【Petroleum Coke】Rising External Dependency, 2025 Imports Up 15.36% YoY

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Rising External Dependency, 2025 Imports Up 15.36% YoY

Market Overview

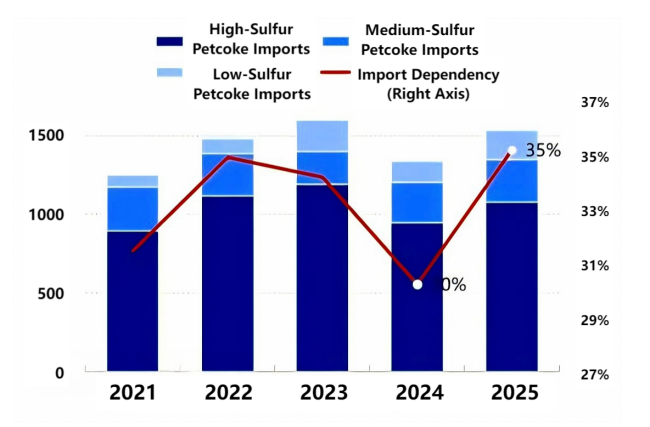

2025 is a year of rebalancing for petroleum coke supply and demand. Domestic refineries coincided with a major maintenance cycle, leading to a decline in domestic supply. On the demand side, newly commissioned capacities continued to be released, with consumption growth exceeding supply growth by 3.8 percentage points. Imported petcoke entered the market to fill the supply gap, pushing China's external dependency on petroleum coke up to 35%.

Stronger Policy Impact, High Imports in Q2

China is the world's largest consumer of petroleum coke. Demand growth across downstream sectors has accelerated, the domestic supply–demand gap has continued to narrow, and inflows of overseas resources have become one of the main components of petcoke supply. From 2021 to 2025, petcoke consumption consistently exceeded annual domestic production, and a supply gap has persisted in the Chinese market. According to customs statistics, China's petroleum coke imports in 2025 totaled 15.36 million tons, an increase of 2.05 million tons year-on-year, representing a growth rate of 15.36%. Monthly imports ranged between 0.9 and 1.83 million tons, mostly showing positive year-on-year growth compared with 2024.

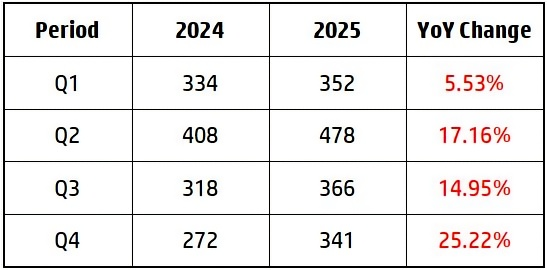

In the first quarter, monthly petcoke imports remained at 1.10–1.20 million tons, with quarterly imports increasing by 5.53% year-on-year. Active downstream procurement sentiment pushed up port spot prices, and traders increased overseas contract signings. From the second quarter onward, previously contracted overseas petcoke arrived successively in China. In addition, influenced by China–US tariff issues, traders accelerated the arrival of imported cargoes, with imports in April–May once exceeding 1.82 million tons per month. Quarterly imports reached 4.78 million tons, up 17.16%, and the theoretical external dependency of petroleum coke climbed to as high as 44%.

In the second half of the year, petcoke imports were relatively stable. As China–US tariff policies became clearer, traders increased overseas contract signings again. Fourth-quarter imports rose to 3.41 million tons. Although imports were at a relatively low level on an annual basis, the year-on-year increase reached 25.22%.

