【Graphite electrode】Price rises slightly

【Graphite electrode】Price rises slightly

With the gradual recovery of downstream steel plants' demand, China's graphite electrode price has shown a slight increase recently. Bids for Chinese steel plants have been increasing since early March. According to the actual transaction situation, in East China, some steel plants' transaction price has increased by about 200 yuan/ton compared to the previous period.

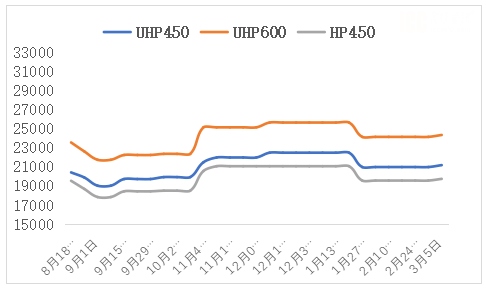

In the market, UHP400mm specification mainstream quotation was 21200-22200 yuan/ton, UHP 450mm specification mainstream quotation with 30% needle coke content was 20700-21200 yuan/ton, UHP 600mm specification mainstream quotation was 24200-25200 yuan/ton, and UHP 700mm specification mainstream quotation was 29200-30200 yuan/ton.

This round of graphite electrode price increase was due to cost pressure. In terms of raw materials, the price of petroleum coke continued to rise, which strongly supported the price rise of graphite electrode. Since February, graphite electrode manufacturers generally had a strong willingness to raise prices, hoping to release their own cost pressure through price adjustment.

In the fourth quarter of 2022, the operation of electric furnaces improved month on month, and the decline in raw material prices led to significant losses, resulting in a significant narrowing of transactions.

According to data, in Q4 of 2022, the average operating rate of 85 electric furnace steel plants was 58.72%, an increase of 4.50% compared to Q3. The average cost of the graphite electrode industry in Q4 of 2022 was 27436.84 yuan/ton, a decrease of 2.66% compared to Q3, with a gross profit of -1011.88 yuan/ton, a decrease of 37.76% compared to Q3.

From January to February 2023, graphite electrode industry cost further decreased, improving the overall industry profit.

According to data, the industry average cost from January to February 2023 was 26507.02 yuan/ton, down 3.39% from the average level in Q4 of 2022. The average gross profit was -334.65 yuan/ton, which is a gross profit loss compared to Q4 of 2022, and a decrease of 66.93% compared to Q3.

China's double carbon policy is expected to rise again, which is expected to promote the graphite electrode industry profit in the medium term.

On March 5, Minister of Industry and Information Technology Jin Zhuanglong stated, "The four major industries of steel, nonferrous metals, building materials, and petrochemical have formulated emission peak plans. Through top-level design, the goals, tasks, approaches, and measures for industrial emission peak have been clarified, and the next step is to implement them one by one." In the past six months, various parts of China have intensively issued double carbon related policies, and the expectation of high carbon industries being included in the national carbon trading market has risen again. As graphite electrodes are mainly used for short process steelmaking, compared to long process steelmaking, this can significantly reduce carbon emissions. The revival of China's double carbon policy will be conducive to the recovery of the graphite electrode industry in the medium term. Feel free to contact us for more guidance on graphite electrode future market policy.

No related results found

0 Replies