【Petroleum Coke】Stable Petroleum Coke Prices with Weak Demand Support

【Petroleum Coke】Stable Petroleum Coke Prices with Weak Demand Support

1. Recent focus

According to the latest data from the General Administration of Customs, China exported 475,300 tons of aluminum not forged or rolled and aluminum products in May 2023. The cumulative exports from January to May were 2.315 million tons, a year-on-year decrease of 20.2%.

2. Recent market

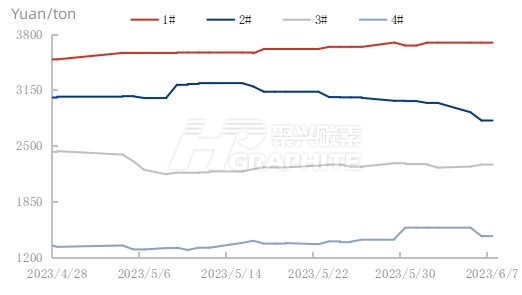

China domestic petroleum coke recent market price trends

Source: Oilchem

Currently, the mainstream domestic petroleum coke market trading is stabilizing, and individual coke prices are sporadically rising or falling during the transitional period. In terms of major players, PetroChina is implementing price maintenance sales in the Northeast market, and the overall shipment speed of PetroChina's coke in the Northwest has slowed down, resulting in some price adjustments. CNOOC refineries are actively fulfilling orders and volumes, and coke prices in the South China region are following a narrow decline of 50 CNY/ton. Sinopec refineries are gradually resuming operations, and there is a slight increase in petroleum coke supply, while transaction prices are temporarily stable during the transition. In terms of local refineries, the Shandong market has a decent shipment volume, and transaction prices are generally stabilizing, with some refineries experiencing minor price fluctuations based on shipment prices. Keyu Petrochemical's petroleum coke has started to be exported, and transaction prices from refineries have adjusted accordingly. In the Central-Eastern region, the medium-sulfur coke market has slowed down in terms of shipments, and refinery inventories have slightly increased, leading to a decline in transaction prices. Zhejiang Petrochemical will launch a new round of bidding from tomorrow, and we will continue to track the prices.

3. Production and sales dynamics

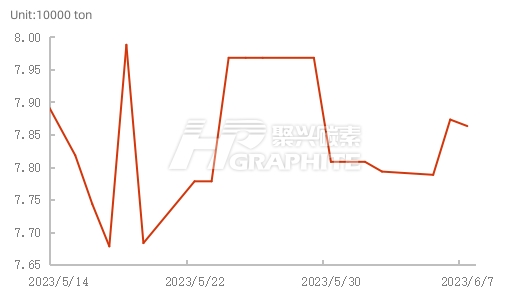

Petroleum coke daily production trend

Source: Oilchem

Currently, China domestic petroleum coke production is 78,630 tons, an increase of 100 tons compared to the previous working day. Some refineries have adjusted their production, and Xintai Petrochemical's northern plant has delayed the maintenance of its coking unit.

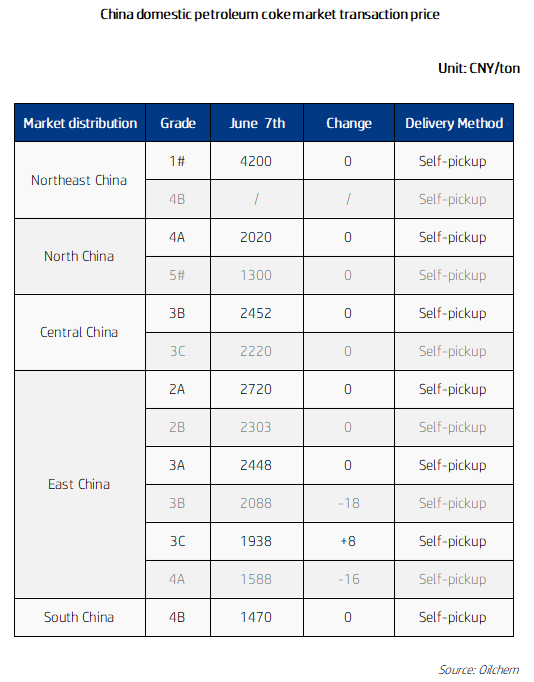

4. Related product

Looking at the demand-side market, the performance of the low-sulfur carbon sector is still relatively weak, and the procurement support for negative electrode materials is weakening, which has slowed down the shipment from refineries. The market for carbon materials used in steelmaking remains sluggish, as the improvement in operating rates for electric arc furnaces in end-user industries has not materialized. The graphite electrode sector also shows lackluster demand, which has not provided any positive momentum for low-sulfur coke shipments. The procurement sentiment in the graphite cathode market is cautious, leading to some downward pressure on prices for low-sulfur calcined coke. The carbon market for aluminum shows relatively stable trading, with commercial calcined coke enterprises fulfilling contracted orders and maintaining low raw material inventories to meet demand, which has provided some support for shipments from nearby refineries. However, the performance of the primary aluminum market in reducing inventories is average, as the recovery of operations in the southwestern region has been slower than expected. Spot prices for electrolytic aluminum continue to fluctuate, without significant improvement in supporting the medium-high sulfur carbon market.

5. Future forecast

In the short term, the market support from the demand side remains weak, with active shipment activities from trading companies at ports and a gradual increase in domestic supply of petroleum coke. The imbalance between supply and demand in the petroleum coke market remains severe. It is expected that the domestic petroleum coke market will continue to stabilize overall, with the possibility of narrow adjustments in coke prices at local refineries. Continued Monitoring of June's Petroleum Coke Market Trend, Contact Us for Details.

No related results found

0 Replies