Import Structure Largely Stable with Minor Adjustments; US Remains the Top Source

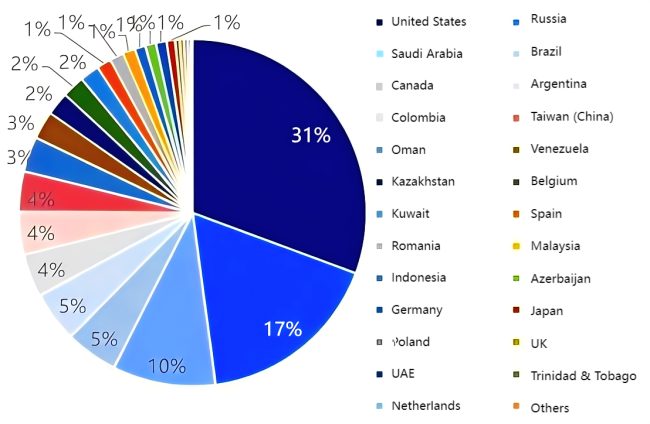

In 2025, China's petroleum coke import origins became more diversified, with shipments arriving from Oman, Japan, the United Arab Emirates, Azerbaijan, and other countries. These origins mainly supplied specification-grade and low-sulfur petroleum coke, partially alleviating the domestic raw material shortage.

The top five import sources of petroleum coke were the United States, Russia, Saudi Arabia, Brazil, and Canada. Except for Brazil, these origins mainly supplied high-sulfur petroleum coke. Total imports from the United States reached 4.71 million tons, accounting for 31% of total imports, firmly ranking first. The share of low-sulfur coke imports from Brazil and Argentina increased, supported by domestic demand from aluminum carbon and anode materials, leading to an overall increase in low-sulfur petcoke usage and benefiting port shipments. Venezuela's annual petcoke imports totaled only 0.40 million tons, down 0.37 million tons year-on-year, a decline of 74.31%. Its import share fell to 3%, down 3 percentage points.

High-Sulfur Coke Accounts for 70% of Imports, Down YoY

Imports of petroleum coke with sulfur content below 1% totaled 1.88 million tons, accounting for only 12% of total imports. These were mainly sourced from Brazil, Argentina, Romania, Indonesia, and Azerbaijan. Among them, imports from Brazil were the largest at 0.7519 million tons, accounting for 40% of low-sulfur coke imports.

Imports of petroleum coke with sulfur content of 1–3% reached 2.73 million tons, accounting for 18% of total imports. China's medium-sulfur coke imports mainly came from the United States, Belgium, Russia, Colombia, and Germany. Among these, imports from the United States reached 1.67 million tons, accounting for 61% of total medium-sulfur coke imports, making it the largest source of this category.

China's imports are still dominated by high-sulfur petroleum coke. In 2025, imports with sulfur content above 3% totaled 10.75 million tons, accounting for 70% of total imports. By origin, these mainly came from the United States, Russia, Saudi Arabia, Canada, Taiwan (China), and Oman. Imports of petroleum coke with sulfur content above 3% from the United States reached 3.04 million tons, accounting for 28% of high-sulfur coke imports. Notably, affected by tariff policies, overall imports of US petroleum coke declined, and the share of high-sulfur coke imports fell by 1 percentage point year-on-year in 2025.

Rising External Dependency, Up YoY

Over the past five years, China's dependency on petroleum coke imports first increased and then declined, fluctuating between 27% and 35%, indicating a relatively high overall reliance.

Petcoke Imports and Dependency

Driven by rapid downstream demand growth and declining domestic supply due to multiple factors affecting refineries, large volumes of imported petcoke entered the domestic market to fill the supply gap. As a result, China's external dependency on petroleum coke rose to 35%, up 5 percentage points year-on-year, reaching a relatively high level over the past five years.

In 2026, losses from domestic refinery maintenance are expected to decrease, and previously shut-down facilities will largely resume production, boosting domestic petroleum coke supply. However, due to adjustments in raw material specifications, the supply structure of petroleum coke is gradually shifting toward medium-sulfur products. Downstream enterprises will continue to release new capacity, and annual consumption may still increase. Overall, a supply gap in the petroleum coke market will persist. Traders remain cautious toward overseas contract signings. Over the full year, the supply–demand gap is expected to narrow gradually, imports may see a slight year-on-year decline, and external dependency on petroleum coke is forecast to fall to around 31%.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies