【Petroleum Coke】August Market Price Review

【Petroleum Coke】August Market Price Review

Market Overview

In late August, the average market price of petroleum coke in China was 2275 yuan/ton, down by 2 yuan/ton, with a decrease of 0.09%. Currently, the overall shipment trend in the petroleum coke market is stabilizing, with most coke prices holding steady. Domestic petroleum coke supply has increased, while downstream sentiment remains cautious. Market demand analysis for calcined coke products...

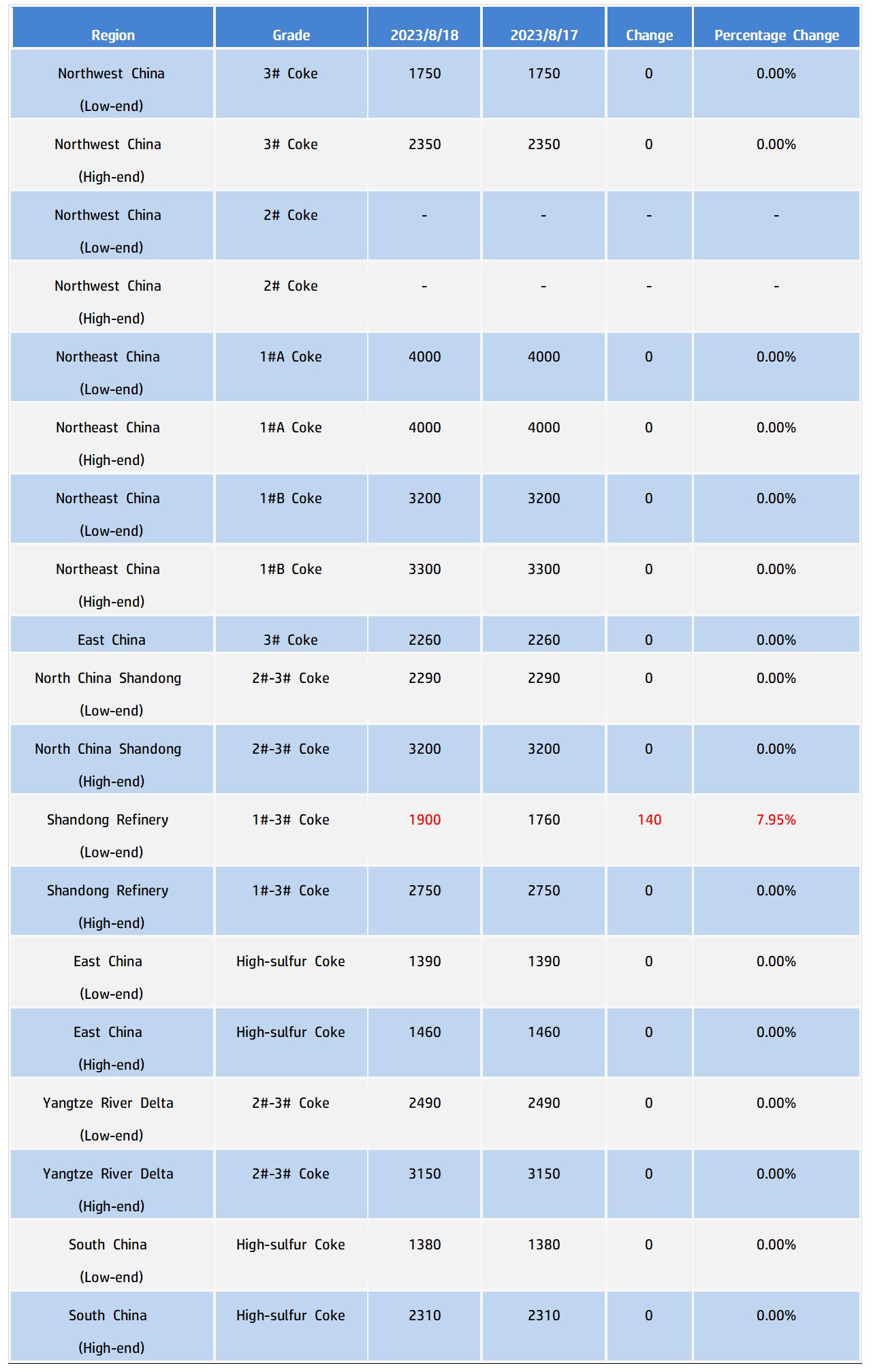

Major Regional Market Prices:

Sinopec

Prices of petroleum coke in Sinopec's refineries remain stable. Moderate trading continues for medium-sulfur petroleum coke in the Yangtze River area, with high downstream receiving activity. Moderate to good shipments are seen for medium to high-sulfur petroleum coke in East China. Steady shipments are observed for high-sulfur petroleum coke in South China. Stable trading continues for petroleum coke in the North China Shandong region, with refinery shipments being the primary driver. In Northeast China, Sinopec's Jinxi and Jinzhou Petrochemical refineries are performing well, with Jinxi Petrochemical's petroleum coke undergoing partial bidding. In the Northwest region, the petroleum coke market is stable, and Dushanzi Petrochemical in Xinjiang continues to ship 4#A coke. Overall shipments from various refineries under CNOOC remain satisfactory.

Local Refineries

Currently, the domestic market for refinery-produced petroleum coke is generally stable, with some slight price adjustments ranging between 10 to 100 yuan/ton. Many local refineries have low inventory levels, and with downstream raw petroleum coke inventory remaining low for an extended period, the market supply remains abundant. Some refineries are executing orders to ship their products, catering mainly to immediate downstream demand. The region where the current indicators fluctuate: the latest sulfur content of Shandong Hualong Shot Coke is 6.0%; Shandong Yatong Petrochemical's latest sulfur content is 2.2%.

Imported Coke

Recent downstream demand growth has led to higher willingness among traders to ship products. Petroleum coke inventory at ports has decreased while maintaining a relatively high level.

Supply Aspect

Currently, there are 9 instances of regular maintenance for coking units nationwide. The daily production of petroleum coke in China is 87,870 tons, with a coking operating rate of 70.22%, representing a 0.13% increase from the previous working day.

Demand Aspect

In the Yunnan region this week, aluminum smelting enterprises have continued to resume production, leading to an increase in aluminum supply, positively impacting the demand for petroleum coke. Graphite electrode market prices are beginning to rise, although the market continues to operate on a need-based procurement model. Prices for negative electrode materials remain steady, with shipment volumes trending upwards. The silicon metal market is strengthening, with satisfactory market trading.

Market Forecast

The petroleum coke market is expected to remain stable overall, with refinery inventories staying at low levels and downstream enterprises exercising cautious procurement practices, focusing on as-needed orders. Petroleum coke prices are predicted to maintain stable operation in the short term, with some adjustments ranging from 20 to 100 yuan/ton. About the supply and demand situation in the calcined coke market, feel free to contact us.

No related results found

0 Replies