【Carburant】Market Trends Influenced by Supply and Demand

【Carburant】Market Trends Influenced by Supply and Demand

As 2023 draws to a close, downstream purchases based on demand, coupled with weak cost factors, have led to a general lack of enthusiasm in manufacturers' production. Under multiple influences, China's carburant market continues to experience a "cold winter" state with a stalemate in the weak situation between upstream and downstream, and the market has yet to show significant improvement.

Source: Oilchem

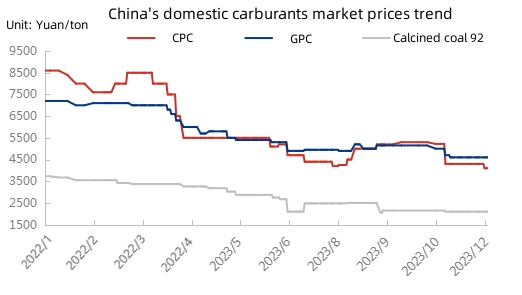

Price Aspect: The mainstream price of 92C carburant from coking coal is CNY 2100/ton, a decrease of CNY 1450/ton or 40.85% compared to the same period last year. The quoted price for low-sulfur calcined petroleum coke (CPC) carburant is CNY 4300/ton, a decrease of CNY 4200/ton or 48.83% from the same period last year. The quoted price for graphitized petroleum coke (GPC) carburant is CNY 4600/ton, a decrease of CNY 2600/ton or 36.11% from the same period last year.

In 2023, the overall prices of China's domestic coal and petroleum coke showed a trend of fluctuating downward. With the escalation of supply-demand contradictions, market prices sharply declined. As raw material prices fell and cost pressures eased, the carburant market prices also followed suit, especially for low-sulfur calcined coke carburants, which showed the most significant decline. The difference between the quoted price and graphitized carburants continued to narrow, and prices began to return to rationality at the end of March.

Source: Oilchem

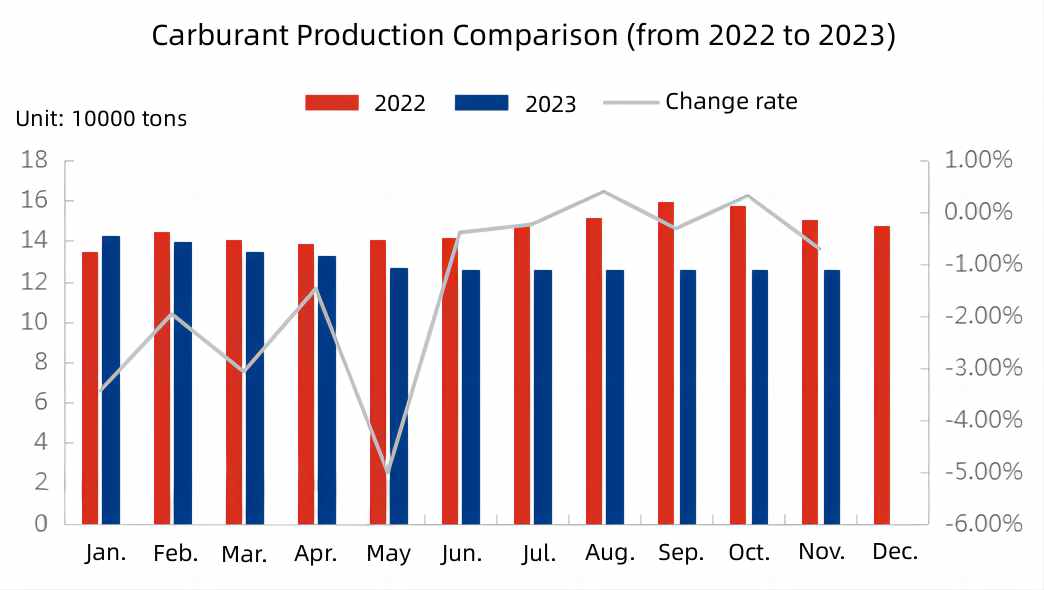

Supply Aspect: According to incomplete statistics, China's domestic carburant production from January to November is approximately 1.435 million tons, a year-on-year decrease of 303,300 tons, a decrease of 17.27%. As of now, the utilization rate of domestic carburant production capacity is maintained at 44.86%, a decrease of 7.89 percentage points compared to the same period last year.

Coking coal manufacturers' production enthusiasm remains reasonable, and the operating rate is relatively stable. Due to high costs, low-sulfur calcined coke carburant enterprises' market competitiveness has weakened, and their production enthusiasm is not high. Downstream demand mainly focuses on graphite electrodes and graphite cathodes, and is mainly composed of mixed coke. Graphitized carburants are currently mostly produced in the form of cathode materials, and with the reshuffling of the cathode market, some enterprises have reduced production due to inventory pressure.

Source: Customs Data

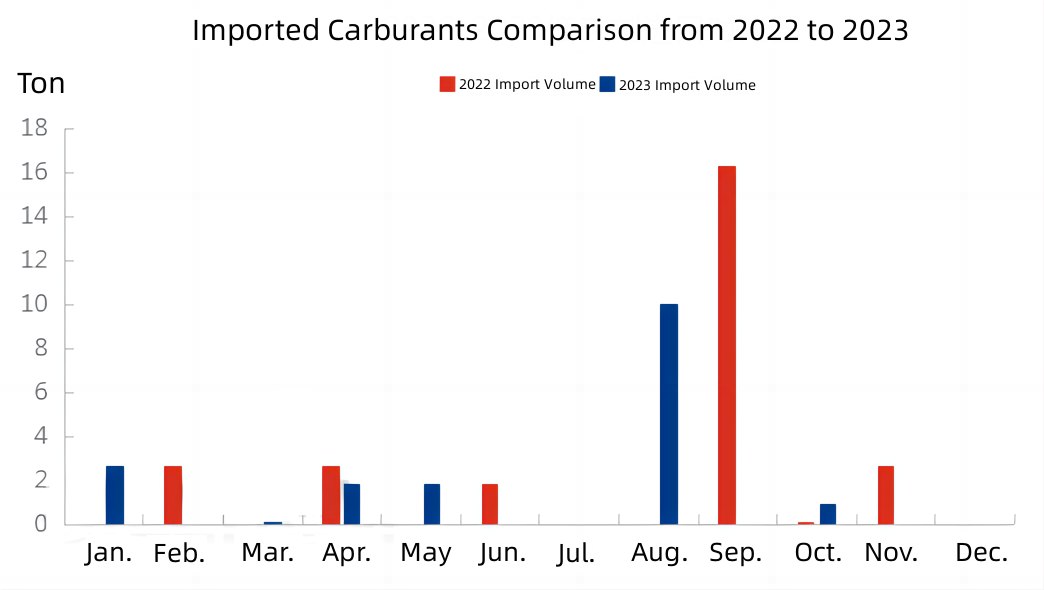

In January-October 2023, the import volume of carburants was only 17 tons, a year-on-year decrease of 9 tons or 34.61%. The carburant market is mainly export-oriented, and the import volume is almost negligible.

Source: Mysteel

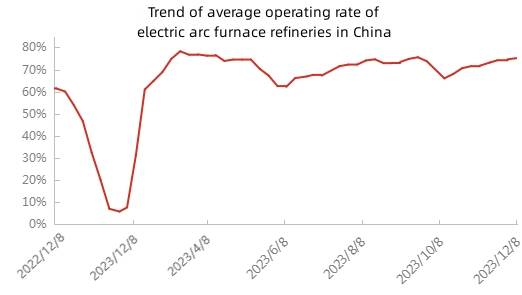

Demand Aspect: Data shows that the average operating rate of 87 independent electric arc furnace steel plants in China is 75.16%, an increase of 0.52 percentage points month-on-month and an increase of 13.69 percentage points year-on-year.

According to the data, except for the impact of the Spring Festival shutdown and maintenance at the end of January, the operating rate of electric arc furnace steel plants has basically remained in the range of 60%-80% for the rest of the time in 2023. Currently, some electric furnace plants are affected by the cold weather, showing signs of a slight reduction in production. However, some steel plants that were shut down for maintenance may return to normal operation in the near future. Therefore, overall, the operating rate of steel plants may have a slight upward trend. However, based on the current bidding situation of domestic steel plants, the number of tenders has been reduced compared to the previous period, and the prices of some bidding steel plants have been lowered.

Source: Customs Data

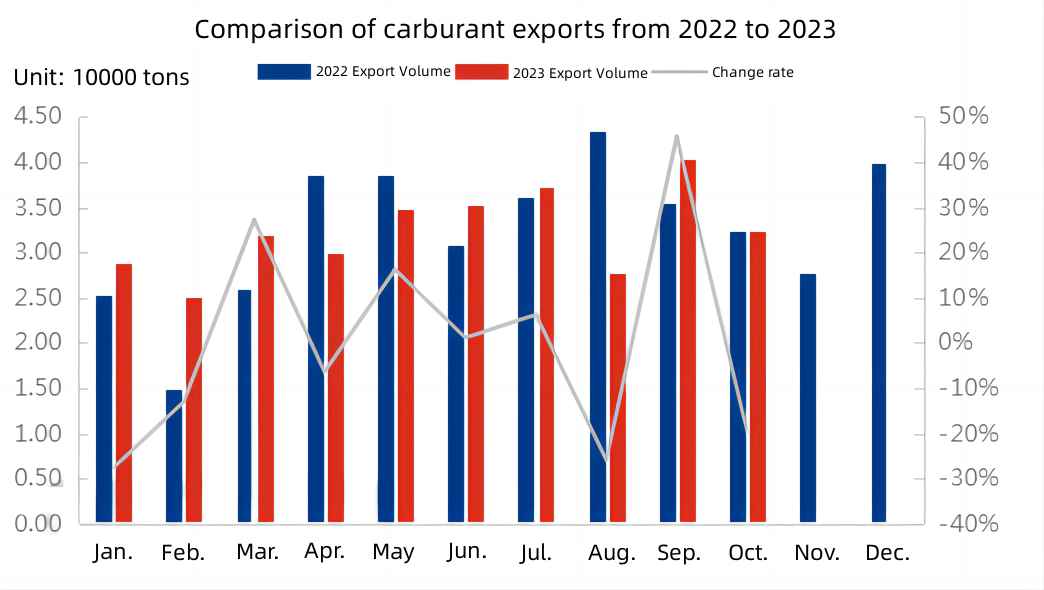

In January-October 2023, China’s domestic export volume of carburants was 323,500 tons, an increase of 160 tons or 0.49% year-on-year.

Looking at the export side, data for the past four years shows a gradual increase in the export quantity of the carburant market. The annual export volume rose to 380,000 tons in 2022. In 2023, the total domestic export volume is expected to surpass 400,000 tons. This indicates that the consumption of the carburant market abroad is gradually increasing, but the growth rate is relatively slow, and its main consumption destination is still the domestic market.

Overall Analysis: In summary, raw material prices may remain weak and fluctuate, reducing cost pressures. At the same time, the weakened support for carburant market prices is due to decreased downstream demand, which directly affects the enthusiasm of carburant enterprises for production. The simultaneous weakness in both upstream and downstream processes has doubled the pressure on intermediate link enterprises. Carburant market prices may stabilize and weakly fluctuate as a result. Contact us to learn more...

No related results found

0 Replies