【Graphite Electrodes Industry】Competitive Landscape and Development Trends

【Graphite Electrodes Industry】 Competitive Landscape and Development Trends

In recent years, the Chinese government has issued a series of policies to reduce excess steel production capacity, such as the "Opinions on Resolving Excess Capacity in the Steel Industry for Sustainable Development." The implementation of these policies has replaced outdated crude steel capacity (such as using blast furnaces with a capacity of 400 cubic meters or less) with electric arc furnaces, significantly boosting the demand for graphite electrodes in the Chinese steel industry.

Analysis of China's Graphite Electrodes Industry Competitive Landscape

1. Market Share

Currently, China's graphite electrode industry has relatively low concentration, with a CR5 (Concentration Ratio of the top 5 companies) of about 30% and a CR10 (Concentration Ratio of the top 10 companies) of about 48% in 2021. Among them, Fangda Carbon, as a leading company in the industry, holds a market share of only around 13%. Their primary products include graphite electrodes, carbon bricks for blast furnaces, graphite cathode blocks for aluminum electrolysis, special graphite products, graphite materials for nuclear power, graphene, and other carbon products. Apart from Fangda Carbon, other companies have capacities of less than 100,000 tons, resulting in a dispersed market share. Companies like Liaoning Danchan, Hunan Mingda, Jilin Carbon, Zhongzhou Carbon, and Shanxi Hongte have market shares of approximately 6%, 5%, 4%, 4%, and 4%, respectively.

2. Capacity Distribution

Relevant enterprises in China's graphite electrode industry are mainly distributed in the Northeast and North China regions. In 2021, North China and Northeast China accounted for more than 60% of the graphite electrode production capacity in China. Among them, North China accounted for 35%, and Northeast China accounted for 27%. Central China and East China regions accounted for approximately 17% and 9%, respectively.

Development Trends in China's Graphite Electrodes Industry

1. Continuous Increase in Industry Concentration

Currently, guided by China's "Dual Carbon" policy, the industry's environmental and energy consumption requirements continue to rise. However, achieving this requires more technological support, placing significant pressure on small and medium-sized enterprises. They face shrinking demand on one hand and increased environmental and energy consumption requirements on the other. This will weaken their competitiveness, leading to gradual elimination. It is expected that with the exit of many mid-to-low-end enterprises and industry consolidation, the concentration of the graphite electrode industry will continue to increase.

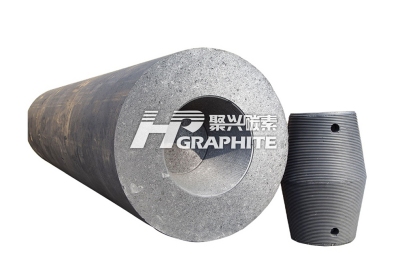

2. Ultra-High-Power Graphite Electrodes Become the Industry Mainstream Trend

Graphite electrodes are essential consumables for electric arc steelmaking, and with the strong support for short-process steelmaking by the country in recent years, electric furnace steelmaking, also known as electric arc furnace (EAF) steelmaking, will become an important trend in the future. High-quality steel and special steel are also produced through EAF steelmaking. To transform China from a steel-producing nation into a steel powerhouse, increasing the share of EAF steel is a crucial measure. Additionally, ultra-high-power graphite electrodes are relatively efficient, environmentally friendly with lower pollution, and cost-effective. They align well with China's requirements for energy conservation and consumption reduction, making them more favored in the market and driving the development of China's graphite electrode industry.

3. Positive Industrial and Export Development Environment

China's industrial development has promoted the steady growth of downstream applications for graphite electrodes, including the electric arc furnace steelmaking market, industrial silicon market, and yellow phosphorus market. Therefore, stable industrial development is one of the driving forces for the Chinese graphite electrode market. On the other hand, as the technological level and product competitiveness of China's graphite electrode industry continue to improve, Chinese graphite electrodes are gaining recognition and trust from overseas customers. The export volume of graphite electrodes is expected to further increase, becoming a key factor in driving the digestion of China's graphite electrode production capacity. For more information on the graphite electrode industry, feel free to communicate with us.

No related results found

0 Replies