【Petroleum Coke】Freight Rates Supporting Prices — U.S.–Venezuela Developments Set the Tone,...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Freight Rates Supporting Prices — U.S.–Venezuela Developments Set the Tone, Medium- to Long-Term Petroleum Coke Prices May Trend Lower

At the beginning of the year, Ukraine, the United States, and Europe entered negotiations aimed at formulating a Ukraine peace plan acceptable to Russia. Attention then shifted to U.S. military actions in Venezuela and the arrest of President Maduro. The Trump administration has announced relevant plans, proposing that Venezuela's nationalized oil reserves be gradually returned to corporate control in the medium term, a move that could ultimately lead to the lifting of U.S. sanctions on Venezuela.

Previously, Greenland, an autonomous territory of Denmark, also attracted public attention. Some observers mistakenly believed that this situation implied a potential invasion of a NATO member state. However, many overlooked the fact that under treaties signed in 1917 and 1951, the United States already has full control over Greenland's defense. Although media coverage amplified tensions, the issue could be resolved through friendly consultations among allies.

Meanwhile, Iran is facing widespread political unrest, and the United States has continued to signal the possibility of renewed joint action with Israel.

Despite this series of developments, the market has shown almost no significant volatility. During the Christmas and New Year holidays, the euro strengthened slightly. At the time of writing, the EUR/USD exchange rate stood at 1.17, slightly higher than the level reported in last month's International Coal Report, and still within the 1.15–1.20 range. Brainwol Ltd. forecasts that the EUR/USD exchange rate in 2026 will range between 1.10 and 1.25, with an average of 1.19.

Oil Market Analysis

U.S. actions in Venezuela are widely seen as efforts to regain control over the country's oil production. Following nationalization, Venezuela's oil output declined sharply over the past several years. For U.S. oil companies re-entering the market and reinvesting, production could increase significantly. Moreover, once export sanctions are lifted, large volumes of Venezuelan oil may flow into the international market.

At present, these events have had almost zero impact on market prices, with oil prices declining rather than rising after U.S. military actions. OPEC and its allies have reassessed production baselines and decided to maintain current output cuts. Several Ukrainian attacks on Russian oil production facilities and refineries have supported Brent crude prices within the USD 60–65 range, with the current price at USD 61.

For 2026, Dutch Title Transfer Facility (TTF) natural gas prices remain unchanged at EUR 26.50. EU gas inventories have fallen to 59%, below levels seen in the same period over the past two years. Brainwol Ltd. forecasts Brent crude prices in 2026 to range between USD 55 and 80, with an average of USD 68.

Coal Market Analysis

Geopolitical developments have had little impact on coal markets. Russia continues to supply discounted coal, India's coal production remains high, and Turkey holds ample coal inventories. These factors combined have driven coal prices slightly lower.

API2 thermal coal Q1 2026 contract prices were unchanged month on month at USD 97, with an expected range of USD 95–100. API2 full-year 2026 contract prices declined 3% month on month to USD 96. API4 thermal coal Q1 2026 contract prices fell 4% month on month to USD 87, with a short-term expected range of USD 85–95.

Brainwol Ltd. forecasts API2 thermal coal futures prices in 2026 to range between USD 85 and 115, with an average of USD 100, while API4 thermal coal futures prices are expected to range between USD 80 and 105.

Petroleum Coke Market Analysis

There has been no major news specific to petroleum coke itself, but declining freight rates have provided support to the otherwise sluggish petroleum coke market.

From a medium- to long-term perspective, if Venezuelan oil production recovers and sanctions are lifted, petroleum coke supply will increase accordingly, with large inventories entering the market.

This could put downward pressure on prices for 4.5% sulfur petroleum coke and narrow the price spread versus 6.5% sulfur petroleum coke. In the short term, falling coal prices have widened petroleum coke's discount relative to coal. U.S. Gulf Coast petroleum coke FOB prices are approaching resistance levels. Future market uncertainty may stem from two factors: changes in the Venezuelan situation and the conclusion of a Ukraine peace agreement. Both could prompt the U.S. and EU to lift sanctions on Russian coal exports.

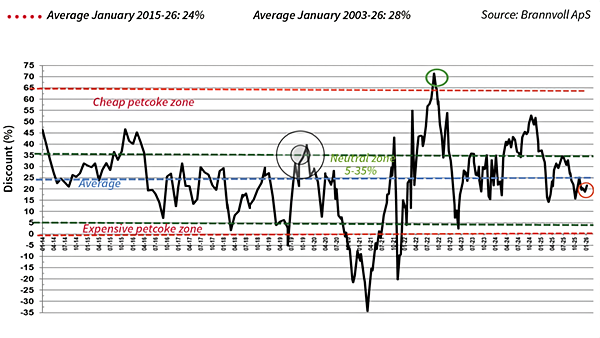

Petroleum Coke Discount Versus Coal — Based on 6,000 kcal API2, U.S. Gulf Coast 6.5% sulfur petroleum coke (CIF Rotterdam–Antwerp–Amsterdam): the discount stood at 22% in January 2026.

U.S. Gulf Coast 6.5% sulfur petroleum coke FOB contract prices rose 3% month on month to USD 71/ton, narrowing the discount versus API4 thermal coal to 35%.

U.S. Gulf Coast 6.5% sulfur petroleum coke CIF Rotterdam–Antwerp–Amsterdam contract prices fell 1% month on month to USD 95/ton, widening the discount versus coal to 22%.

U.S. Gulf Coast 4.5% sulfur petroleum coke FOB contract prices rose 2% month on month to USD 77/ton, narrowing the FOB discount versus API4 thermal coal to 27%.

4.5% sulfur petroleum coke CIF Rotterdam–Antwerp–Amsterdam contract prices declined 1% month on month to USD 101/ton, widening the discount versus coal to 17%.

Brainwol Ltd. forecasts that in 2026, CIF Rotterdam–Antwerp–Amsterdam prices for 6.5% sulfur petroleum coke will range between USD 85 and 105/ton, with an average of USD 95/ton and an average discount to coal of 25%.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies