【Calcined Petroleum Coke】So Tough! Big Swings in 2025, Limited Improvement Expected in 2026...

【Calcined Petroleum Coke】So Tough! Big Swings in 2025, Limited Improvement Expected in 2026, Supply–Demand Pressure Still Hard to Ease

Market Overview

In 2025, China's calcined petroleum coke (CPC) market remained under sustained pressure. The industry showed clear divergence throughout the year. Only in the third quarter, supported by rising demand from the anode material sector, did some enterprises see a short-term recovery in profits. For the rest of the year, the CPC industry remained deeply in loss, and overall operating pressure was significant.

In 2025, price increases in all grades of CPC lagged behind those of raw petroleum coke in both magnitude and frequency. With new capacity continuing to come onstream, China's CPC market remained in an overall state of oversupply.

Main influencing factors for low-sulfur CPC in 2025

(1) Low-sulfur petroleum coke prices: Anode materials and electrolytic aluminum industries competed for low-sulfur petroleum coke resources. Overall supply of low-sulfur petroleum coke was tight and prices fluctuated sharply, making it the key reference for pricing low-sulfur CPC.

(2) Weak demand support: Demand for recarburizers declined. Downstream consumption was mainly from graphite electrodes and cathode carbon blocks. Cathode carbon block operating rates were good, but the largest downstream segment—graphite electrodes—remained sluggish, which weighed on the low-sulfur CPC market.

Main influencing factors for medium- and high-sulfur CPC in 2025

(1) Slight increase in demand: Anode material demand was better than expected, boosting CPC consumption.

(2) Slower-than-expected commissioning of new capacity: Many projects were planned or under construction, but due to weak market conditions most producers postponed start-ups.

(3) Cost control was critical: Under international macro influences, petroleum coke price volatility increased, and procurement timing led to significant cost differences among producers.

Low-sulfur CPC prices fluctuated significantly in 2025. In December, the monthly average price was RMB 5,940.91/ton, up RMB 1,913.17/ton year-on-year, an increase of 47.50%.

Medium- and high-sulfur CPC (S < 3%, V < 400) prices were mainly pushed higher during the year, but eased slightly in December due to weaker raw material prices and demand. The December monthly average price was RMB 3,859.09/ton, up RMB 1,163.32/ton year-on-year, an increase of 30.14%.

General-grade medium- and high-sulfur CPC (S < 3.5%, no micro-element requirements) followed a rise–fall–rise–fall pattern.In December 2025, the monthly average price was RMB 2,647.73/ton, up RMB 724.44/ton year-on-year, an increase of 37.67%.

Price Performance

Low-sulfur CPC

In 2025, the low-sulfur CPC market remained under pressure, with prices following a rise–fall–rise trend. Petroleum coke price movements directly determined CPC cost curves. Meanwhile, downstream demand constrained CPC pricing, making adjustments relatively passive.

In January–February, low-sulfur CPC prices surged with rising costs, generally increasing by more than RMB 2,000/ton. In March and Q2, prices continued to decline, and enterprises suffered ongoing losses due to high-priced raw material inventories. In Q3, prices rebounded, with Fushun CPC rising to around RMB 6,200/ton and Jinxi CPC to around RMB 5,600/ton. In early Q4, prices rose by about RMB 200/ton with raw materials, but from mid-to-late December prices fell again due to weaker feedstock prices.

From a detailed market perspective, downstream steel mills operated at low rates. Markets for graphite electrodes, high-purity graphite, special graphite, and recarburizers were weak, and the number of operating companies declined compared with last year. Purchases of low-sulfur CPC were mainly small-lot replenishments, and buying interest dropped sharply when prices rose too fast.

Weak demand kept the low-sulfur CPC market in a passive position throughout 2025. Even with production cuts, supply–demand imbalances remained. Because of large price increases, CPC produced from high-priced raw materials faced heavy selling pressure, and the industry suffered heavy losses from January to July.

In exports, 2025 volumes increased only slightly from 2024, mainly shipped via Panjin Port and Tianjin Port after screening. No new CPC capacity was planned in 2025, and most enterprises ran at low loads or conducted maintenance. Compared with 2024, prices in 2025 fluctuated much more sharply. In Q1, low-sulfur CPC prices rose by RMB 3,000/ton, but adjustments lagged petroleum coke due to weak graphite electrode demand.

Medium- and High-Sulfur CPC

The medium- and high-sulfur CPC market was weak in 2025. Exports shrank significantly, and competition in the domestic market intensified. Prices rose in January and July–November due to raw materials, while falling in other months. Except for marginal profitability in Q3, most months saw severe losses.

In Q1, raw material prices surged. Although downstream demand was stable, price acceptance was slow, causing serious price inversions.

In Q2, competition intensified, and prices fell by RMB 150–300/ton to reduce inventory.

In Q3, maintenance and rising downstream anode demand drove prices up by RMB 300–400/ton, with shortages in September. From late November, prices fell again as demand weakened and feedstock support collapsed.

Demand was mainly supported by aluminum smelters, while anode filler demand was price-driven and highly cost-sensitive.

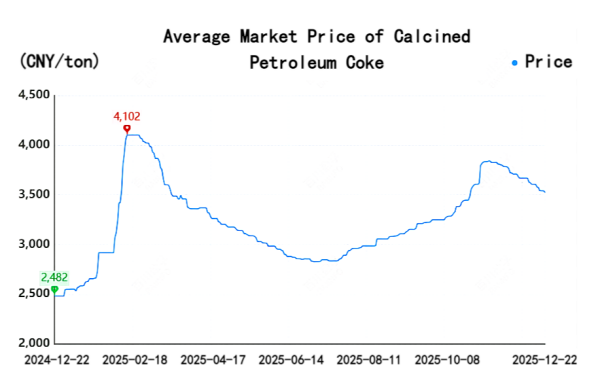

Monthly Average Prices of Calcined Petroleum Coke

Profitability

Low-sulfur CPC

In Q1, enterprises suffered heavy losses due to high raw material costs and weak demand.

In Q2, losses remained RMB 150–200/ton.

In Q3, prices rebounded and profits improved to RMB 50–100/ton.

In Q4, profits fell back to breakeven by December.

Medium- and High-Sulfur CPC

Q1 losses averaged RMB 220/ton.

Q2 losses narrowed to RMB 140/ton.

Q3 was marginally profitable.

Early Q4 saw profits around RMB 30/ton, but from November losses deepened to RMB 100–150/ton.

Supply

From Jan–Nov 2025, China's commercial CPC output was 8.9818 million tons, up 1.94% YoY.

Low-sulfur CPC output fell 15.55% to 712,600 tons.

Medium- and high-sulfur CPC output rose to 8.2693 million tons, up 3.79%.

Inventory

Low-sulfur CPC inventories rose in H1, normalized in Q3, and increased again in Q4.

Medium- and high-sulfur CPC inventories were high in H1, balanced in Q3, and rose again from late Q4.

Imports & Exports

From Jan–Nov 2025, China imported 198,900 tons of CPC, up 40.19%.

Low-sulfur imports (<0.8% S) reached 112,100 tons.

Oil-based needle coke imports rose 47.84% YoY.

Total CPC exports were 1.1557 million tons, down 18.74%.

Outlook for 2026

Raw material prices are expected to stay strong, but new capacity will keep supply pressure high.

Low-sulfur CPC prices will track petroleum coke, while medium- and high-sulfur CPC will see limited improvement.

Forecast 2026 Prices:

1. Jinxi low-sulfur CPC: RMB 5,600–6,500/ton

2. Fushun/Daqing CPC: RMB 6,200–7,000/ton

3. Low-density low-sulfur CPC for recarburizers: RMB 5,200–6,000/ton

Medium- and high-sulfur CPC:

1. S 3.0%: RMB 2,500–3,100/ton

2. S 3.0%, V ≤ 400: RMB 3,600–4,500/ton

3. S 3.5%: RMB 2,400–3,000/ton

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies