【Lithium Batteries】Anode Material Market Demand Remains Strong in December!

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Lithium Batteries】Anode Material Market Demand Remains Strong in December!

In December, demand in the anode material market continues to increase, mainly driven by the energy storage and power battery markets. Operating rates of anode material producers are expected to remain at high levels. As year-end approaches, anode material producers are focusing on cash recovery and prioritizing the digestion of existing inventories.

I. Increase in Lithium Battery Production Schedules in December

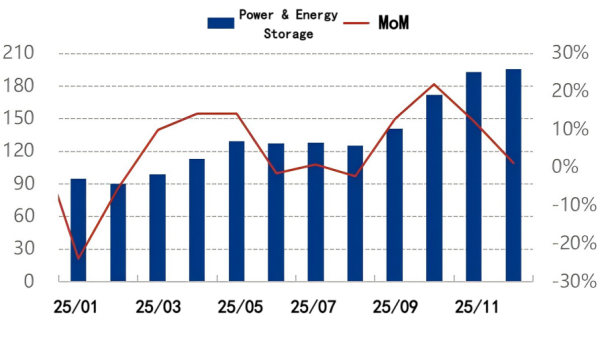

Figure 1: Lithium Battery Production Schedule (GWh)

Source: Oilchem

In December, lithium battery production schedules are estimated at 220 GWh, of which power and energy storage batteries account for 195 GWh, up 1.2% month-on-month. Overall battery production schedules increased slightly month-on-month, mainly driven by demand for energy storage batteries. In European and U.S. markets, requirements for energy storage duration have increased to 4–6 hours, while China's mandatory energy storage allocation policies continue to deepen, driving sustained growth in demand for large-capacity battery cells. Orders for energy storage batteries at most battery manufacturers have already been scheduled through the first quarter of 2026. Capacity utilization in the energy storage market remains high, with full order books.

Power battery production schedules, however, declined slightly month-on-month due to seasonal adjustments and strategic planning. This reflects preparations for potential changes in new energy vehicle purchase tax policies as well as the impact of trade-in programs.

II. Anode Material Monthly Output Remains at High Levels

Figure 2: Monthly Output of Anode Materials (10,000 tonnes)

Source: Oilchem

It is estimated that in December, monthly output of anode materials will increase by 0.3 percentage points month-on-month, with capacity utilization expected to reach 71.5%. Since the second half of the year, monthly output of anode materials has risen steadily, mainly driven by growing downstream demand. Anode material producers adjust production plans based on downstream orders to maintain reasonable inventory levels and avoid excessive stock accumulation. In the second half of this year, demand for anode materials has grown significantly, pushing capacity utilization back to high levels. In particular, leading anode material producers have maintained full-capacity operations.

III. No New Orders Signed in the Anode Material Market

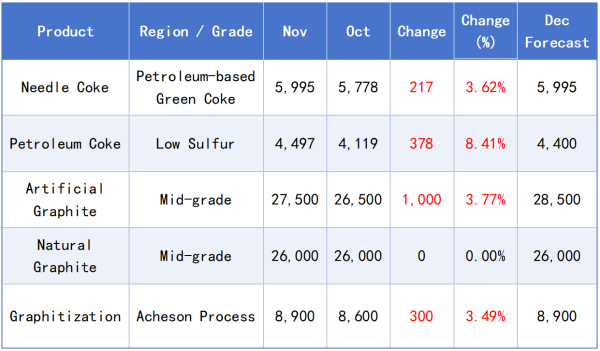

Source: Oilchem

In November, prices of anode materials, raw materials, and graphitization processing fees all increased, raising production costs and squeezing margins for anode material producers. Entering December, leading anode material companies have focused on cash recovery and inventory digestion, slowing the pace of raw and auxiliary material procurement. As a result, increases in raw material prices have been limited, with the market remaining largely stable, while prices of low-sulfur petroleum coke at high levels have shown signs of retreat. New anode material orders have not yet been signed. Meanwhile, prices of downstream batteries have begun to rise in some segments, indicating that there is still some upward potential in the anode material market.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies