【Quarterly Petcoke Market Review】 From Upsurge to Downturn in Q3, Possible Weakness in Q4

【Quarterly Petcoke Market Review】

From Upsurge to Downturn in Q3, Possible Weakness in Q4

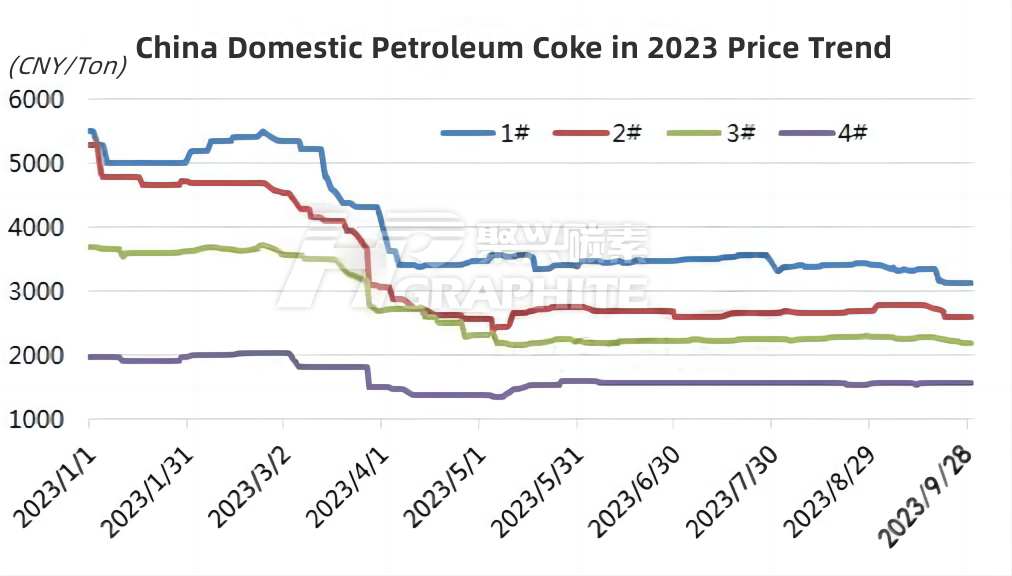

Since the third quarter, China domestic petroleum coke market has displayed a trend of upsurge followed by consolidation due to changes in supply and demand dynamics, resulting in moderate price adjustments. According to data, as of September 28, the domestic petroleum coke indices were as follows: 1# Petroleum Coke Index at 3140 points, 2# Petroleum Coke Index at 2612 points, 3# Petroleum Coke Index at 2190 points, and 4# Petroleum Coke Index at 1568 points. The average price of petroleum coke in Shandong refineries was around 1844 CNY/ton, with a slight increase of 0.2% compared to the second quarter, and the information about calcined petroleum coke products for your reference.

Ups and Downs in China Domestic Petroleum Coke Market in Q3

Towards the end of the second quarter, around the end of June, China domestic petroleum coke market showed signs of recovery. The arrival of the rainy season in the southwestern region, along with the gradual resumption of downstream electrolytic aluminum production, led to a significant increase in demand. This boosted market sentiment, and a series of short-term supply-side advantages, such as refinery unit maintenance with reduced output and a decrease in petroleum coke imports since June, supported the market's bullish trends. In July, the domestic petroleum coke market prices increased across the board. By the end of July, the average price of petroleum coke in Shandong refineries had risen to a high of 1944 CNY/ton. However, as the electrolytic aluminum plants in the southwestern region gradually completed their restart, the market's demand began to stabilize. Concurrently, refineries that had previously undergone maintenance resumed production in late August and September. Starting from the middle of August until the end of September, the domestic petroleum coke market transitioned from strength to weakness, and prices started to fluctuate downward. Towards the end of September, just before the Mid-Autumn Festival and National Day holidays, refineries actively reduced prices to clear their inventories. This resulted in a new round of price declines. By the end of September, the average price of petroleum coke in refineries had dropped to 1695 CNY/ton, returning to the price range seen in late Q2.

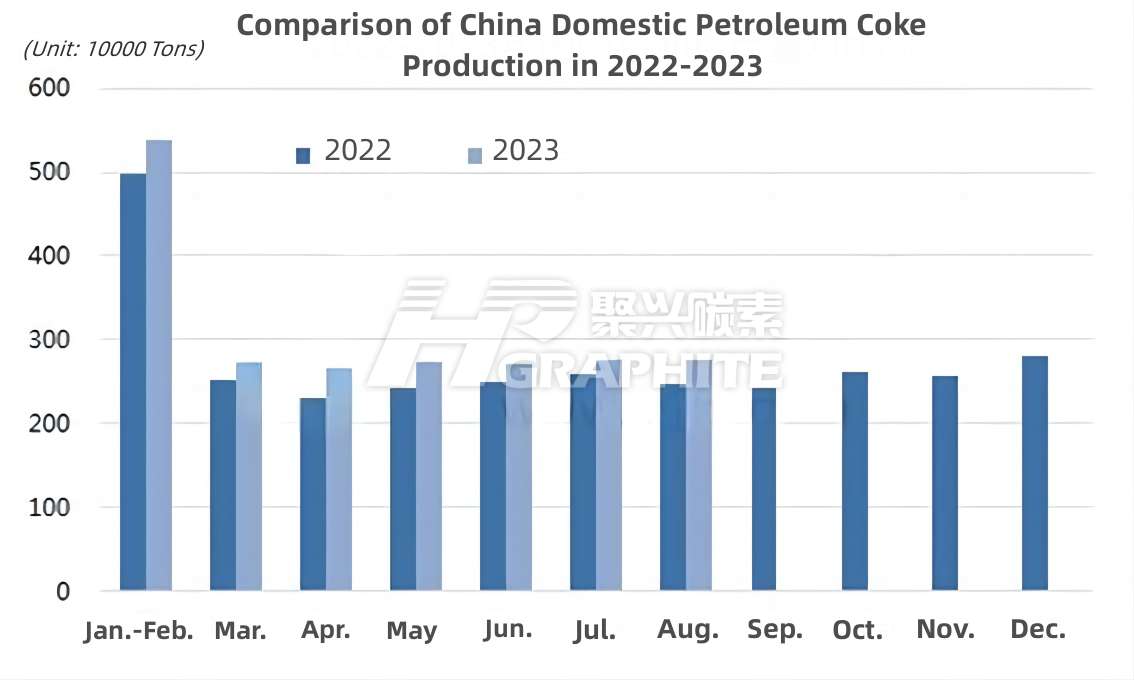

9% YoY Increase in China Domestic Petroleum Coke Production in Q3

In Q3 2023, China domestic petroleum coke market witnessed relatively ample supply. The petroleum coke production in China in July and August was around 551.8 million tons, representing an approximately 9% YoY increase over the same period last year. Despite some planned maintenance of individual refinery coking units in Q3, they gradually recovered around the middle and late September. For main refineries, there were no routine maintenance activities, and refineries that had previously undergone maintenance resumed production within Q3. Furthermore, due to the relatively strong performance of the domestic petroleum coke market since July, refineries demonstrated high production enthusiasm. This led to a minor increase in domestic petroleum coke production during Q3, taking into consideration multiple factors.

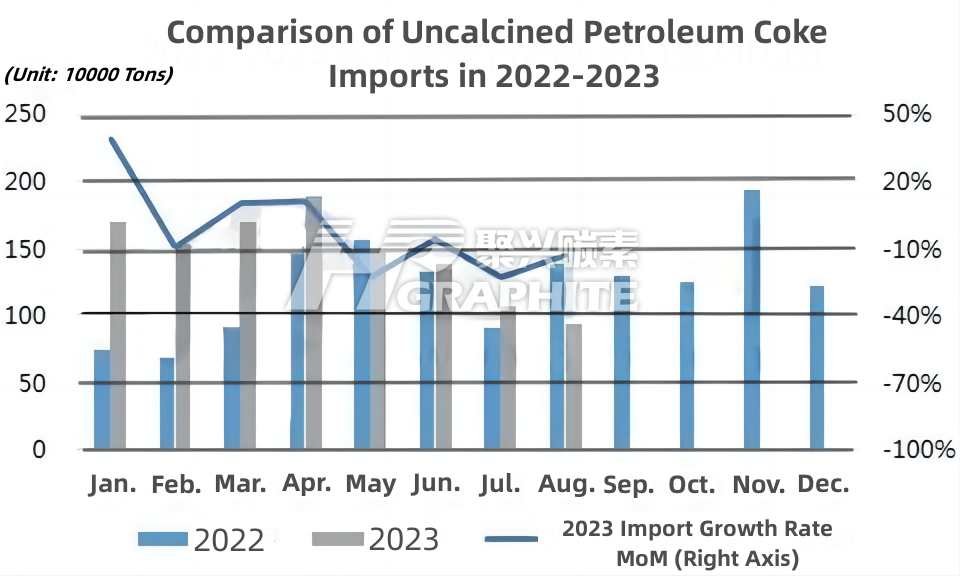

12% YoY Decline in China Domestic Petroleum Coke Imports in Q3

In Q3 2023, the import volume of domestic petroleum coke witnessed a significant drop. According to customs data, the import volume of calcined petroleum coke in July and August was around 201.8 million tons, indicating a 12% decrease compared to the same period last year and about a 40% drop compared to the second quarter. As can be observed in the chart, the import volume of domestic petroleum coke has shown a clear decreasing trend since May. The primary reason for this was the insufficient demand support in the domestic market. Amid market oversupply, the downward trend in domestic petroleum coke prices caused importers to become less active, resulting in reduced new order placements. Therefore, Q3 saw a continuing downward trend in the import volume of domestic petroleum coke.

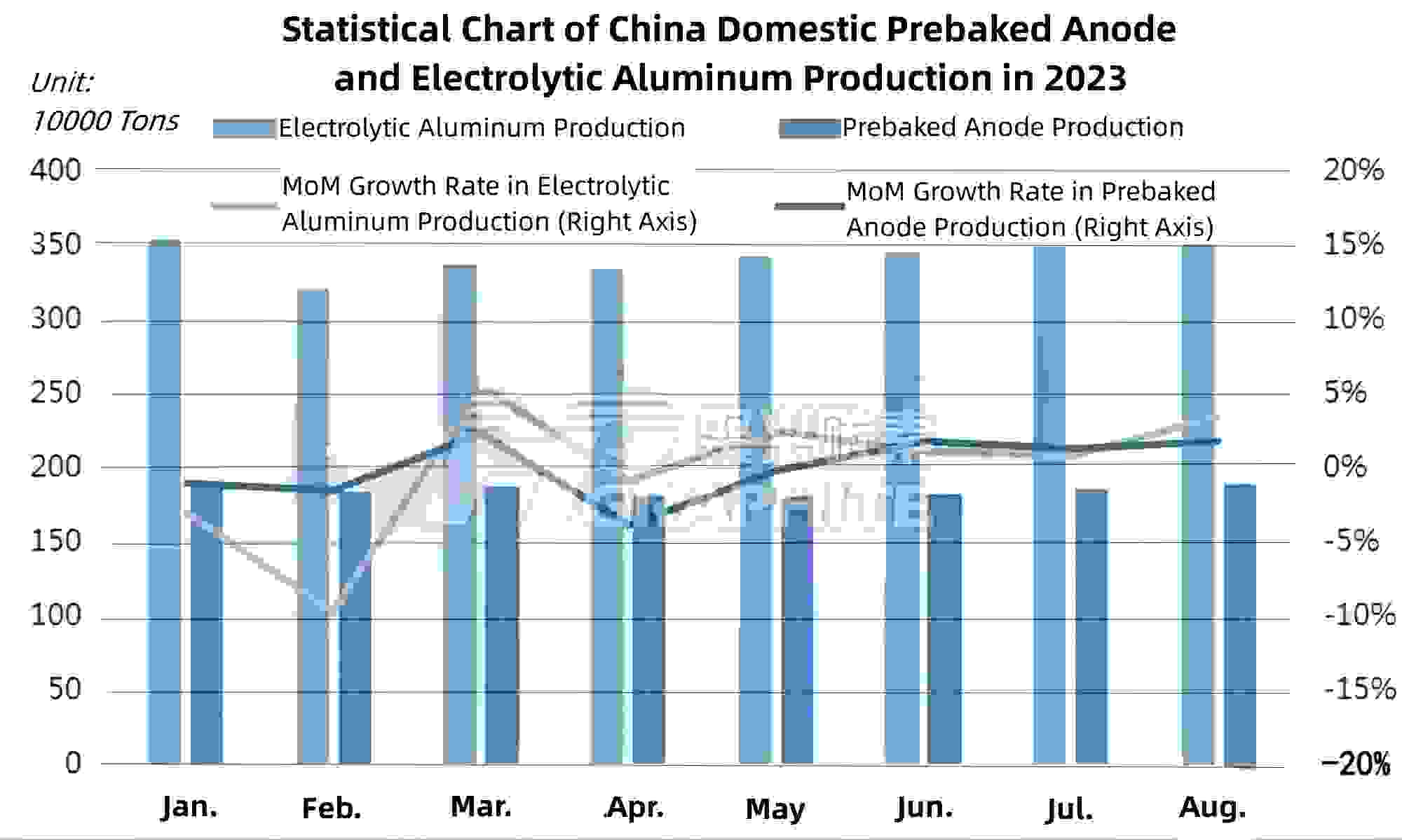

Decent Performance in Downstream Industries of the Domestic Petroleum Coke Market in Q3

Since downstream prebaked anodes account for a relatively high proportion of demand in the petroleum coke sector, their performance significantly affects the petroleum coke market. The chart reveals that the production of prebaked anodes and electrolytic aluminum increased slightly in July and August compared to the second quarter. This was mainly due to the resumption of electrolytic aluminum production in the southwestern region, which had been halted earlier. Full resumption occurred around the middle of August. As a result of demand support during this period, the domestic petroleum coke market displayed stable to slightly bullish market conditions. However, after the completion of the resumption of electrolytic aluminum plants, the demand remained relatively stable, and from late August onwards, the domestic petroleum coke market transitioned from strength to weakness, entering a weak consolidation phase towards the end of Q3.

Market Forecast for Q4:

In terms of raw material costs, the global crude oil market may show a shift from strength to weakness in Q4. International oil prices in Q4 may demonstrate a fluctuating trend, with WTI expected to have a mainstream operating range of $70 to $85 per barrel and Brent expected to have a mainstream operating range of $75 to $90 per barrel. Due to the impact of the volatile performance of crude oil futures, the domestic oil market may exhibit corresponding trends, and the market for residual oil may also experience a fluctuating trend, providing limited support to the petroleum coke market.

In terms of supply side, in Q4, it is expected that there will be limited routine maintenance plans for main refineries and local refinery coking units. However, due to the effects of raw materials and the seasonal demand changes in the market, the theoretical operating load of coking units in Q4 may decrease. This may lead to a decline in domestic petroleum coke production, alongside the anticipation of a reduction in the import market. Therefore, the overall supply side of the domestic petroleum coke market in Q4 is not expected to be under pressure, despite the continued high level of port inventories.

In terms of demand, entering the winter season in China, certain industries enter their traditional off-season for demand. The operating loads of some downstream industries may not match those of the earlier period. As the dry season begins in some regions, the operating loads of downstream electrolytic aluminum units may gradually decrease. The overall performance of the negative electrode materials market may remain stable. Therefore, when looking at the comprehensive aspects of supply and demand, the petroleum coke market in Q4 may see weak market conditions, and prices may continue to fluctuate with a bias towards weakness. Fourth-quarter petroleum coke industry updates are available. Feel free to contact us for more information.

No related results found

0 Replies