【Graphite Electrodes】Expected to Rise 300–500 RMB! Rising Petroleum Coke, High Cost Pressure,...

【Graphite Electrodes】Expected to Rise 300–500 RMB! Rising Petroleum Coke, High Cost Pressure, Electrode Market Actively Seeking Increases

Market Overview

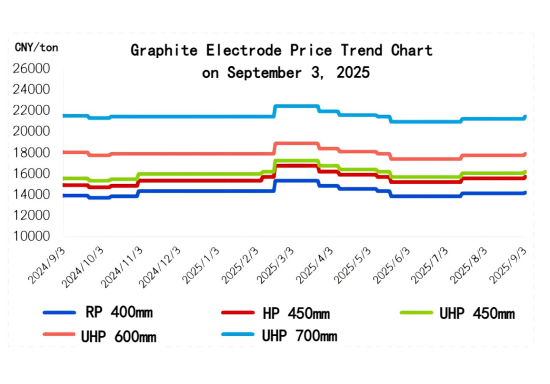

Previously, graphite electrode raw material prices have risen continuously, and the cost impact is gradually showing at the current stage. Production enterprises are facing higher costs, and transactions in the market are mostly at a loss or on the verge of loss. To alleviate the cost inversion pressure, driven by costs, mainstream graphite electrode enterprises are actively pushing for price increases, and quotations have been raised one after another. In this atmosphere, some low-priced resources in the market have followed suit in a timely manner. However, as downstream procurement remains limited, actual transaction prices in the market have not changed significantly. The overall transaction price in the market has risen slightly. As of the publication date, the average market price of graphite electrodes is 15,883 RMB/ton, up 1.03% compared with the same period last month.

Market Price Range:

Mainstream prices of graphite electrodes with diameters of 300–600mm:

Regular power: 14,000–15,500 RMB/ton

High power: 15,000–17,500 RMB/ton

Ultra-high power: 15,500–18,400 RMB/ton

Ultra-high power 700mm: 21,000–21,900 RMB/ton

Cost Trends

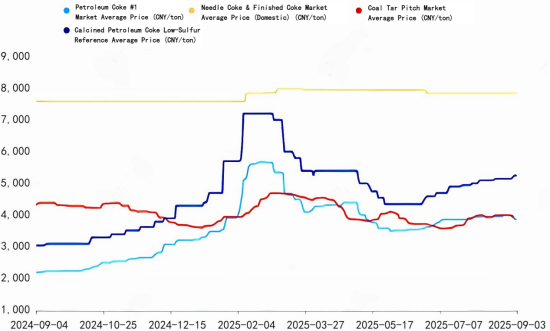

Needle Coke

Upstream raw material pitch prices have slightly increased, and petroleum-based needle coke enterprises have slightly raised costs under increasing pressure. Overall, market price changes are not obvious. As of the publication date, the average market price of calcined needle coke is 7,829 RMB/ton, remaining stable compared with the same period last month and up slightly 3.22% compared with the beginning of the year.

Petroleum Coke

In the recent period, the market shows a continuous upward trend. Downstream purchasing enthusiasm is relatively good. Coupled with refinery inventories mostly at medium to low levels, this is favorable for petroleum coke sales. As of the publication date, the average market price of low-sulfur petroleum coke is 3,978 RMB/ton, up 1.47% from the same period last month and up 18.11% from the beginning of the year.

Coal Tar Pitch

Purchasing enthusiasm has declined, and prices are slightly falling, but overall remain at a high level compared with last month. Under pressure from deep processing of tar, suppliers generally maintain stable or supported prices. As of the publication date, the average market price of coal tar pitch is 3,910 RMB/ton, down 0.41% from the same period last month and down 9.62% from the beginning of the year.

Low-Sulfur Calcined Petroleum Coke

(Jinxi, Jinzhou petroleum coke as raw material) mainstream market transaction price: 5,050–5,300 RMB/ton

(Fushun petroleum coke as raw material) factory mainstream transaction price: 6,100–6,200 RMB/ton

(Liaohe, Binzhou Zhonghai petroleum coke as raw material) mainstream market transaction price: 4,750–5,300 RMB/ton

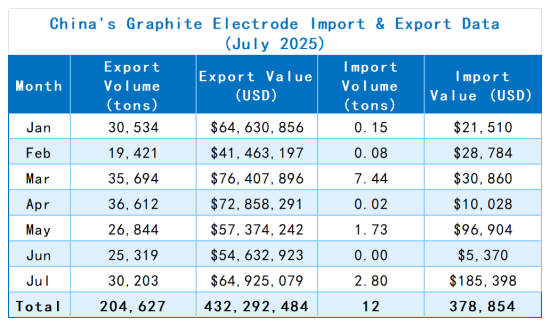

Export Data

According to customs statistics, in July 2025, China's graphite electrode exports were 30,200 tons, up 19.29% month-on-month and up 24.77% year-on-year. From January to July 2025, the total exports of China's graphite electrodes were 204,600 tons, up 6.71% year-on-year. In July 2025, the main export destinations for Chinese graphite electrodes were the UAE, Russia, and Iran.

Demand

Steel Mills: Currently, market confidence is insufficient. Overall demand remains weak, and the trend of accumulating inventory pressure has not changed. Short-term spot prices lack sustained upward momentum. Coupled with the weakening influence of macro news, manufacturers maintain a cautious and watchful attitude. Affected by the September 3 military parade, some steel mills in Tangshan began maintenance at the end of August.

Yellow Phosphorus: Operating well, overall monthly output shows an upward trend.

Silicon Metal: Northern large enterprises have resumed supply. In the Southwest, due to lower electricity prices during the high-water period, capacity release has increased. Supply in the main production areas of Southwest and Northwest China shows varying degrees of increase. Overall, silicon metal output has risen month-on-month.

Future Forecast

Supply Side

With high costs, graphite electrode enterprises face significant production pressure. Some enterprises will continue low production or shutdowns to alleviate raw material purchasing pressure. Mainstream enterprises maintain stable production, while some large factories have maintenance plans, expecting shutdowns for about one month. Overall market supply is expected to decline slightly.

Demand Side

With the "Golden September and Silver October" market just beginning, downstream inquiries and bidding demands are gradually emerging. Market demand for electrodes is expected to see a temporary increase.

Cost Side

Upstream raw material prices remain strong. The price of low-sulfur petroleum coke is expected to rise slightly, needle coke is expected to remain stable, and overall graphite electrode costs will continue at a high level.

Comprehensive View

Cost-side support for graphite electrodes remains. Mainstream enterprises' bargaining power has increased. Meanwhile, with expected demand improvement, the market has strong intentions for price increases. In the near future, graphite electrode prices may further rise by 300–500 RMB/ton.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies