【Needle Coke】Interweaving of Bulls and Bears: Where is the Needle Coke Market Headed?

【Needle Coke】Interweaving of Bulls and Bears:

Where is the Needle Coke Market Headed?

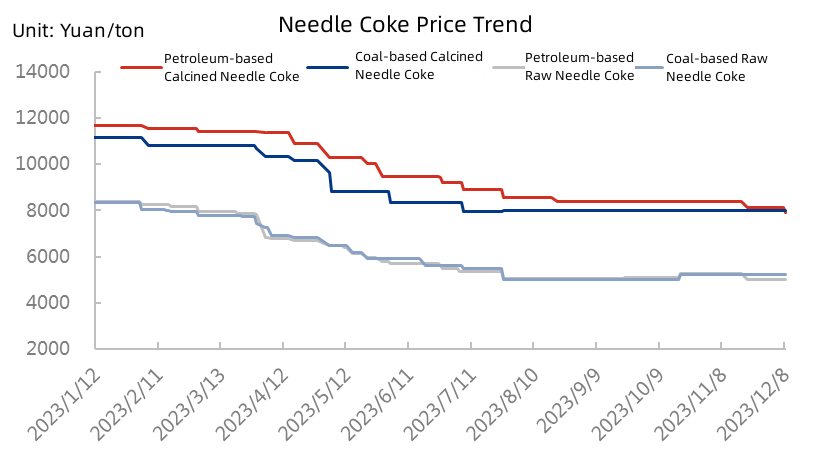

Data Source: Oilchem

As observed from the needle coke price trend chart, since 2023, the needle coke market prices have shown an overall trend of oscillating decline. In October, needle coke enterprises faced pressure to raise prices, but by November, suppressed by downstream demand, manufacturers encountered obstacles in shipments and had to lower prices for transactions. As of December 8th, the mainstream prices are approximately 5000-5300 yuan/ton for petroleum-based raw needle coke, 7000-8500 yuan/ton for petroleum-based calcined needle coke, 5200-5300 yuan/ton for coal-based raw needle coke, and 7000-8500 yuan/ton for coal-based calcined needle coke. The reasons hindering the upward push of needle coke prices include:

1. Decline in Prices of Low-Sulfur Petroleum Coke

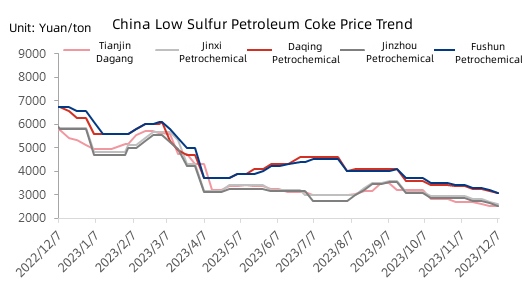

Data Source: Oilchem

Currently, China domestic petroleum coke market faces an oversupply situation, challenging to overcome. Refinery shipments are focused on volume, and approaching the end of the year, companies are consolidating funds, leading to subdued downstream enterprise transactions. It is expected that in the near term, petroleum coke prices will find it challenging to rise, with prices fluctuating narrowly in the low range. The decline in prices of low-sulfur petroleum coke, coupled with the trend of downstream enterprises reducing costs, has led to an increasing use of low-cost resources such as petroleum coke to replace needle coke, to some extent impacting the external procurement demand for needle coke.

2. Slowdown in Procurement Demand for Downstream Negative Electrodes

Approaching the end of the year, there is a decline in the order volume for negative electrode materials, leading to a slowdown in the speed of raw material procurement, mainly focusing on digesting previous inventories, with fewer new orders.

3. Maintenance of Low Output in the Graphite Electrode Sector

Graphite electrode companies, affected by factors such as the low enthusiasm for electric arc furnace steel mills to start operations, environmental protection, and high raw material prices, maintain low output. The consumption of needle coke is relatively sluggish. Although the start-up rate of steel mills has slightly increased in recent weeks, it still takes time for this to be transmitted to needle coke.

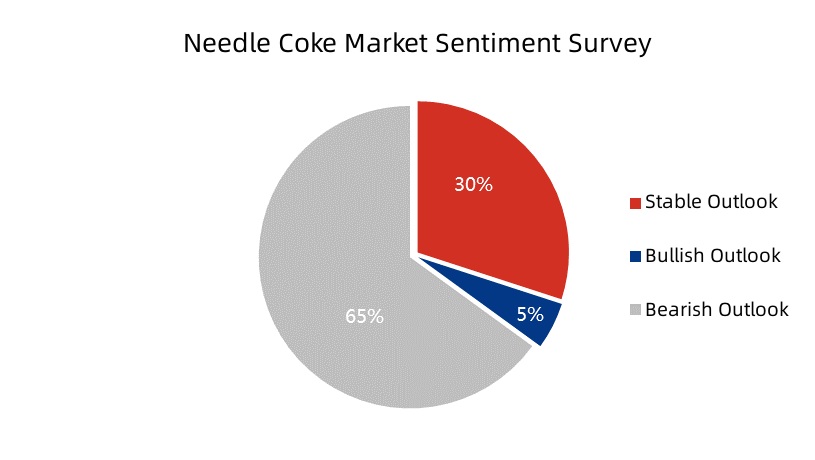

Data Source: Oilchem

Looking ahead, taking into account feedback from upstream and downstream customers, 5% of businesses are optimistic about the future, believing that needle coke production costs are under pressure, and there is still room for upward movement in prices, with positive factors for graphite electrodes providing support. 30% of businesses adopt a wait-and-see attitude, considering that needle coke prices are close to the cost line, with limited downward space, and stability is the main focus in the short term. Additionally, 65% of businesses hold a bearish attitude, believing that downstream enterprises still have some raw material inventory to digest. Before the holiday season, most companies are primarily controlling inventory, with fewer new orders. As some companies' inventories increase, there is a possibility of a slight downward adjustment in market prices to seek proactive shipments. Fourth-quarter Dynamics of Needle Coke and Downstream Markets. Consult with us for more insights.

No related results found

0 Replies