【Steel Market】Overview of Fundamentals

Graphite electrodes are vital to EAF steelmaking—acting as the "core component" for arc heating. With excellent conductivity and heat resistance, they're key to improving steel quality and output. Master them, master EAF steelmaking!

【Steel Market】Overview of Fundamentals

Prices Aspect:

Since July, the macro environment has continuously released positive signals, focusing on "anti-involution" efforts and the establishment of a unified national market. The Ministry of Industry and Information Technology is set to introduce a work plan to stabilize growth for key industries, including the steel sector, with a core focus on structural adjustments, supply optimization, and phasing out outdated production capacity.

Demand Support:

Urbanization is accelerating, major infrastructure projects such as the downstream section of the Yarlung Tsangpo River hydropower station are starting, and the equipment replacement policy (trade-in programs) continues—all forming strong demand drivers.

Market Sentiment:

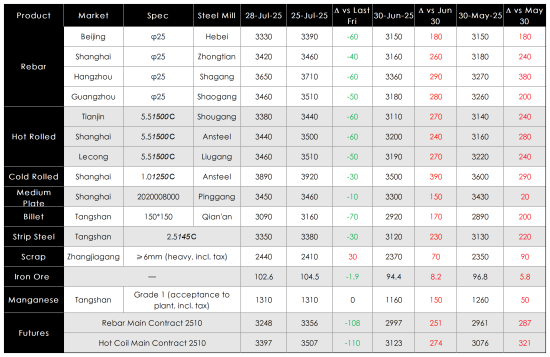

With strong policy expectations and cost support from raw materials (e.g., coking coal prices leading the rise), market sentiment has been significantly boosted, resulting in varying degrees of increase in both futures and spot steel prices. Steel price trends in major regions are as follows:

Supply Aspect:

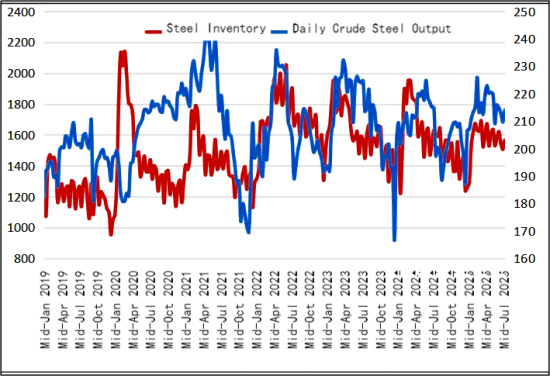

According to China Iron and Steel Association (CISA) statistics, in mid-July 2025, key steel enterprises produced a total of 21.41 million tons of crude steel, with an average daily output of 2.141 million tons, an increase of 2.1% compared to the previous period.

Pig iron production was 19.44 million tons, averaging 1.944 million tons per day, up 0.6% compared to the previous period.

Steel output reached 20.80 million tons, with an average daily output of 2.080 million tons, a 4.6% increase compared to the previous period.

Based on this, it is estimated that Chinese daily crude steel production was 2.76 million tons (up 2.1%), daily pig iron production was 2.37 million tons (up 0.6%), and daily steel production was 4.19 million tons (up 2.3%).

Inventory Aspect:

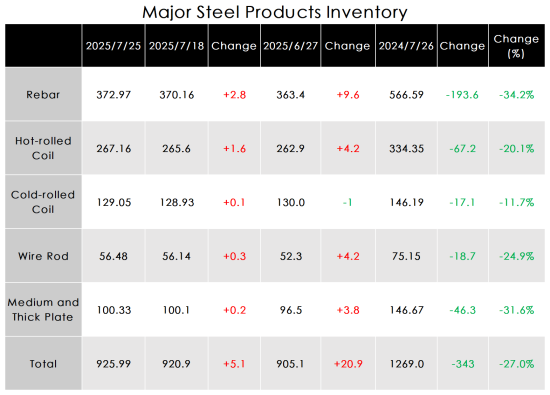

In mid-July 2025, key steel enterprises (hereinafter referred to as "key enterprises") held 15.66 million tons of steel inventory, an increase of 580,000 tons (up 3.9%) compared to the previous period.

Compared to the beginning of the year, this represents an increase of 3.29 million tons (up 26.6%);

Compared to the same period last month, a decrease of 550,000 tons (down 3.4%);

Compared to the same period last year, a decrease of 640,000 tons (down 3.9%);

Compared to the same period two years ago, a decrease of 10,000 tons (down 0.1%).

Inventory and Daily Crude Steel Output of Key Steel Enterprises:

Driven by strong expectations, rising raw material costs, and low inventory, steel prices surged sharply. However, as the stimulation effect of macro-level positive news weakens, and given the seasonal characteristics of slack demand under current high temperatures and rainfall, the pace of demand release has slowed.

Market Outlook:

In the coming period, attention should be focused on supply-side adjustments and their potential to trigger price volatility.

Short-term focus: China-U.S. trade negotiations, the Politburo meeting, release of macroeconomic data, and other influencing factors.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies