【Petroleum coke】Strong Demand, No Pressure on Domestic Coke Shipments

【Petroleum coke】Strong Demand, No Pressure on Domestic Coke Shipments

Industry update:

The operating rate of delayed coking units in China was 65.61% this week, down from last week. The petroleum coke market had decent shipments this week, with low-sulfur coke prices continuing to rise slightly and mid-to-high sulfur coke prices remaining stable. In terms of major refining plants, Sinopec's refineries had average shipments and stable petroleum coke market prices, while refineries under PetroChina were supported by downstream demand, with some refineries experiencing small price increases. Refineries under CNOOC had stable shipments to terminal enterprises, except for Huizhou Petrochemical which was undergoing maintenance, and prices fluctuated based on changes in indicators and demand. Local refineries had lower inventory and good shipments, resulting in a partial rebound in petroleum coke market prices.

Refinery updates:

Sinopec: Sinopec's refineries had average shipments this week, with downstream carbon enterprises mainly purchasing according to demand to execute orders, and petroleum coke market prices remaining stable.

PetroChina: PetroChina's refineries had decent shipments this week, with the price of coke from refineries in Northeast China beginning to rise while those in Northwest China fell. However, some refineries' sales at fixed prices have not yet been completely resolved.

CNOOC: CNOOC's refineries had stable shipments this week, mainly to terminal enterprises. Refinery prices fluctuated based on changes in indicators and demand status, with some refineries experiencing price increases and others decreases, except for Huizhou Petrochemical which was undergoing maintenance.

Shandong local refineries: Shandong local refineries had good shipments this week, mainly due to slower shipments from port inventories and effective supplementation of local coke, resulting in an overall trend of rising prices followed by stability.

Northeast and North China: Refinery trading in Northeast China was good this week, with petroleum coke market prices continuing to rise slightly; while in North China, refinery indicators were adjusted to stabilize supply and demand, and refineries executed new indicator prices for shipments.

East and Central China: New Sea Petrochemical in East China had good shipments this week, and petroleum coke market prices began to rise; while in Central China, Jin'ao Technology adjusted its indicators, and refineries executed new indicator shipments.

Port updates:

The total inventory at ports this week was about 4.3 million tons, an increase from the previous week. The inventory of petroleum coke at ports continued to increase, and the majority of imported coke shipments were limited. Shipments were mainly focused on domestically produced coke due to weaker overall downstream demand, high costs of imported coke in previous periods, and larger inventories. Although the price of domestically produced coke has increased, the price gap between the two types of coke remains large, leading to further hindrances to imported coke shipments. Additionally, most importers' letters of credit have expired, resulting in increasing financial pressures. It is not ruled out that some traders may adopt a strategy of selling at low prices to recoup funds.

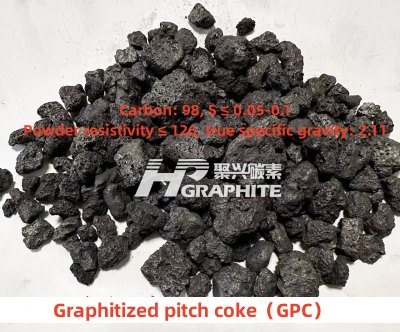

Overall, the domestic petroleum coke market remained stable this week with a balance between supply and demand. However, imported coke still faces difficulties in terms of prices and funding, which pose challenges to its shipment. For more information about graphitized petroleum coke products, feel free to inquire with us.

No related results found

0 Replies