【Anode Materials】Caution in Downstream Procurement, Anode Material Prices Weakly Stable

【Anode Materials】Caution in Downstream Procurement, Anode Material Prices Weakly Stable

Ⅰ. Recent Developments:

Yunnan Zhongsheng's 100,000-ton lithium-ion battery anode material integrated project is expected to have a total capacity of 130,000 tons and a value of 4 billion RMB once completed by the end of August this year. Construction of a 200,000-ton project is scheduled to begin next year, with completion expected by the end of 2025, reaching a total capacity of 330,000 tons and a value exceeding 10 billion RMB. More Information on Graphite Powder for Negative Electrode Materials.

On June 1st, Baowu Carbon's 100,000-ton anode material project in Lanzhou conducted a successful full-load trial run of the LZ1 line in the Anode area, marking the comprehensive production launch of the first production line. The project is located in Lanzhou New District, Gansu Province, and is divided into two phases. The first phase includes a 50,000-ton/year anode production line and a 100,000-ton/year graphiteization (including calcination) production line. The second phase will include a 50,000-ton/year anode production line and plant construction. China Metallurgical Group is responsible for the construction, including the first phase's 50,000-ton/year anode material production line. The produced anode materials will be used in new energy vehicles, 3C consumer electronics, and industrial energy storage.

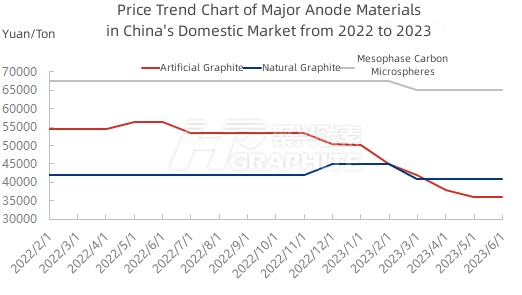

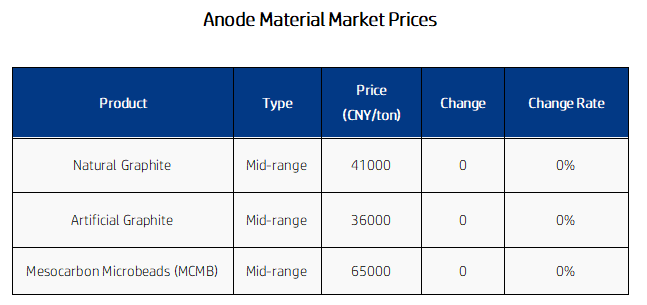

Ⅱ. Recent Market Trends:

Source data: Oilchem

The mainstream anode materials' prices are around 41,000 CNY/ton for natural graphite, 34,000-38,000 CNY/ton for artificial graphite, and 65,000-70,000 CNY/ton for Mesocarbon Microbeads.

Ⅲ. Production and Sales Dynamics:

1. Supply: Some major anode material manufacturers have plans for slight production increases, but limited by inventory, the incremental supply is limited.

2. Demand: Downstream battery manufacturers have a slow recovery in demand and mainly focus on necessary purchases of anode materials.

Ⅳ. Related Products:

1. Petroleum Coke: Currently, the mainstream petroleum coke market in China is trading steadily, with occasional fluctuations in certain regions.

2. Needle Coke: The supply and demand for needle coke are both weak, and end-demand is relatively sluggish. The market lacks positive factors, and prices remain weakly stable. The mainstream price for needle coke is 8,500-9,800 CNY/ton, and for green coke, it is 5,200-6,500 CNY/ton.

Future Outlook: In June, the production capacity of battery manufacturers increased slightly, but procurement remains cautious. With major manufacturers starting a new round of bidding, there is a trend of further price reduction for anode materials. Market Outlook for Negative Electrode Materials, Welcome Your Inquiry.

No related results found

0 Replies