【Petroleum Coke】Off-Season but Not Weak: Buyer Resistance, Supply Support,...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Off-Season but Not Weak: Buyer Resistance, Supply Support, Prices Remain Firm

Despite global petroleum coke prices stabilizing, buyer resistance continues to suppress spot trading activity.

Supply control measures and freight costs are providing price support across different petroleum coke grades.

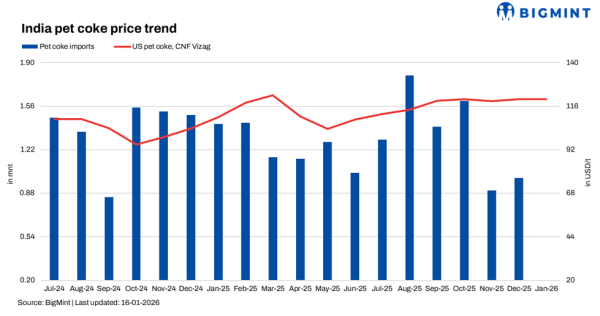

Indian Petroleum Coke Price Trend, Unit: USD/ton

Statistical Period: July 2024 – January 2026

Data Source: BigMint

In mid-January 2026, the global petroleum coke market remains in a phase of light trading but strong resilience.

Buyers in major importing regions are increasingly resistant to high CIF costs. However, prices for most sulfur grades and origins remain firm. Tight supply, seasonal shipment constraints, and elevated freight rates continue to underpin prices. Even with sluggish spot transactions, no material price correction has occurred.

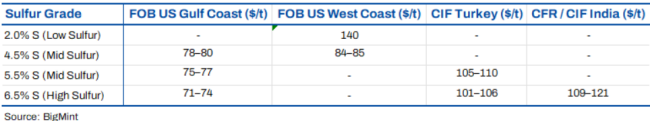

Price Overview: By Sulfur Grade and Origin

Price Unit: USD/ton

Statistical Period: Early to Mid-January 2026

Note: Indian market price ranges are based on a combination of buyer bids, reference prices, and seller offers. Actual purchasing demand is concentrated in the cost-plus-freight range of USD 112–116/ton.

Market Performance by Sulfur Grade

High-Sulfur Petroleum Coke (Sulfur Content 6.5%): Range-Bound, Cautious Market

High-sulfur petroleum coke prices remain firm across markets, but upside potential is limited. U.S. export prices are largely flat, reflecting a balance between weak spot demand and tight prompt supply. In the Turkish market, CIF prices remain in the lower USD 100/ton range. Both buyers and sellers are quoting, but the market is relatively balanced with thin成交 volumes.

Buyer resistance is more pronounced in the Indian market. Buyer bids are concentrated in the low USD 110/ton cost-plus-freight range, while seller offers are close to USD 120/ton. This widening bid-offer spread has resulted in very limited spot transactions. Most buyers remain on the sidelines, purchasing only volumes required for immediate production needs.

Medium-Sulfur Petroleum Coke (Sulfur Content 4.5%–5.5%): Localized Strength

Medium-sulfur petroleum coke prices are showing modest strengthening. The Turkish market continues to favor the 5.5% sulfur grade. Supported by cement sector demand, prices for this grade remain consistently higher than those for high-sulfur petroleum coke. Medium-sulfur petroleum coke prices along the U.S. Gulf Coast are stable. On the U.S. West Coast, prices for 4.5% sulfur petroleum coke have edged higher, supported by regional supply tightening and limited spot availability.

Low-Sulfur Petroleum Coke (Sulfur Content 2%): Structural Supply Tightness

Low-sulfur petroleum coke supply on the U.S. West Coast remains structurally tight, with prices consistently at elevated levels. Limited production combined with rigid demand from niche industrial applications has insulated this grade from broader market weakness. Prices continue to maintain a significant premium over high-sulfur petroleum coke.

Structural Factors Influencing the Market

Seasonal Supply Controls

Following year-end inventory drawdowns, producers reduced spot availability at the beginning of the year. This seasonal supply tightening has led to reduced availability across all sulfur grades, with low- and medium-sulfur products particularly affected. As a result, sellers have limited room to expand sales through price reductions.

High CIF Costs and Buyer Resistance

Rising freight rates continue to push up CIF costs in the Indian and Turkish markets. Even as FOB prices remain stable, buyer resistance is intensifying. Indian buyers generally consider prices in the mid-USD 110/ton cost-plus-freight range to be workable and are unwilling to accept offers above this level.

Fuel Substitution Risk

High-sulfur petroleum coke is facing competitive pressure from thermal coal, particularly in price-sensitive cement applications. This substitution risk limits the upside potential for 6.5% sulfur petroleum coke and reinforces its current range-bound price pattern.

Short-Term Market Outlook

High-sulfur petroleum coke prices are expected to remain range-bound. Supply controls will continue to provide price support, while buyer resistance will cap upside potential. Medium-sulfur petroleum coke is likely to maintain a modest premium, with tighter supply markets showing stronger performance. Low-sulfur petroleum coke, supported by structural scarcity, is expected to remain firm.

Overall, the petroleum coke market is expected to remain quiet in terms of trading activity, but prices are supported against downside risks. The prevailing theme is cautious buyers, low spot transaction volumes, and price support driven by supply controls rather than demand growth.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies