【Anode Materials】 Significant Momentum in the 2025 Energy Storage Market Drives ...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】 Significant Momentum in the 2025 Energy Storage Market Drives Incremental Consumption of Anode Materials

The energy storage battery industry chain can be divided into upstream materials and equipment, midstream battery manufacturing and system integration/installation, and downstream applications. The upstream of the energy storage battery industry chain mainly includes battery cell raw materials and battery production equipment. The raw materials for battery cells include cathode materials, anode materials, electrolyte, separator, and other materials. The midstream of the industry chain mainly includes energy storage battery systems, energy storage converters, energy management systems, and system integration/installation. Energy storage battery systems include battery packs, battery management systems (BMS), and battery PACK. The downstream mainly includes operation and maintenance services for different application scenarios, such as energy storage used on the power generation side, grid side, and user side, achieving peak shaving and frequency regulation, reducing curtailment of solar/wind power, mitigating grid congestion, arbitraging peak-valley price differences, and managing capacity electricity tariffs. Other application scenarios include backup power for communication base stations and data centers, as well as powering robotics systems and ensuring stable operation of high-performance weaponry. Overall, the energy storage battery industry chain covers a wide scope with many participants.

I. Analysis of Energy Storage Battery Supply

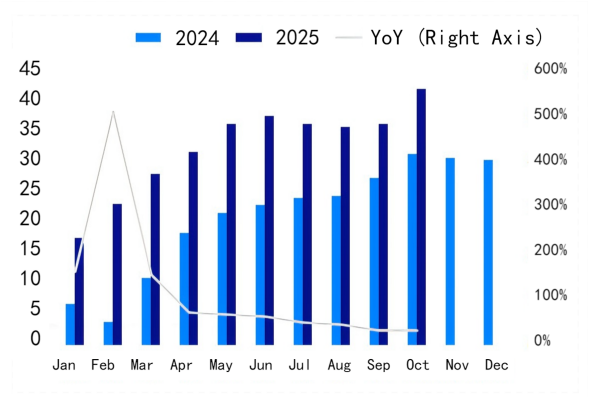

Figure 1: China's Energy Storage Battery Sales Data (GWh), 2024–2025

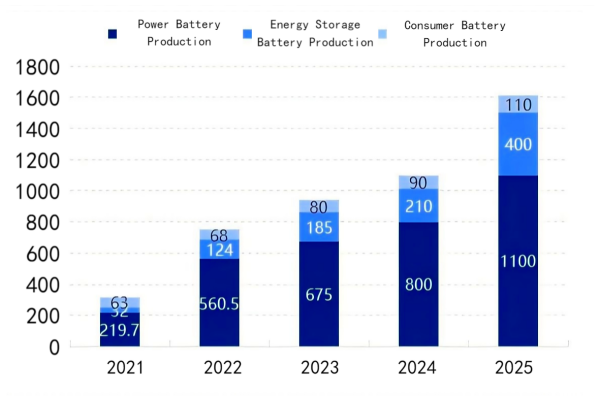

Figure 2: Energy Storage Battery Production Statistics (GWh), 2021–2025

Data Source: Oilchem

From the perspective of energy storage battery sales, in January–October 2025, China's energy storage battery sales reached 323 GWh, up 68.76% year-on-year. From a policy perspective, according to the Special Action Plan for Scaled Development of New Energy Storage (2025–2027), the target for national new energy storage installed capacity by 2027 is 180 GW, driving approximately 250 billion yuan in direct investment. As of the end of September 2025, China's cumulative new energy storage installed capacity exceeded 100 GW, and new bid volumes in the first three quarters of 2025 saw a significant year-on-year increase.

In January–September 2025, global energy storage battery shipments reached 428 GWh, up 90.7% year-on-year. China accounted for over 90% of global shipments. Meanwhile, overseas markets are also experiencing high growth—Europe, the Middle East, and Australia all show strong demand. In 2025, Chinese energy storage companies signed approximately 180 GWh of new overseas system orders, doubling year-on-year.

From 2021 to 2022, demand from energy storage base stations and the photovoltaic industry drove rapid growth in energy storage battery production, with year-on-year growth of 287.5%. In 2023–2024, demand continued to rise, supporting an increase in output of energy-storage-related anode materials. In 2025, strong demand persists, with production expected to reach 400 GWh, up 90.48% year-on-year. Large-scale storage projects in Xinjiang, Inner Mongolia, Qinghai, and Gansu provide domestic demand support, while additional overseas procurement from the Middle East, Eastern Europe, Southern Europe, and the U.S. keeps leading cell manufacturers running at full capacity, extending the period of high market activity.

The large-scale expansion of the energy storage industry continues to drive strong demand. As wind-solar paired storage expands, policies deepen, and commercial/industrial storage approaches an economic inflection point, the energy storage sector's demand growth in 2025 is expected to surpass that of power batteries, becoming a major incremental source of demand.

II. Analysis of Energy Storage Battery Market Structure

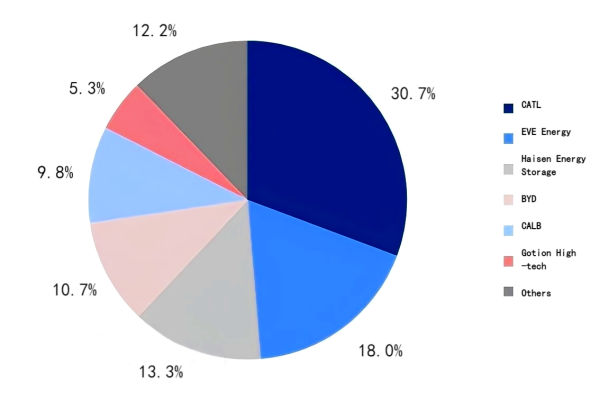

Figure 3: Global Market Share of Energy Storage Battery Manufacturers

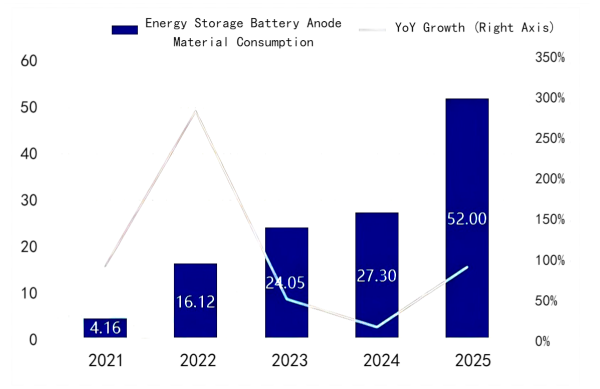

Figure 4: China's Anode Material Consumption Structure (10,000 tons), 2021–2025

Data Source: Oilchem

Chinese companies dominate the global energy storage battery market. The top 10 enterprises are all Chinese, with a combined market share exceeding 90%. CATL (Contemporary Amperex Technology Co., Ltd.) has ranked first in global shipments for multiple consecutive years, with a 2025 market share of 30.7%. EVE Energy focuses on commercial and industrial storage, with a relatively high share of overseas revenue. Hithium focuses on 587Ah long-duration storage cells, with a market share of 13.3%.

In 2025, the three major downstream sectors of anode materials are power batteries, energy storage, and consumer batteries, all increasing year by year. Power batteries have the largest consumption, accounting for 69%, down 2 percentage points year-on-year. Energy storage batteries rank second, accounting for 24%, up 5 percentage points. Consumer batteries account for 7%, down 1 percentage point.

III. Analysis of Energy Storage Battery Demand for Anode Materials

Figure 5: Consumption of Anode Materials by Energy Storage Batteries, 2021–2025 (10,000 tons)

Data Source: Oilchem

From 2021 to 2025, the consumption of anode materials by energy storage batteries has increased year after year. In 2025, consumption of anode materials by energy storage batteries is expected to reach 520,000 tons, up 90.48% year-on-year, accounting for 24% of total anode material consumption, with a year-on-year growth rate of 89%.

The global energy storage industry is undergoing rapid development. Chinese enterprises dominate the global market, and under the dual drivers of technological innovation and market expansion, the industry is experiencing simultaneous scaling and high-quality development. This year, the removal of mandatory storage-matching policies has promoted market-based pricing and driven earlier-than-expected demand growth in energy storage.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies