【Petroleum coke】Port inventory rise, petroleum coke market is not expected to rise in the short term

[Petroleum coke] Port inventory continues to rise, petroleum coke market is not expected to rise in the short term

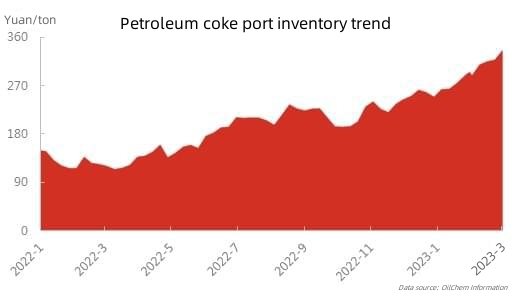

In 2023, China's petroleum coke market basically maintained a weak trend, the imported resources continued to arrive at ports in large quantities, and the demand end trading slightly weak. As a result of oversupply, the petroleum coke market has been volatile and showing a downward trend. However, the import petroleum coke market has been impacted by China's domestic products, port dredging has slowed down, and the total port inventory has reached a new high.

According to market survey data, about 2.1 million tons of imported petroleum coke resources have arrived in China's domestic market since 2023. With the continuous and massive warehousing of imported resources, the total inventory of ports has accumulated from 2.491 million tons at the end of 2022 to 3.356 million tons, an increase of 865000 tons or 34.73 percentage points.

According to the statistics of customs declaration and shipment date, the import volume of petroleum coke from the United States, Venezuela and Russia still ranks the top3. Rizhao Port, as the main domestic petroleum coke gathering and distributing port, slows down the speed of port clearance due to the low purchasing enthusiasm of downstream enterprises, with the port clearance ranges from 60000 tons to 100000 tons per week, and the spot inventory has increased to 2 million tons by the end of February. A small amount of imported petroleum coke is transferred to the port for storage. The monthly operation volume of petroleum coke varies from 40,000 to 100,000 tons. The surrounding enterprises have good purchasing enthusiasm, and the spot inventory of Zhenjiang Port and Nanjing Xiba Wharf is maintained at about 100000 tons. The spot imported resources in the South China market are mainly imported fuel grade petroleum coke, and 80% of them are American pellet coke, Saudi coke, Venezuela petroleum coke and Canadian sources, which are mainly used in the surrounding power plants; Part of Russian petroleum coke is unloaded into storage for the production of aluminum carbon market in Guangxi region; The spot coke inventory of Formosa Plastics has not been significantly reduced temporarily, and is mainly used for the production and use of silicon metal enterprises in South China and Southwest China. As the southwest region is still in the dry season, the low starting point of silicon metal enterprises has no obvious positive support for the price of Formosa Plastics coke. During the dry season in the southwest region, the low production rate of silicon metal enterprises does not significantly support the price of Formosa Plastics coke.

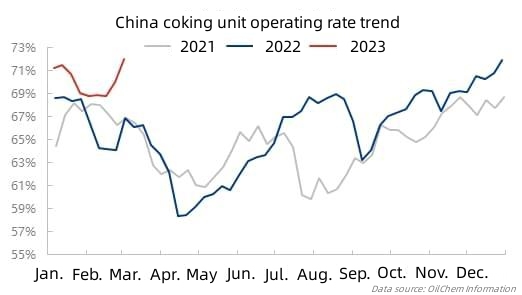

From the perspective of the operating rate of delayed coking units in China, due to the reduction of production in the early stage and the continuous resumption of production by the refineries, with the increase of domestic petroleum coke resource supply, China's delayed coking unit operating rate rose to 71.99%. However, since March, some delayed coking units of Sinopec, CNOOC and local refineries have successively started maintenance mode. It is estimated that the estimated capacity of shutdown overhaul is about 7.2 million tons/year, and the monthly overhaul loss of petroleum coke is about 100000 tons.

From the perspective of the market in March, China's domestic refineries delayed coking unit overhaul will gradually increase, domestic petroleum coke supply is expected to decline, the total amount of imported petroleum coke will also decline, but the overall social inventory will remain at a high level. The purchasing enthusiasm of the demand-side market has not significantly improved, the pre-baked anode pricing has fallen again, the downstream enterprises are more cautious in entering the market, Demand market procurement enthusiasm is still not significantly improved. It is expected that China's local refined petroleum coke prices will maintain a range of fluctuations in March, as well as a decline in mainstream prices. Learn more about the petroleum coke market.

No related results found

0 Replies