【Petroleum Coke Market】Weak Demand Performance Leads to Volatility and Decline

【Petroleum Coke Market】Weak Demand Performance Leads to Volatility and Decline

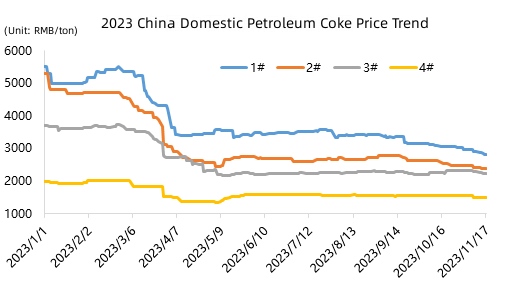

Entering November, the traditional peak demand season "Golden September and Silver October" has ended. However, the overall trend of the domestic coke market continues to show a weak downward trajectory. According to monitoring data from JLC, as of November 17, the average price of petroleum coke at Shandong refineries is 1605 RMB/ton, a decrease of around 1% from the end of October. Find the market news of calcined petroleum coke (CPC).

In terms of major operations, the low-sulfur coke market in Northeast China, operated by PetroChina, is influenced by the sluggish downstream market for negative electrode materials. As of November 17, the prices of low-sulfur coke have experienced a downward trend of 100-150 RMB/ton, and the pricing policy continues. In the Northwest region, market transactions are moderate, with some refineries experiencing downward pressure on shipments. As for Sinopec, the market situation for medium to high-sulfur coke remains favorable. Refineries mostly maintain contract shipments, with most of them having no inventory pressure, and coke prices are currently stable. In the case of CNOOC, the prices of low-sulfur coke have also followed a downward trend, with a somewhat subdued trading atmosphere and a decline in coke prices ranging from 100-300 RMB/ton.

On the local refineries side, the trend of refinery coke prices has shown differentiation within the month. In the early to mid-month, the low-sulfur coke market performed relatively well. Due to limited supply in the medium to low-sulfur coke market, prices sporadically increased. However, with insufficient stimulation from the demand side, especially in terms of negative electrode materials, and the continuous downward movement of prices for low-sulfur coke from major refineries, the mid-month period saw a high-level consolidation in the medium to low-sulfur coke market. On the contrary, the high-sulfur coke market has shown a trend of suppression followed by rebound within the month, with some refineries experiencing a low-level rebound.

On the supply side, the domestic petroleum coke market has relatively sufficient supply in November. Among major refineries, only Qingdao Petrochemical and Guangzhou Petrochemical have undergone maintenance, and most local refineries are operating normally, with a few undergoing short-term maintenance or slight reductions in production.

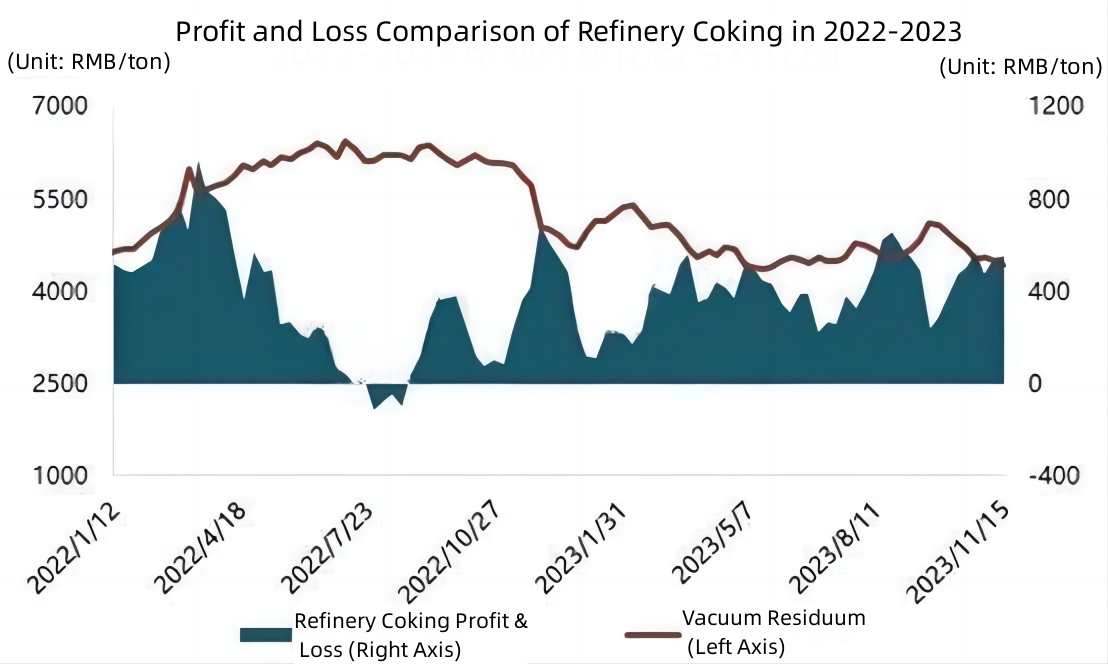

Regarding coke profit, as of November 15, the profit of refinery coking units is approximately around 550 RMB/ton, a decrease of around 3% from the end of October. This is mainly attributed to the recent volatile downward trend in European and American crude oil futures. The oil market has been weak, with downstream product prices falling more than the drop in raw material residual oil, leading to a slight decline in coking profits.

On the demand side, in November, the Southwest region entered the dry season, and downstream aluminum electrolysis units have successively reduced production, resulting in a decreased enthusiasm for purchasing petroleum coke as a raw material. The market atmosphere for negative electrode materials is weak, with limited orders, and companies mostly rely on previous inventory. Some fuel-related demands may face production restrictions due to environmental policies.

Future Market Forecast: Considering the comprehensive impact of costs and supply and demand, it is expected that from late November to December, the overall situation in the domestic petroleum coke market will continue to maintain a stable but weak consolidation trend.

On the raw material side, European and American crude oil futures may continue to show a volatile trend, and the retail limit prices for finished oil products in the next cycle may be lowered, realizing an overall weak sentiment in the oil market, with little positive support from the cost side.

On the supply side, there are currently no expectations for maintenance of domestic coking units in the near term. The operating load of coking units may remain relatively firm, and the supply of petroleum coke in the domestic market may remain sufficient. Moreover, due to the sluggish market demand, the consumption rate of port inventories is expected to slow down.

On the demand side, the impact of the dry season in the Southwest region may limit the upward space for the operating load of downstream aluminum electrolysis units, resulting in weak demand performance in the carbon market for aluminum use. Additionally, with the arrival of the winter heating season in the northern regions, some downstream industries may see a decline in operating loads due to environmental policies, and short-term demand may be difficult to boost positively. If you have any demand for petroleum coke series products, feel free to contact us.

No related results found

0 Replies