【Petroleum Coke】Supply-Demand Imbalance Leads to Weak Performance in Carburant Market

【Petroleum Coke】Supply-Demand Imbalance Leads to Weak Performance in Carburant Market

Source: Oilchem

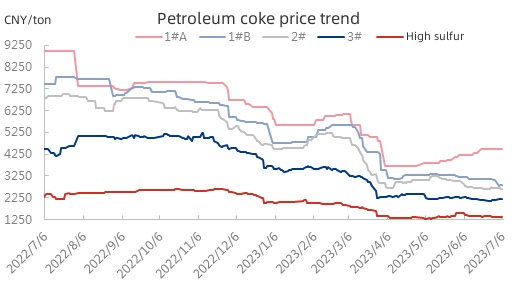

In terms of cost: As of the time of writing, the average price of low-sulfur coke type 1 is 3,658 CNY/ton, a decrease of 150 CNY/ton or 3.93% compared to the previous period; coke type 2 is 2,464 CNY/ton, a decrease of 59 CNY/ton or 2.33% compared to the previous period. Currently, the domestic petroleum coke prices are mainly fluctuating at a low level, with stable main prices and relatively small inventory pressure for refineries. The coke prices are stabilizing in transition. Recently, the prices of local refineries have seen a slight rebound, with various refineries following the upward trend. However, the domestic petroleum coke market still faces sufficient supply, and port inventories remain high. Therefore, it is difficult for the supply-demand contradiction in the petroleum coke market to break through in the short term, and the prices are expected to continue to fluctuate.

Source: Oilchem

In terms of price: The market quotation for low-sulfur calcined coke carburant is 4,500-4,700 CNY/ton, a decrease of 500 CNY/ton compared to the previous period; the market quotation for graphitized carburant is 4,900 CNY/ton, a decrease of 400 CNY/ton compared to the previous period. The market quotation for calcined coal carburant is 1,800-2,700 CNY/ton, showing a significant decline in prices compared to the previous period. The purchasing enthusiasm in the demand side is average, the production cost of graphitized carburant is rising, and the trading in the negative electrode market is sluggish, providing insufficient support to the carburant market. The price of raw material coal used for calcined coal has declined, leading to a decrease in the cost of calcined coal carburant. However, downstream steel mills and forging plants lack strong support, resulting in a downward trend in the prices of calcined coal carburant.

Source: Oilchem

Downstream demand: The average capacity utilization rate of independent electric arc furnaces (EAFs) in China has shown a slight increase, along with a slight increase in capacity utilization rate. The main reasons are as follows: a steel plant in North China has newly built electric furnaces that entered production this week but is still in the trial production stage with unstable output; a steel plant in East China that was previously shut down for environmental reasons has resumed production, leading to a certain level of production recovery; meanwhile, a furnace in a steel plant in South China has started a shutdown for maintenance since the 27th. Currently, the difficulty of collecting scrap steel still exists, resulting in reduced production efficiency and a slight decrease in output for some electric arc furnaces. Looking ahead to next week, the fluctuations in the prices of finished products are expected to be small. Some regional electric arc furnace plants have seen their profits restored, but the shortage of scrap steel as raw material and no plans for production resumption by the shutdown steel plants are present. It is predicted that next week, the average capacity utilization rate and capacity utilization rate of independent electric arc furnaces may experience a slight decrease.

Overall, with narrow fluctuations in raw material prices and the impact of low enthusiasm in downstream demand, coupled with a slowdown in export speed, the support for the carburant market is not yet evident. It is expected that the domestic carburant market will continue to fluctuate at a low level in the near term.

No related results found

0 Replies