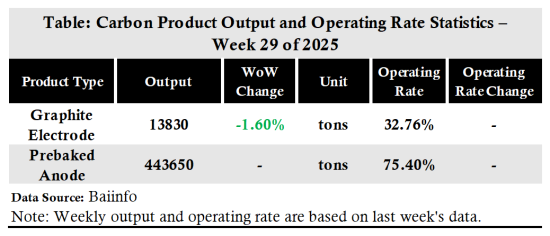

This week, demand in the graphite electrode market was average. Steel mills were slow to finalize new orders, and actual transactions were cautious. With low-sulfur CPC prices continuing to rise, the willingness of graphite electrode producers to stock up increased due to expectations of further price increases.

Cathode block producers showed no major price fluctuations this week, but inquiries and tenders for low-sulfur CPC increased. However, there was limited acceptance of high-priced low-sulfur CPC, and procurement sentiment leaned strongly toward price suppression.

Medium-to-High Sulfur CPC:

Downstream procurement willingness for medium-to-high sulfur CPC significantly increased this week.

In the aluminum sector, the electrolytic aluminum market remained stable, and downstream enterprises continued to procure steadily under long-term contracts. No significant changes in supply and demand were observed.

The anode materials market remained weak and stable. However, driven by the price increase of standard medium-to-high sulfur CPC, demand for sulfur content between 3.5%–4.5% increased.

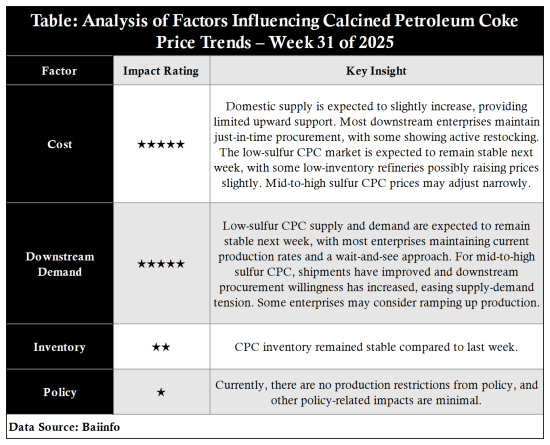

Price Trend Forecast for Calcined Petroleum Coke Next Week

Raw Materials Outlook:

Chinese domestic overall supply is expected to increase slightly, offering limited positive support. Currently, downstream enterprises are mostly buying petroleum coke on a just-in-time basis, though some show a proactive attitude toward restocking.

Next week, the low-sulfur market is expected to remain generally stable. Refineries with low inventory may slightly raise prices. Medium-to-high sulfur CPC prices are expected to remain stable with limited adjustments.

Supply and Demand Outlook:

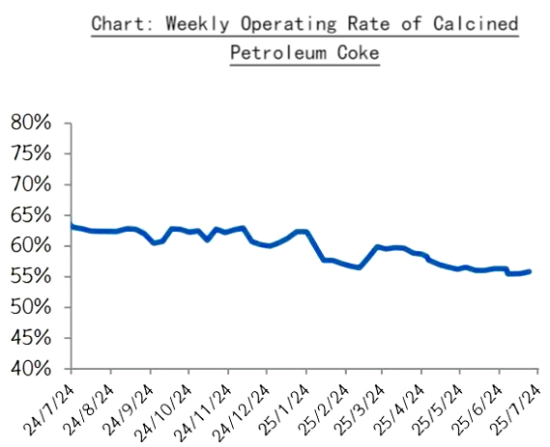

Next week, the supply and demand situation for low-sulfur CPC is expected to remain stable. Most enterprises maintain a wait-and-see attitude and will likely stick to current operating rates. For medium-to-high sulfur CPC, shipments are improving and downstream procurement willingness is increasing, easing supply-demand tensions. Some producers are expected to increase output in the following period.

Overall Outlook:

Low-Sulfur CPC:

Prices for low-sulfur green coke are expected to remain mostly stable. However, shipment speeds for low-sulfur CPC may slow down. Prices for low-sulfur calcined coke are likely to remain stable next week.

Medium-to-High Sulfur CPC:

Market activity for medium-to-high sulfur CPC improved overall this week. Raw material green coke prices are expected to remain firm or rise slightly next week. As CPC producers enter negotiations for monthly orders, to relieve cost pressure and reduce financial losses, medium-to-high sulfur CPC prices are expected to increase by 50–100 yuan/ton.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies