【Anode Materials】Market Express — November 11: Prices Steady with Mild Increases...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Market Express — November 11: Prices Steady with Mild Increases, Year-End Momentum Building

Price Overview

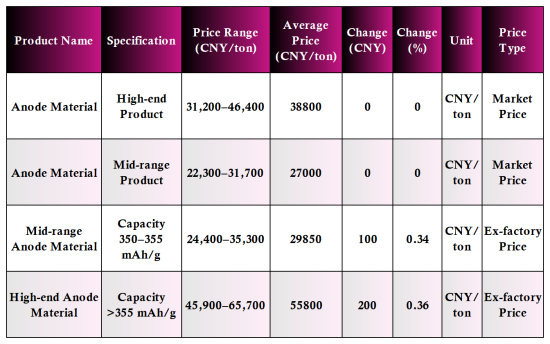

Today, the market price of high-end anode materials (including tax, cash) remained stable at 31,200–46,400 RMB/ton, with an average of 38,800 RMB/ton, unchanged from yesterday.

The mid-end anode material market price (including tax, cash) also remained stable at 22,300–31,700 RMB/ton, averaging 27,000 RMB/ton, unchanged from the previous day.

The mid-range anode materials (capacity 350–355 mAh/g) factory prices (including tax, cash) increased slightly to 24,400–35,300 RMB/ton, averaging 29,850 RMB/ton, up 100 RMB/ton from yesterday.

The high-end anode materials (capacity >355 mAh/g) factory prices (including tax, cash) rose to 45,900–65,700 RMB/ton, with an average of 55,800 RMB/ton, an increase of 200 RMB/ton compared with the previous day.

Market Summary

Today, the price of anode materials saw partial increases, ending the previously stable trend.

On the supply side, some enterprises raised prices due to reduced raw material inventories and higher cost pressure, with production control policies showing gradual effect.

On the demand side, power battery manufacturers increased procurement to prepare for year-end stocking, leading to a rebound in orders.

At the policy level, several departments have jointly promoted the "New Energy Vehicle to the Countryside" initiative, boosting market demand expectations.

On the cost side, needle coke prices are steadily rising, and graphitization processing fees have slightly increased, improving corporate profit margins.

Market sentiment has clearly warmed up, with stronger price-holding intentions from traders and more active market transactions.

Market Outlook

In the short term, anode material prices are expected to continue a mild upward trend.

On the supply side, driven by rising costs, some producers may continue moderate price adjustments.

On the demand side, the year-end stocking cycle is likely to release sustained procurement needs.

Cost-side support will further strengthen, providing momentum for price increases.

Attention should be given to downstream stocking progress and raw material price movements — if demand recovery continues, price growth potential may expand.

However, actual transaction volumes still need monitoring, and the market is expected to operate in a steady-to-strong pattern in the short term.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies