【Steel Market】October May Experience Fluctuating Trends

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel Market】October May Experience Fluctuating Trends

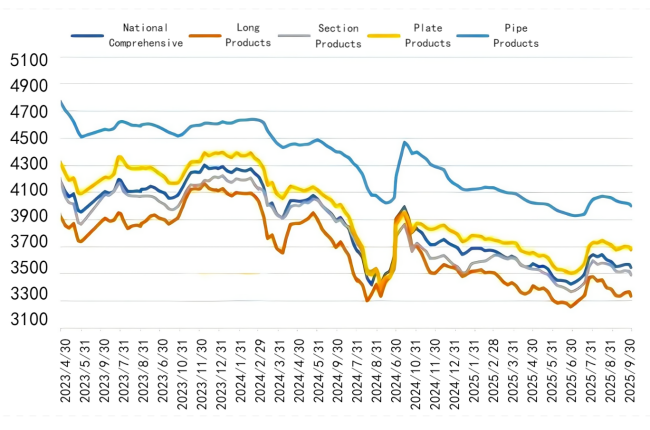

In September 2025, under the influence of a complex and severe external environment, coordinated macro policies, gradually increasing supply release, limited recovery of traditional peak-season demand, differentiated market transactions, resilient cost support, and intensified trade frictions, China's steel market showed a fluctuating and weakening trend. According to online monitoring data, as of the end of September, the comprehensive price of steel in China was 3,546 CNY/ton, down 44 CNY/ton from the same period last month, a month-on-month decline of 1.2%, and a year-on-year decline of 2.6%. From the monthly average perspective, in September, China's steel comprehensive price averaged 3,563 CNY/ton, down 54 CNY/ton from the previous month, a decline of 1.5%.

Figure 1: Lange Steel Absolute Price Index Trend (CNY/ton)

Looking ahead to October, the trend of China's steel market is still influenced by multiple factors. Demand in the construction steel market may continue to improve, social inventories of steel are expected to rise first and then fall, the supply side will remain relatively low, and cost support will remain resilient. However, insufficient demand recovery, as well as pressures from declining steel exports due to international trade disputes and changes in tariff policies, and altered market sentiment, may impose considerable constraints on the market. The Big Data AI-assisted decision-making system predicts that China's steel market in October 2025 may show a fluctuating trend, with average prices slightly lower than last month. The main factors affecting steel price trends in October are as follows:

1. Despite being in the consumption peak season, downstream demand for construction steel remains insufficient

From January to August 2025, China's cumulative fixed-asset investment growth slowed by 1.1 percentage points from the previous month to 0.5%. Real estate investment continued to decline year-on-year, while growth in infrastructure and manufacturing investment slowed, which were the main reasons for the slowdown in overall investment. However, the "dual construction" projects advanced steadily, with infrastructure investment in key areas showing strong growth; the effects of large-scale equipment renewal policies continued to release, and equipment purchase investment grew rapidly, driving continued growth in infrastructure and manufacturing investment.

In September, construction steel demand increased slightly month-on-month with improving weather, but remained significantly lower year-on-year, reflecting insufficient demand. According to online statistics, the daily average transaction volume of construction steel in 20 key cities in September was 124,500 tons, up 2,500 tons month-on-month, an increase of 2.0%, but down 15.5% year-on-year.

In 2025, China's fiscal policy has become more proactive, with new special bonds issued 500 billion CNY higher than last year. Monitoring data shows that as of the end of September, China's new special bond issuance reached 3,663.5 billion CNY, a year-on-year increase of 1.9%, accounting for 83.3% of total issuance, with nearly 740 billion CNY of special bond quotas still to be issued. Going forward, China will coordinate the use of central budget investments, ultra-long-term special national bonds, local government special bonds, and other policy tools, implement and refine the "dual construction" and "dual new" policies, leverage major projects to drive additional real work volume, vigorously cultivate new-type productive forces, accelerate the transformation and upgrading of traditional industries, improve mechanisms for private enterprises to participate in major national projects, effectively stimulate private investment vitality, and further expand effective investment. In October, as funding gradually becomes available and policies are implemented, construction steel demand is expected to improve. However, the drag from the real estate sector remains, with new starts and investment data declining year-on-year, limiting the extent of demand recovery.

2. Production of various steel products shows growth trends

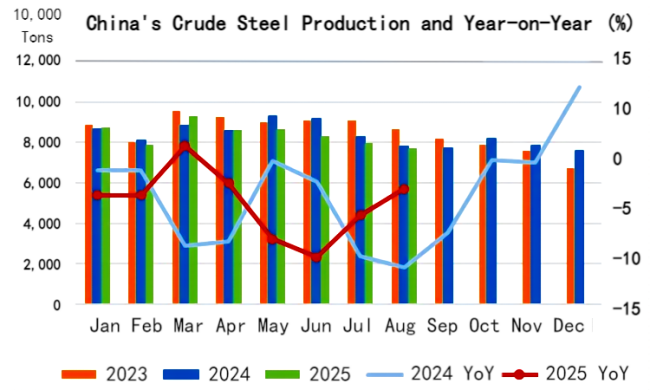

In August 2025, with the gradual implementation of production restriction policies for the military parade, continued off-season effects, and resilient cost support, China's steel market showed a fluctuating and weakening trend, with steel mill capacity release continuing to decline. According to data released by the National Bureau of Statistics, in August, China's pig iron production reached 69.79 million tons, a year-on-year increase of 1.0%, turning from negative to positive growth; crude steel production reached 77.37 million tons, a year-on-year decrease of 0.7%, with the year-on-year decline narrowing by 3.3 percentage points from the previous month (see Figure 2). From January to August, cumulative pig iron production was 579.07 million tons, down 1.1% year-on-year; cumulative crude steel production was 671.81 million tons, down 2.8% year-on-year.

Figure 2: China's Crude Steel Production and YoY

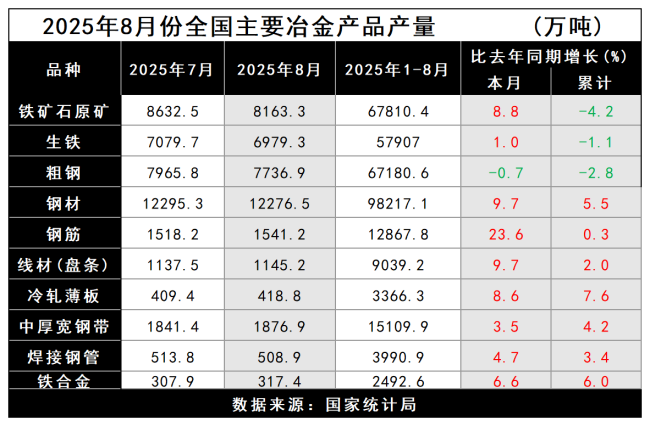

Regarding steel product output, both monthly and cumulative production still showed year-on-year growth. In August, steel production reached 122.77 million tons, a year-on-year increase of 9.7%, expanding the growth rate by 3.3 percentage points; cumulative production from January to August was 982.17 million tons, up 5.5% year-on-year. By product type, monthly output of all categories increased year-on-year, with rebar and wire rod production turning from negative to positive growth; cumulative production of all categories also showed growth (see Table 1).

National Major Metallurgical Products Production in August 2025

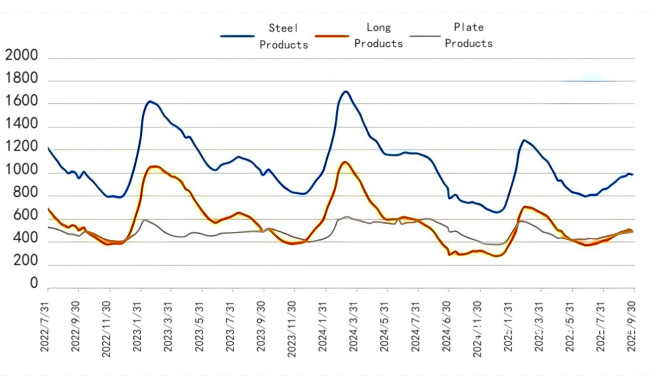

3. Social inventory of steel continues to rise

In September 2025, social inventory of steel showed a peak and slight decline trend, but the month-end still increased month-on-month. According to online monitoring data, as of the end of September, steel social inventory in 29 key cities was 9.881 million tons, a month-on-month increase of 5.2%, and a year-on-year increase of 13.8%. Among them, construction steel social inventory was 4.985 million tons, up 6.1% month-on-month, and up 46.2% year-on-year; plate steel social inventory was 4.896 million tons, up 4.2% month-on-month, and down 7.1% year-on-year (see Figure 3).

After the National Day holiday in October, due to the holiday factor, steel social inventory is expected to accumulate again, and as demand gradually recovers, steel social inventory is expected to show a declining trend later.

Figure 3: China's Steel Social Inventory Trend (10,000 tons)

4. Coke prices decreased in two rounds, cost support gradually weakened

Since September, iron ore prices showed a fluctuating upward trend. According to online monitoring data, as of the end of September, Tangshan 66% grade dry-basis iron ore fines price was 1,005 CNY/ton, up 20 CNY/ton from the previous month; imported Australian 61.5% fines at Rizhao Port was 785 CNY/ton, up 10 CNY/ton month-on-month.

Coke prices underwent two rounds of reductions in September. According to online monitoring data, as of the end of September, Tangshan secondary metallurgical coke price was 1,330 CNY/ton, down 100 CNY/ton from the previous month.

Scrap steel prices slightly declined in September. Tangshan heavy scrap price was 2,310 CNY/ton, down 10 CNY/ton month-on-month.

With the decline in coke and scrap steel prices, month-end production costs slightly decreased, weakening cost support for steel prices. According to the Research Center's cost monitoring data, the Lange pig iron cost index based on fuel purchased at the end of September was 104.0, down 1.5% from last month; tax-excluded cost of ordinary carbon billets decreased by 28 CNY, down 1.1% month-on-month.

5. China's steel exports under pressure may intensify

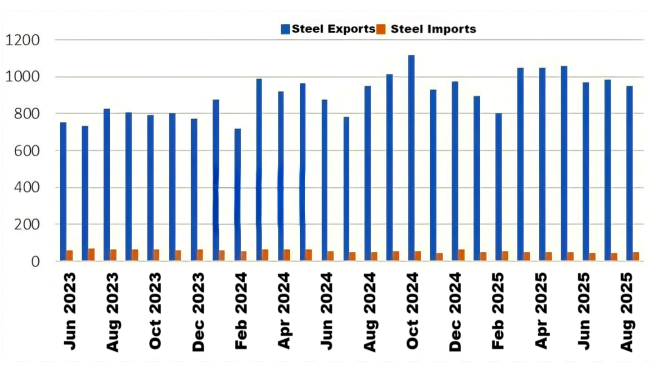

In August 2025, China's monthly steel exports showed slight year-on-year growth. According to the General Administration of Customs, in August, China exported 9.51 million tons of steel, up 0.1% year-on-year, with the growth rate falling 25.5 percentage points from the previous month; from January to August, cumulative steel exports reached 77.49 million tons, up 10.0% year-on-year, with the growth rate down 1.4 percentage points from the previous month. Imports in August reached 0.50 million tons, down 2.0% year-on-year, with the decline narrowing 7.6 percentage points from the previous month; cumulative imports from January to August were 3.977 million tons, down 14.1% year-on-year, narrowing 1.6 percentage points from the previous month.

Figure 4: Monthly Steel Import and Export Trends (10,000 tons)

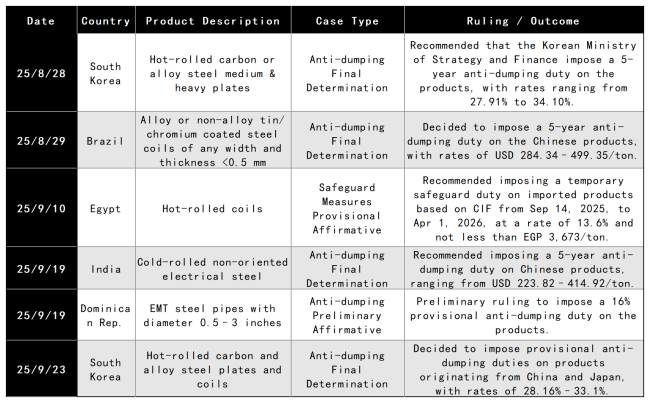

Since September, trade remedy investigations in the steel industry have continued. On September 1, Indonesia initiated an anti-dumping investigation on hot-rolled coils from China's Wugang Group Co., Ltd.; on September 4, Australia launched an anti-circumvention investigation on Chinese welded pipes; on September 10, Egypt initiated safeguard investigations on imported billets and cold-rolled, galvanized, and pre-painted sheets; on September 22, Vietnamese enterprises submitted an anti-circumvention investigation application on Chinese hot-rolled coils.

Previous anti-dumping rulings and extensions are also being issued (see Table 2). Reports indicate that the European Commission plans to impose punitive tariffs of up to 50% on Chinese steel products in the coming weeks, which will further restrict China's relevant steel exports.

Table 2: Recent Trade Investigation Rulings on Chinese Steel Products (Past Month)

Currently, China's steel exports maintain price advantages. Global manufacturing indices have rebounded, and overseas demand has slightly improved. Export order indices for steel enterprises have returned to expansion territory, providing some short-term support for steel exports. However, global crude steel production has increased, and trade frictions and related taxes will continue to suppress exports. Considering the higher export base in the same period last year (1,015,000 tons in September 2024, 1,118,000 tons in October 2024), steel exports in September and October 2025 may face year-on-year decline pressure.

The above factors may constrain China's steel market in October. However, China's economic fundamentals remain stable, with multiple advantages, strong resilience, and great potential, providing favorable conditions for high-quality development. Especially with accelerated cultivation of new growth drivers, market vitality continues to increase, and ongoing macro policy support, the economy is expected to maintain overall stability with moderate progress. Domestic demand underpins steel demand. Attention should be paid to the implementation of macro and industrial policies, and the policy signals from key October meetings will be important for guiding market sentiment.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies