【Steel】Brief Analysis of Supply and Demand Structure Trends in China's Steel Industry ...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel】Brief Analysis of Supply and Demand Structure Trends in China's Steel Industry During the Transformation Cycle

After years of development, China's steel industry has become the world's largest producer and consumer of steel. However, with the slowdown of the global economy and the decline of the real estate sector, the contradiction between overcapacity and weak demand has become increasingly prominent. On one hand, China is eliminating outdated capacity through policy regulation; on the other hand, it supports the development of emerging sectors and encourages export-oriented growth, guiding the steel industry to seek new breakthroughs. As China's economy enters a transformation cycle, the demand structure for steel in downstream industries is gradually changing. Demand for traditional construction steel is declining, while demand for manufacturing steel is steadily rising under the impetus of emerging industries. This compels steel enterprises to accelerate product structure adjustment and industrial upgrading, gradually moving toward high-performance, multi-functional, customized, and other high value-added products. Meanwhile, steel exports have seen breakthrough growth in recent years, with 2024 witnessing the highest export volume in nearly five years, approaching the 2015 peak. Against this backdrop, how is China's steel industry specifically performing, and what lies ahead? The following aspects will be elaborated.

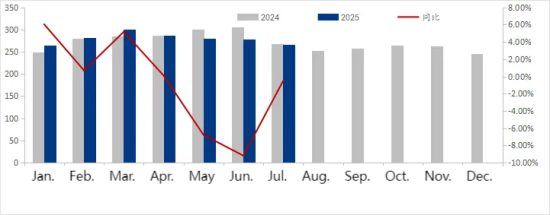

I. Crude Steel Output Peaks Then Declines in 2025

Over the past three years, with domestic real estate investment declining (down about 10% year-on-year), demand for construction steel has weakened. Combined with increasing environmental pressure and production restriction policies, crude steel output has gradually declined. In the first half of 2025, crude steel production was 514.826 million tons, down 3.0% year-on-year. From the perspective of daily average crude steel output, this year shows a different pattern from the past: in the first quarter, daily output increased to varying degrees, mainly driven by external demand compensating for weak domestic demand (under the export rush phenomenon, cumulative steel exports in Q1 were 27.43 million tons, up 61.6% quarter-on-quarter). In the second quarter, the growth of steel exports slowed, and with seasonal shifts, crude steel output began to decline. In the third quarter, both domestic and overseas demand shrank simultaneously, production cut policies intensified, and crude steel output may decline further.

Figure 1: Changes in Daily Crude Steel Output (Monthly) from 2024–2025(Unit: 10,000 tons)

Source: Mysteel Data

II. Changes in Steel Export Flows in 2025

With domestic demand under pressure, steel exports have become a key channel for diverting excess capacity, and exports remained high in 2025. From January to May, China's steel exports totaled 48.469 million tons, up 8.5% year-on-year, with construction steel exports performing particularly well (rebar exports up 90%, wire rod exports up 42%). China's export growth is mainly price-driven, using a "low-cost, volume-for-price" strategy to shift excess capacity to international markets. Emerging markets in Southeast Asia and South America, with strong demand for infrastructure and manufacturing development and heavy reliance on imports, have become indispensable main forces for China's export growth. In addition, the structure of steel exports shows clear differentiation: plate exports slowed due to overseas anti-dumping policies, while bar and wire products, with higher price elasticity, saw significant increases in exports.

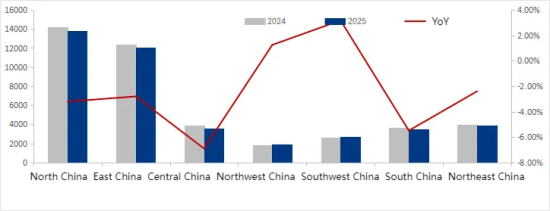

III. Adjustments in Regional Steel Flows in 2025

Overall, steel production and consumption between the north and south of China are becoming more balanced, with regional differences narrowing. In 2025, driven by production restriction policies, steel capacity replacement shifted from "quantity increase" to "quality improvement." New capacity is prioritized for short-process steelmaking projects, following the principle of "reduction replacement" (new capacity must replace 1.25 times the old capacity). As a result, crude steel output in traditional high-production regions such as North and East China significantly declined (down 3.21% and 2.81% respectively in January–June), while output in Northwest and Southwest China increased (up 1.25% and 3.17% respectively).

Figure 2: Regional Changes in Crude Steel Production from January–June 2025(Unit: 10,000 tons)

Source: Mysteel Data

IV. Changes in Downstream Steel Demand Structure

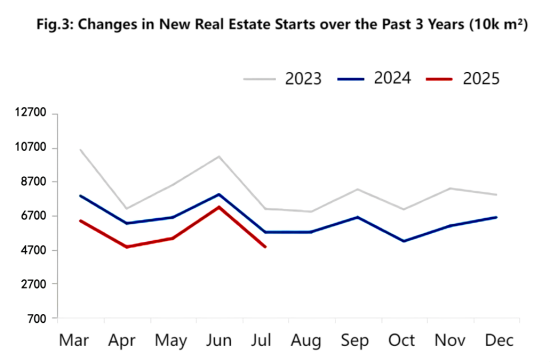

1. Construction Industry

Since 2020, newly started real estate construction areas have continued to decline. In 2024, the national newly started real estate construction area was 644.639 million square meters, down 21.20% year-on-year. From January to July 2025, the national newly started area was 285.922 million square meters, down 16.65% year-on-year, with the decline narrowing.

Figure 3: Changes in Newly Started Real Estate Construction Areas in the Past 3 Years (10,000 m²)

Source: Mysteel Data

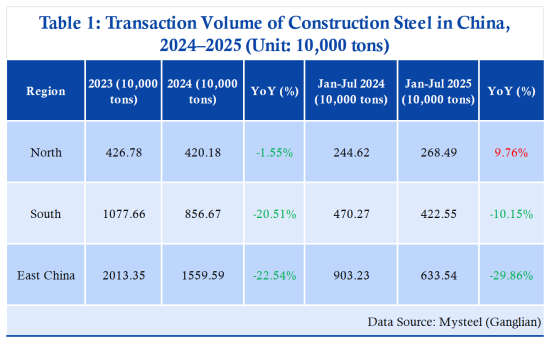

Construction steel is the core area of steel consumption, accounting for more than 50% of China's steel demand. However, in recent years, with the decline of the real estate economy, construction steel demand has fallen significantly. In 2024, construction steel transactions dropped 19.37%; from January to July 2025, they fell another 18.14%. By region, East and South China saw sharper declines (down 29.86% and 10.15% year-on-year respectively), while North China's construction steel transactions grew 9.76%, indirectly reflecting the "difficulty" of reducing supply in northern China under supply-side reforms.

Table 1: China's Construction Steel Transactions in 2024–2025 (Unit: 10,000 tons)

2. Manufacturing Industry

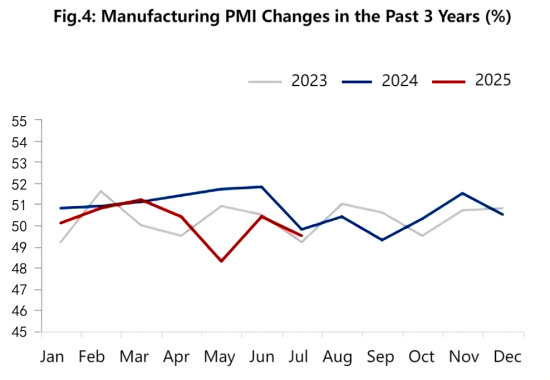

From the perspective of the Manufacturing PMI, growth has slowed in 2025. In July 2025, the Manufacturing PMI was 49.5, down from the previous month (50.4) and the same period last year (49.8), reflecting that the manufacturing sector is still in a continuous contraction phase.

Figure 4: Changes in Manufacturing PMI in the Past 3 Years (%)

Source: Mysteel Data

Steel demand in the manufacturing sector covers home appliances, machinery, and shipbuilding. In 2025, China's manufacturing steel demand shows structural growth and industry differentiation. According to data from the China Iron and Steel Association, the proportion of manufacturing steel consumption rose from 42% in 2020 to 50% in 2024, reflecting its rising importance in steel consumption. Among them, home appliance steel demand has grown significantly under the "trade-in" policy, with demand expected to reach 19.4 million tons in 2025, up 8.4% year-on-year. However, with policy momentum tapering off, production growth in home appliances and air conditioners has slowed. In August, although cold-rolled coil prices rose due to macro sentiment, actual transactions remained mediocre, indicating that demand was mainly speculative rather than real consumption.

For machinery and shipbuilding, excavator output increased 12.4% year-on-year in January–June, but external demand for industrial machinery remained weak. Meanwhile, new shipbuilding orders rose 9.4%, supporting steel demand, though insufficient to offset overall manufacturing weakness.

V. Outlook

Driven by national "anti-involution" policies, outdated steel capacity may be further consolidated and eliminated. Enterprises may either enhance product added value and channel competitiveness through technological upgrades or reduce production and transportation costs to strengthen price competitiveness. This has already led some enterprises to shift capacity to the south and inland. Demand for steel in southern China is stronger than in the north, and with steel exports increasingly directed to Southeast Asia and South America—where ports are mainly located in Guangdong and Fujian—capacity relocation southward is likely. The commencement of the Yarlung Zangbo River hydropower project may also promote capacity transfer inland. In the future, improving competitiveness in southern markets may become a key direction for steel enterprises.

However, demand reduction remains inevitable. The decline in construction steel demand has eased somewhat but remains nearly 20%. Meanwhile, the growth momentum in manufacturing steel is gradually slowing. Weak domestic demand will continue to exert upward pressure, forcing accelerated elimination of capacity.

As for exports, intensifying international trade disputes and tariff barriers under Trump-era policies still restrict China's steel exports. Combined with the "rush exports" in the first half of the year, steel export orders may face sharper declines going forward.

In summary, the outlook for China's steel market points to a more severe imbalance between supply and demand, with accelerated restructuring and reorganization of the industry. In the short term, steel enterprises should focus on structural opportunities and policy implementation, while in the long term, breakthroughs will still rely on transformation and upgrading.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies