【Petroleum Coke】Expected to Rise Slightly and Steadily! Early-Month Carbon...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Expected to Rise Slightly and Steadily! Early-Month Carbon Plants Replenish Inventories, Supporting Market Improvement

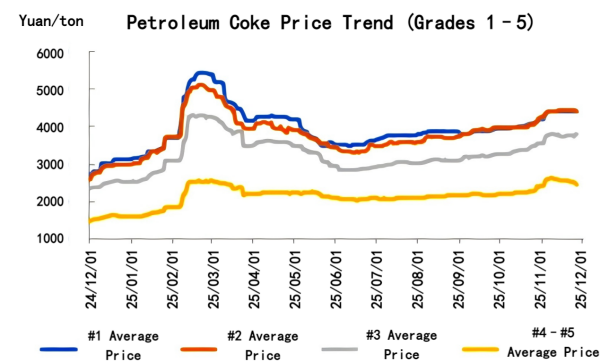

In November, petroleum coke prices first rose and then fell.

In early November, downstream replenishment was active, with strong purchasing enthusiasm. Combined with reduced production at major refineries in Northwest China, Northeast China, and along the Yangtze River, the prices of medium- and low-sulfur petroleum coke were supported upward. High-sulfur coke followed with an increase. Local refinery petroleum coke inventories were at low levels, and boosted by the upward movement in mainstream prices, local refinery prices actively increased.

By mid-month, as petroleum coke prices continued rising earlier, downstream purchasing enthusiasm weakened. Mainstream refinery prices tended to stabilize, and some auction prices declined. Supported by strong downstream orders for anode materials in energy storage and power battery sectors, anode coke prices continued to rise. However, shipments from local refineries were weaker than before, downstream sentiment grew more cautious, and petroleum coke prices came under downward pressure.

Entering December, a certain aluminum plant in Shandong significantly increased its benchmark purchasing price for prebaked anodes for December as expected. Downstream buyers gradually entered the market, improving transaction activity in the petroleum coke market.

Supply Side

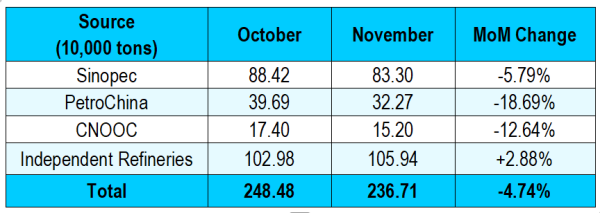

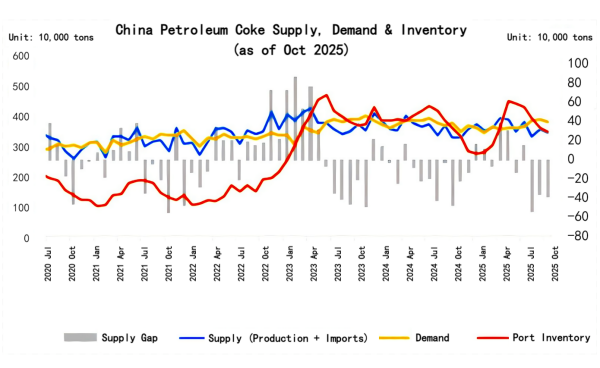

According to statistics, China's petroleum coke output in November 2025 is expected to reach 2.3671 million tons, down 4.74% from October.

Specifically, the reduction in domestic petroleum coke supply occurred mainly at major refineries. On October 23, the EU officially passed a sanctions resolution targeting major Chinese refineries and oil traders for the first time. As a result, some major refineries and local refineries in Shandong, along the Yangtze River, and in North China experienced shortages of feedstock for coking units, restricting production. This situation did not improve significantly in November, and mainstream petroleum coke supply continued to tighten.

Local refinery petroleum coke supply increased slightly, mainly because six additional local refinery coking units resumed production in mid-to-late November, contributing significantly to the increase in petroleum coke output.

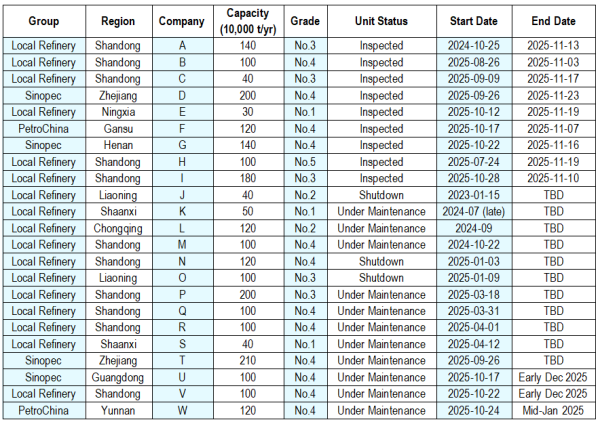

As of December 1, 18 coking units nationwide were under shutdown or maintenance, including 19 occurrences among local refineries. In November, nine coking units resumed production, and there were no new shutdown units.

Demand Side

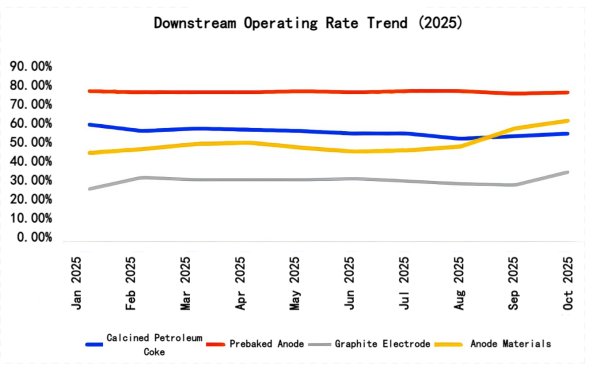

The aluminum carbon market is operating at high rates. Combined with the December benchmark purchasing price for prebaked anodes increasing by 300 yuan/ton compared with November, this provides positive support for the petroleum coke market.

The operating rate of the calcined petroleum coke market is 57.88%, up 0.41% from the same period last month. Most calcined petroleum coke producers maintain stable production, keeping petroleum coke demand steady.

The operating rate of the anode material sector is 63.63%, up 1.8% from last month. Orders for anode materials remain stable, but downstream purchasing has slowed due to the earlier continuous rise in petroleum coke prices.

The graphite electrode market is operating at medium-to-low levels. As winter temperatures continue to drop, some companies face production disruptions and have planned shutdowns. Mainstream producers maintain stable production rhythms, and their petroleum coke demand remains weak and steady. The silicon carbide market shows limited changes, and demand for petroleum coke persists.

Market Outlook

Supply Side

Petroleum coke supply in December is expected to increase slightly compared with November.

In December, 3–4 units are expected to undergo maintenance, impacting daily output by about 2,000 tons. Additionally, two units are expected to resume production in early December, adding approximately 1,400 tons of output. Beyond this, by the end of 2025, a 2-million-ton/year coking unit may be commissioned.

Demand Side

Downstream aluminum carbon plants are operating at high levels and are expected to maintain solid petroleum coke demand.

The anode material market benefits from increased terminal demand, with stable orders and continued demand for anode coke.

Graphite electrode production remains at medium-to-low levels, with minimal fluctuations in petroleum coke consumption.

The silicon carbide industry maintains demand for high-sulfur shot coke.

Conclusion

Overall, although petroleum coke supply is expected to increase slightly in December, port inventories remain low and imported coke costs are high, providing continued support on the supply side. Downstream anode material orders are stable, and their willingness to accept petroleum coke remains acceptable. Aluminum carbon plants purchase on demand, and some enterprises hold 1–2 months of raw material inventory, providing some—but limited—support in the short term.

In conclusion, petroleum coke prices are expected to rise slightly and steadily in December.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies