【Petroleum Coke】Market Trading Atmosphere Improves, Prices Fluctuate

【Petroleum Coke】Market Trading Atmosphere Improves, Prices Fluctuate

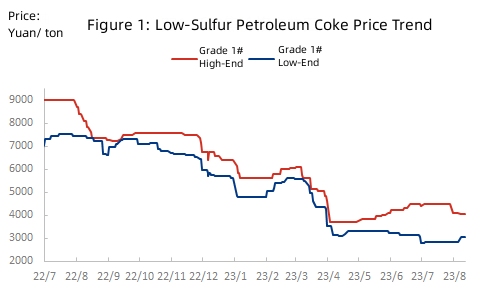

1. During this week, China domestic low-sulfur petroleum coke market showed a stabilizing trend. Prices of high-quality low-sulfur petroleum coke remained steady compared to the previous period, with improved shipments. The calcined coke products is used as carburant in steel, aluminum and refractory plants. Prices of low-quality low-sulfur coke exhibited a stable-to-upward trend, with a pattern of initially dropping and then rising. The earlier price decline favored shipments, stimulating the market and improving trading conditions. Increased downstream purchasing enthusiasm contributed to the support of the upward movement in prices of low-sulfur coke.

Source: Oilchem

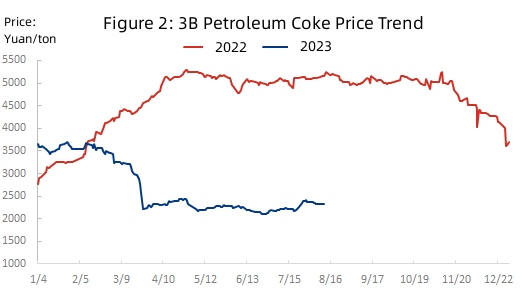

2. In this week, the average price of domestic 3B petroleum coke was 2331 yuan/ton, a decrease of 1.5% compared to the previous period and a 54.6% decrease from the same period last year when it was 5135 yuan/ton. The prices of 3B petroleum coke remained relatively stable during this period, with a slight decline compared to the previous period. Downstream enterprises maintained their enthusiasm for receiving shipments at the beginning of the month. As the weekend approached, the demand for this round of necessary restocking also neared its end, resulting in a downward trend in coke prices.

Source: Oilchem

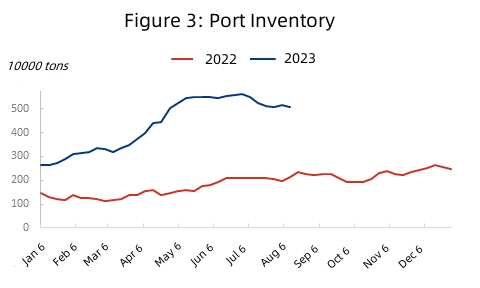

3. As of the time of writing, the total port inventory was 5.091 million tons, a decrease of 86,000 tons or 1.66% compared to the previous period, and an increase of 136.46% compared to the same period last year. During this week, port shipments increased. Influenced by the rise in domestic petroleum coke prices, there was positive outbound activity of imported coke. As coke prices rose, the pace of port clearing accelerated, enhancing confidence in imported coke.

Source: Oilchem

Market Outlook

Due to the significant amount of inventory at ports, the petroleum coke market currently has abundant tradable commodities. The supply-demand imbalance remains the primary contradiction in the market. Downstream enterprises have been mainly procuring based on immediate needs. During this period, as it coincided with a procurement cycle, shipments of petroleum coke were satisfactory. However, as the procurement cycle approaches its end, petroleum coke prices have begun to decline. It is expected that in the early stages of the next period, petroleum coke prices will remain relatively stable, but certain refineries might experience a downward trend. Contact us to learn the latest petroleum coke market news.

No related results found

0 Replies