【Mysteel】Analysis of National Crude Steel Production and September 2023 Forecast

【Mysteel】Analysis of National Crude Steel Production and September 2023 Forecast

In July 2023, the daily average crude steel production in China was 2.929 million tons, a decrease of 3.6% compared to the previous month. It is estimated that in August, the daily average crude steel production in China will be around 3 million tons. During the first half of August, the domestic steel market experienced weak and volatile prices, while the second half saw narrow fluctuations, with supply exceeding demand leading to a weak balance. As we enter September, the macroeconomic policy adjustments are expected to intensify, coupled with the approaching traditional peak demand season. This is anticipated to lead to a slight recovery in the steel market's supply and demand dynamics, with steel prices likely to experience a slightly stronger but still volatile trend, to learn more about graphite electrode supply and demand.

1. July National Crude Steel Production Averaged 2.929 Million Tons, Down 3.6% MoM

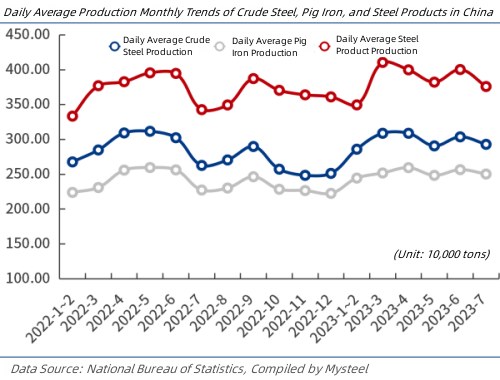

According to data from the National Bureau of Statistics, China's crude steel production in July 2023 was 90.797 million tons, a year-on-year increase of 11.5%. Pig iron production reached 77.596 million tons, up 10.2% year-on-year, and steel production was 116.534 million tons, a 14.5% increase year-on-year.

From January to July 2023, China's crude steel production reached 626.514 million tons, a 2.5% year-on-year increase, while pig iron production was 528.919 million tons, up 3.5% year-on-year, and steel production was 788.995 million tons, up 5.4% year-on-year.

In July 2023, the daily average crude steel production in China was 2.929 million tons, down 3.6% compared to the previous month. Several factors contributed to this decline, including seasonal factors as demand typically decreases in July due to hot weather and heavy rainfall, leading to maintenance shutdowns in steel plants. Furthermore, in late July, environmental restrictions on production in Tangshan and reduced production in some Sichuan steel mills during the Chengdu National Games contributed to supply constraints.

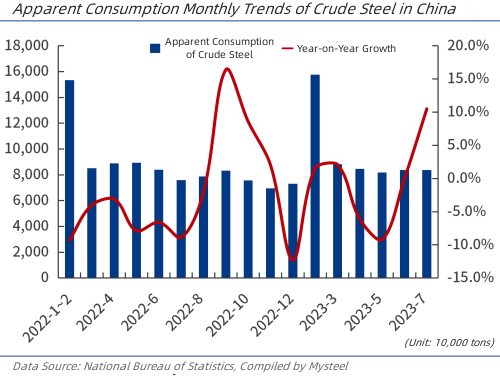

2. January to July National Crude Steel Apparent Consumption Decreased by 0.4%

Data from the National Bureau of Statistics and the General Administration of Customs showed that in July 2023, China's crude steel production was 90.797 million tons, with net steel exports of 6.63 million tons, equivalent to a net crude steel export of 6.906 million tons (calculated at 0.96 times for steel). Net exports of billets and ingots were 78,000 tons, and the apparent consumption of crude steel was 83.81 million tons, a 10.5% year-on-year increase.

From January to July 2023, China's crude steel production was 626.514 million tons, with net steel exports of 46.473 million tons, equivalent to a net crude steel export of 48.409 million tons (calculated at 0.96 times for steel). Net exports of billets and ingots were 548,000 tons, and the apparent consumption of crude steel was 5.78 billion tons, a decrease of 0.4% year-on-year.

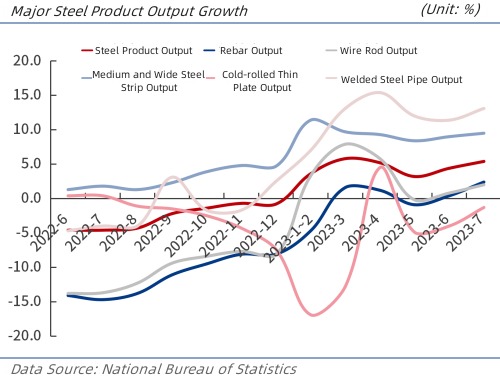

3. July Production Decrease for the Five Major Steel Product Categories

From January to July 2023, China's steel production reached 789 million tons, a 5.4% year-on-year increase. This production included 137.242 million tons of rebar (up 2.4% year-on-year), 82.989 million tons of wire rods (up 2.0% year-on-year), 21.207 million tons of cold-rolled thin plates (down 1.3% year-on-year), 117.74 million tons of medium and heavy wide strip steel (up 9.5% year-on-year), and 35.079 million tons of welded steel pipes (up 13.1% year-on-year).

In July 2023, the daily average production of rebar, wire rods, medium and heavy wide strip steel, cold-rolled thin plates, and welded steel pipes was 650,000 tons, 395,000 tons, 562,000 tons, 112,000 tons, and 168,000 tons, respectively. This represents a decrease of 37,000 tons, 24,000 tons, 29,000 tons, 4,000 tons, and 33,000 tons compared to the previous month.

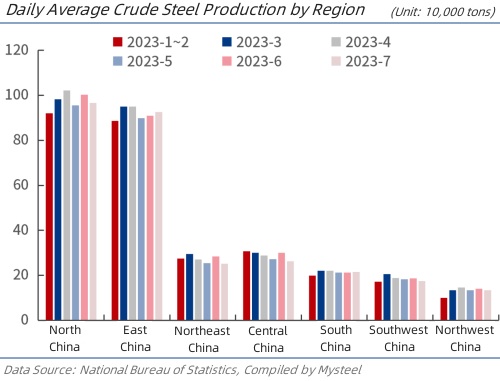

4. Production Decreased in July for Crude Steel on a Regional Basis

From January to July 2023, crude steel production in different regions showed various trends. Crude steel production in North China increased by 4.3% year-on-year, while East China saw a 2.6% increase. In contrast, the Northeast had a 1.0% increase, Central China experienced a 0.6% increase, South China saw a 3.8% increase, Southwest China had a 7.0% increase, and Northwest China had a 4.5% decrease.

In July 2023, daily average crude steel production in different regions was as follows: 967,000 tons in North China, 251,000 tons in the Northeast, 262,000 tons in Central China, 175,000 tons in Southwest China, and 134,000 tons in Northwest China. This represents a decrease of 36,000 tons, 33,000 tons, 38,000 tons, 11,000 tons, and 7,000 tons, respectively, compared to the previous month. In contrast, daily average crude steel production in East China and South China was 925,000 tons and 215,000 tons, respectively, representing an increase of 15,000 tons and 2,000 tons compared to the previous month.

5. Forecast and Analysis of Future Crude Steel Production

During the first half of August, the Chinese steel market experienced weak and volatile prices, and the second half saw narrow fluctuations. The early half of August witnessed a further contraction in steel demand due to heavy rainfall and flooding in many northern regions. Additionally, some steel mills in Sichuan and Tangshan gradually resumed production, increasing supply and demand pressure. As northern regions progressed with post-disaster recovery and reconstruction, steel demand started to recover in the latter half of August, leading to some improvement in the supply-demand balance and a decline in steel inventories. However, due to the relatively weak internal growth drivers in the Chinese economy, concerns related to the debt of some real estate companies, and the potential impact of frequent typhoons, market sentiment remains cautious. As a result, the rebound in steel prices in the latter half of August lacked strong momentum.

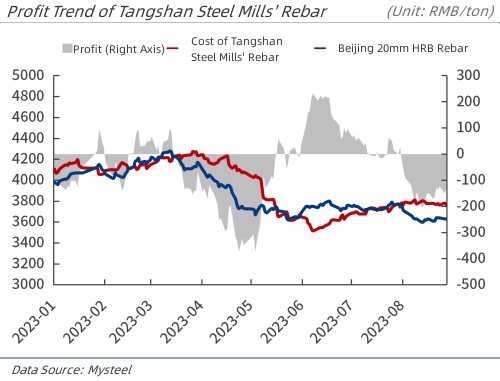

According to my calculations, by the end of August, certain Tangshan long-process steel mills were incurring losses of over 100 RMB/ton for rebar. As several steel mills completed maintenance and resumed production, steel production increased month-on-month in August. It is estimated that the daily average crude steel production in China for August will be around 3 million tons, increasing supply pressure. Considering that many domestic steel mills are operating on the brink of profitability, steel production in September may expand moderately.

In July, several economic indicators in China, including investment and consumption, experienced a decline, primarily influenced by extreme high temperatures, heavy rainfall, and certain industries entering the traditional low season. From January to July, real estate investment decreased by 8.5% year-on-year, with the decline continuing to expand. Infrastructure and manufacturing investment grew by 6.8% and 5.7% year-on-year, respectively, but the growth rate slowed down. Total retail sales of consumer goods increased by 7.3% year-on-year, with a declining growth rate.

In the manufacturing sector, from January to July, overall production remained stable. Shipbuilding and the production of major home appliances continued to grow at a relatively fast pace, while excavator production saw an increased decline. Specifically, from January to July, national shipbuilding completions increased by 15.6% year-on-year, with new ship orders growing by 74% year-on-year. Production of washing machines, refrigerators, and air conditioners increased by 19.9%, 13.8%, and 17.9% year-on-year, respectively, while television production grew by 3.9% year-on-year. Excavator production, on the other hand, decreased by 20.3% year-on-year. In July, the production and sales of automobiles remained at a high level for the year but shifted from positive to negative growth in terms of growth rate.

Overall, the demand for steel in July and August showed weakness. Manufacturing production remained stable, with some improvement in corporate profits. Since August, there has been an issuance of special bonds totaling 476.7 billion RMB, more than twice the scale of the entire month of July (196.3 billion RMB), indicating relatively rapid growth in infrastructure investment. The real estate market is still in an adjustment phase, significantly impacting steel demand. However, in the latter half of August, there was a gradual increase in real estate transaction volumes, and various regions continued to optimize real estate control policies. In the past week (August 19th to 25th), the transaction area for commercial housing in 30 cities increased by 5% month-on-month, marking two consecutive weeks of growth.

Recently, China has implemented a series of policies to boost domestic demand, stabilize investment, and promote consumption. Macro-policy control measures have been significantly strengthened, with monetary policy reinforcing countercyclical adjustments. These policies include:

The State Council's 24 policy measures to further optimize the investment environment for foreign investors.

The People's Bank of China's second interest rate cut of the year to promote corporate financing and stabilize the cost of household credit.

The National Development and Reform Commission (NDRC) and other departments issuing 28 measures to promote the development of private enterprises.

The Ministry of Finance and the State Taxation Administration issuing five consecutive notices, focusing on technology-based enterprises, small and micro enterprises, and individual businesses, with clear continuations of multiple tax preferential policies.

The China Securities Regulatory Commission (CSRC) launching a combination of policies to invigorate the capital market and boost investor confidence.

Three departments promoting the implementation of first-home mortgage loans based on house recognition rather than credit.

In summary, during the first half of August, there was an intensification of supply and demand contradictions in the steel market, with some relief in the latter half, resulting in a weak equilibrium. However, market confidence remains lacking, and steel prices are expected to continue fluctuating at the bottom range in the short term. As we enter September, macroeconomic policy adjustments will continue to strengthen, combined with the approaching traditional peak demand season. This is expected to lead to a slight recovery in the supply and demand balance in the steel market, with the possibility of price increases. However, the recovery in demand and confidence will take time and may be accompanied by hesitation, making it difficult for significant price surges. The most likely scenario is a period of strong but fluctuating steel prices. Feel free to inquire about graphite electrodes and related products for electric arc furnace steelmaking.

No related results found

0 Replies