Monthly report: UHP graphite electrode price or strong operation in October

Monthly report: UHP graphite electrode price or strong operation in October

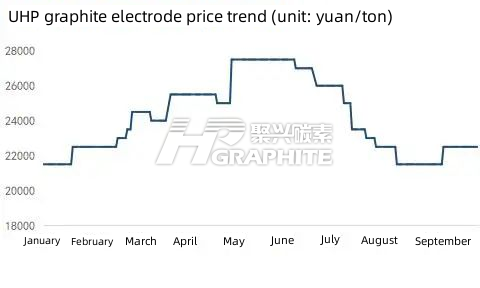

In September, UHP graphite electrode price rebounded from the bottom, with a month-on-month increase of 1000 yuan/ton, which was mainly restricted by the rise in cost price and the sharp decline in production. The downstream BF (blast furnace) and EAF (electric arc furnace) started to recover, and the demand showed a slight warming trend, but the overall recovery was less than expected. Entering the period of "Gold September and Silver October", graphite electrode price rose temporarily due to high cost pressure. What changes will happen to China's UHP graphite electrode market when the "Silver October" is approaching? The author elaborates from the following aspects.

Ⅰ. Macroscopic - stimulating the economy at home and abroad

1. Centralized construction of major projects

According to incomplete statistics, on the eve of the National Day, many regions in China have held activities, such as concentrated construction and signing activities, with a total investment of 3,163.9 billion yuan.

2. Export growth speed up

From January to August this year, China's exports reached 15.48 trillion yuan, up 14.2% year-on-year. In terms of year-on-year export growth, a total of 27 provinces and cities achieved positive growth, of which 18 provinces and cities exceeded the average level of 14.2%.

Ⅱ. Review - prices bottomed out and rebounded

In August, China's crude steel average daily output was 2.7055 million tons, up 3.0% month-on-month. Although the production efficiency was low, due to the improvement of demand in September, the steel plant also increased its efforts to resume work. Crude steel average daily output in September was expected to increase by more than 5.34% compared with that in August. The supply and demand of the domestic steel market are in a weak balance, and the steel inventory is expected to be further reduced after the National Day holiday. The macro steel market is conducive to the domestic demand for graphite electrode, supporting its price rebound. Although the actual rebound range was limited, it did curb the decline in prices.

For example, Jiangsu φ 500 UHP graphite electrode, as of September 29, the UHP graphite electrode quotation was 22500 yuan/ton, with a year-on-year increase of 1000 yuan/ton. Most of the supply is concentrated in domestic leading manufacturers, and some emerging manufacturers appear, but the supply is limited.

Ⅲ.Cost - pressure multiplies and the rising trend is hard to change

Graphite electrode raw materials price analysis (unit: yuan/ton)

Product | Specification | September 29th | August 29th | Month on month |

Petroleum coke | Daqing 1 # A, raw coke | 7600 | 7400 | 200 |

Petroleum coke | Jinxi 1 # B, raw coke | 7450 | 6900 | 550 |

Needle coke | Jinzhou Petrochemical, raw coke | 9500 | 11000 | -1500 |

Coal tar pitch | Medium temperature, Hebei high-end price | 7200 | 6500 | 700 |

In September, China's low sulfur coke price rebounded, with Daqing raw petroleum coke price rising by 200 yuan/ton and Jinxi raw petroleum coke price rising by 550 yuan/ton. Anode materials entered the peak stock period in the fourth quarter, and petroleum coke price that fell in the earlier period gradually rose. The petroleum coke yield diversion for the preparation of anode materials still has a great influence on the graphite electrode enterprises. In terms of needle coke, due to the sharp drop in the output of graphite electrode and weak demand, the price has declined. In terms of coal pitch, affected by poor air quality and strict environmental control around the National Day, the production and supply in Hebei Province are low, and the price is rising. In addition to basic raw materials, Inner Mongolia and other places have canceled the electricity price preference, and graphite electrodes graphitization cost increasing is an accomplished fact.

From the perspective of raw material price and supply output, graphite electrode production pressure is still large. At present, only a few leading enterprises are in production. Relying on early reserves of raw materials, they struggled to survive. However, in October, with the gradual consumption of raw material inventory, the high cost pressure of graphite electrode has become a reality. From the statistical data, according to the market price, the price of φ500 UHP graphite electrode was 22,500 yuan/ton, and the loss was 44 yuan/ton. According to the market transaction price, the highest price might be more than 3000 yuan/ton. Therefore, judging from the current low production of UHP graphite electrode, no matter the price of raw materials rises or falls in the later period, UHP graphite electrode price will rise to make up for the current serious deficit.

Ⅳ. Demand - downstream production operation rate rises and the demand remains

September 29, China's BF (blast furnace) and EAF (electric arc furnace) operating rate and profit schedule

| Production mode | Operating rate% | Month on month% | Profit (yuan/ton of steel) | Month on month (yuan/ton) |

BF | 82.81 | 2.67 | 26.91 | -85. 78 |

EAF | 62.07 | 8. 25 | -271.20 | -82. 26 |

Looking at the mainstream steel market, although the BF and EAF construction has improved, the profits are still insufficient. Although the steel demand picked up in September, the scope of the resumption of steel production has been further expanded, the macro pressure is relatively high. The domestic policy of stabilizing the economy continued to increase to curb inflation, while the Federal Reserve continued to raise interest rates, increasing the risk of global economic recession, which seriously hampered the recovery of domestic market confidence. Many uncertain factors in the downstream affect the graphite electrode market.

Ⅴ. October market outlook - stable and strong

Looking forward to the steel market in October, the domestic economy may continue to recover slowly in the short term. After the National Day holiday, steel demand still has a certain support, and steel prices may fluctuate significantly. With the gradual end of the "golden season" of construction, the external environment has become more severe and complex. In addition to the uncertainty of the epidemic situation and other factors, steel prices may fall seasonally, which will have a negative impact on the domestic graphite electrode market. Despite the bullish attitude, graphite electrode price growth may be difficult to match the growth of raw materials prices. In the case of insufficient supply, UHP graphite electrode can only meet the basic needs of the downstream market, thus accelerating the simplification and de-scaling process of graphite electrode market. Therefore, in general, UHP graphite electrode price is still likely to rise, while the supply is difficult to increase. Reading the latest market reports of graphite electrode, welcome to contact us.

No related results found

0 Replies