【UHP Graphite Electrode】December Domestic Market Trends

【UHP Graphite Electrode】December Domestic Market Trends

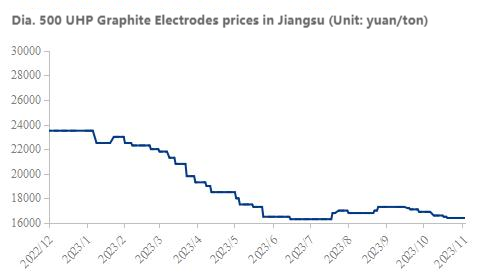

In November, China domestic ultra-high power (UHP) graphite electrode market showed mixed strength and weakness, with a month-on-month decline of 500 yuan/ton in some specifications. Fierce market competition led to another drop in ultra-high power graphite electrode prices. What will be the trend in December?

Ⅰ. Review—Price Pressure

In November, domestic ultra-high power graphite electrode prices experienced a rising and then falling trend. Intense competition among graphite electrode manufacturers and frequent instances of low prices, influenced by cost reduction efforts, resulted in many graphite electrodes being awarded at low prices, ultimately leading to weak price support.

II. Cost—Continuous Weakness in Raw Materials

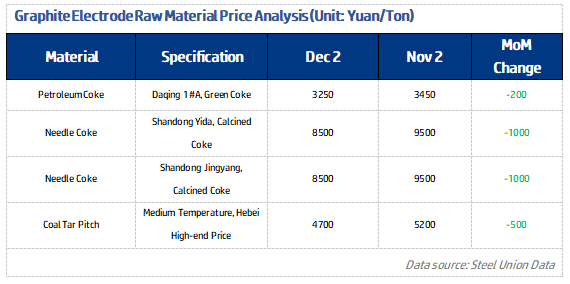

In November, Daqing petroleum coke prices were lowered by 200 yuan/ton. China domestic needle coke prices were weak, with Shandong Yida and Jingyang needle coke prices falling by 1000 yuan/ton. The overall trend of graphite electrode raw material prices was weak, with downstream industries mainly procuring based on immediate needs.

III. Demand—Positive for the Steel Market

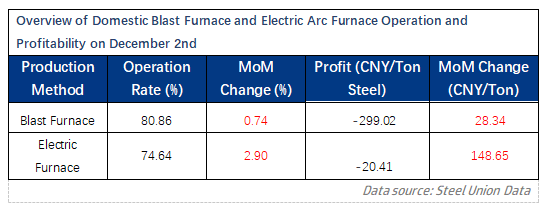

In November, the comprehensive price index of building materials rose by 5.61 points year-on-year, indicating a recovery in the steel market. From a profit perspective, electric furnaces showed a significant improvement, but blast furnaces remained in deficit. The month-on-month increase in the startup of blast furnaces and electric furnaces was slight. Demand for large-sized ultra-high power graphite electrodes rebounded, while demand for medium and small-sized graphite electrodes remained weak.

IV. December Market Outlook—Demand Persists, Competitive Pressure Unabated

(1) On the demand side, entering December, due to acceptable profits for electric furnaces, seasonal shutdowns may be postponed. Blast furnaces, due to continuous losses, may not see significant changes in the short term. Purchasing power for ultra-high power graphite electrodes may be comparable to November.

(2) On the supply side, graphite electrode production is concentrated in major manufacturers, with limited production from small and medium-sized manufacturers. Overall supply may show no significant changes.

(3) On the cost side, raw material price expectations are pessimistic, and the cost of ultra-high power graphite electrodes may trend weaker. In downstream procurement, transactions are mostly awarded at low prices, making it difficult for high prices to support ultra-high power graphite electrode prices. Prices may continue to hover around production costs.

In summary, with little change in supply and demand, a weakening cost trend, it is expected that the domestic ultra-high power graphite electrode market in December may undergo a stable yet slightly weak consolidation. Contact us to learn more about graphite electrode market news.

No related results found

0 Replies