【Petroleum Coke】Decrease in Imports: Can the Domestic Market Experience Positive Stimulus?

【Petroleum Coke】Decrease in Imports:

Can the Domestic Market Experience Positive Stimulus?

Data Source: General Administration of Customs, Oilchem

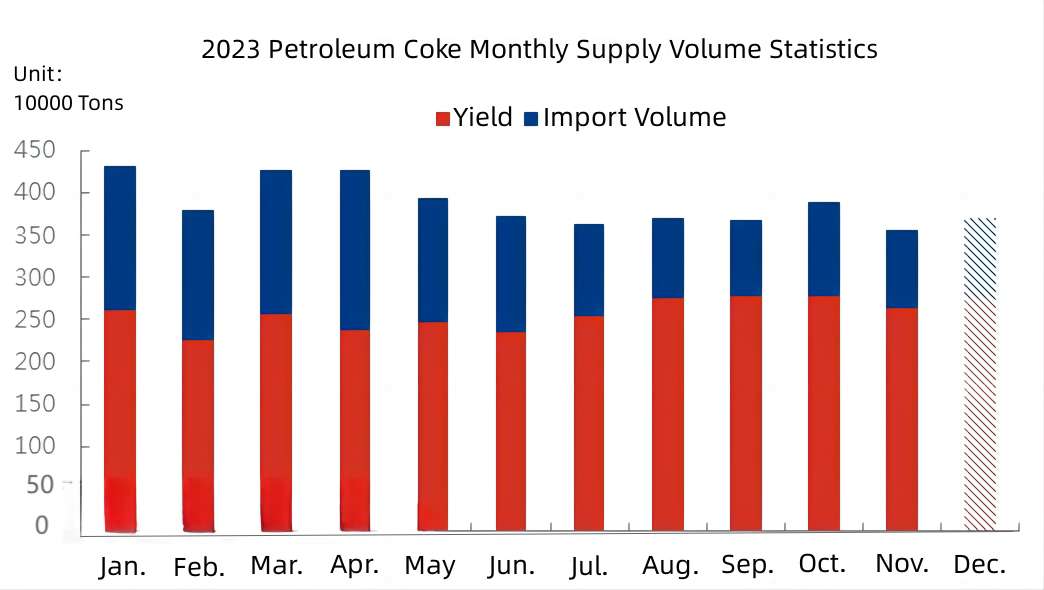

The overall trading in the domestic petroleum coke market in December has improved from weakness to strength. In the latter part of the month, there was a noticeable pull in demand, with refineries' transaction prices stabilizing and some coke prices slowly rebounding. From the supply side, domestic petroleum coke production is gradually recovering, leading to an increase in domestic resource supply. Additionally, due to cost differences and a reduction in overseas orders, there has been a significant decrease in the import of petroleum coke.

According to data from the General Administration of Customs, the total import of uncalcined petroleum coke from January to November 2023 was 14.6444 million tons, a year-on-year increase of 7.25%, and the specifications of calcined petroleum coke products for your reference. However, the import volume in November hit the lowest point for the year, reaching only 920,800 tons, a month-on-month decrease of 17.28% and a year-on-year decline of 52.6%, with a reduction of 1.0218 million tons compared to the same period last year.

In December, domestic petroleum coke supply continued to increase, with refinery delayed coking unit operating rates reaching around 75%, resulting in a monthly petroleum coke production of approximately 2.75 million tons. Imported petroleum coke continued to enter the domestic market, with import sources concentrating on sulfur content of 1.0% or less and 3.5% or more, showing a continuous imbalance in import indicators. Coupled with the high overseas prices, the domestic coke prices continued to decline, creating a sustained cost advantage for imported coke, leading to a strong reluctance among traders to sell.

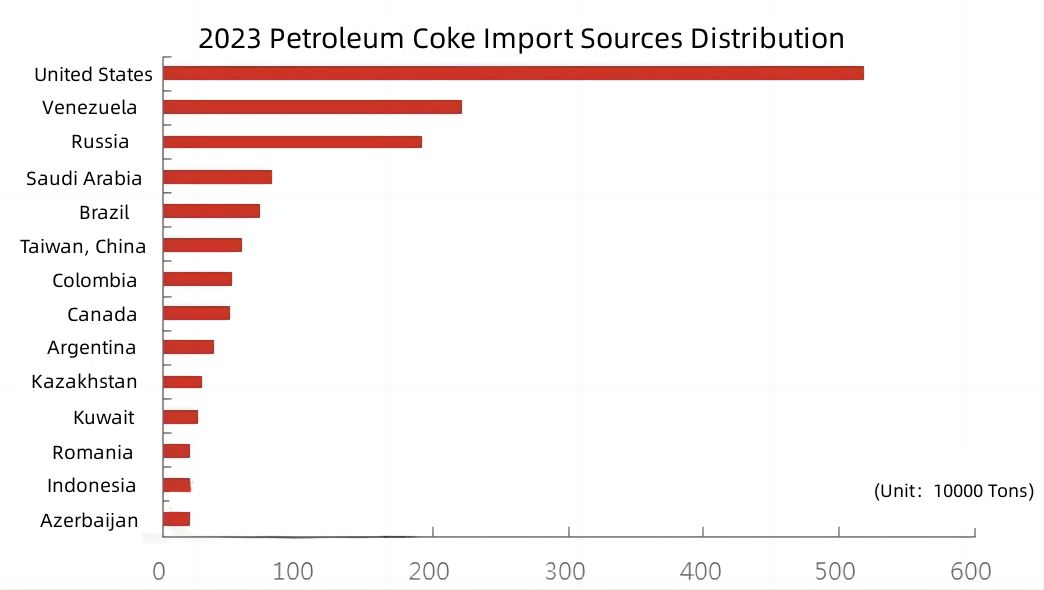

Data Source: General Administration of Customs

Looking at the main sources of petroleum coke imports from January to November, the United States remained the top importer with a volume of 5.1882 million tons. Venezuela followed with an import volume of 2.2146 million tons, but there is no import data for Venezuelan shipments in November. Russia imported 1.9204 million tons of petroleum coke, and there is significant attention from industry insiders regarding Russia's cancellation of petroleum coke tariffs. However, according to market research from Longzhong Information, the current export tariff for Russian petroleum coke is $1.6 per ton, and the actual impact after the cancellation is minimal. Importers are still mainly concerned about domestic import tariff policies, providing no substantial positive boost for the subsequent import of Russian petroleum coke.

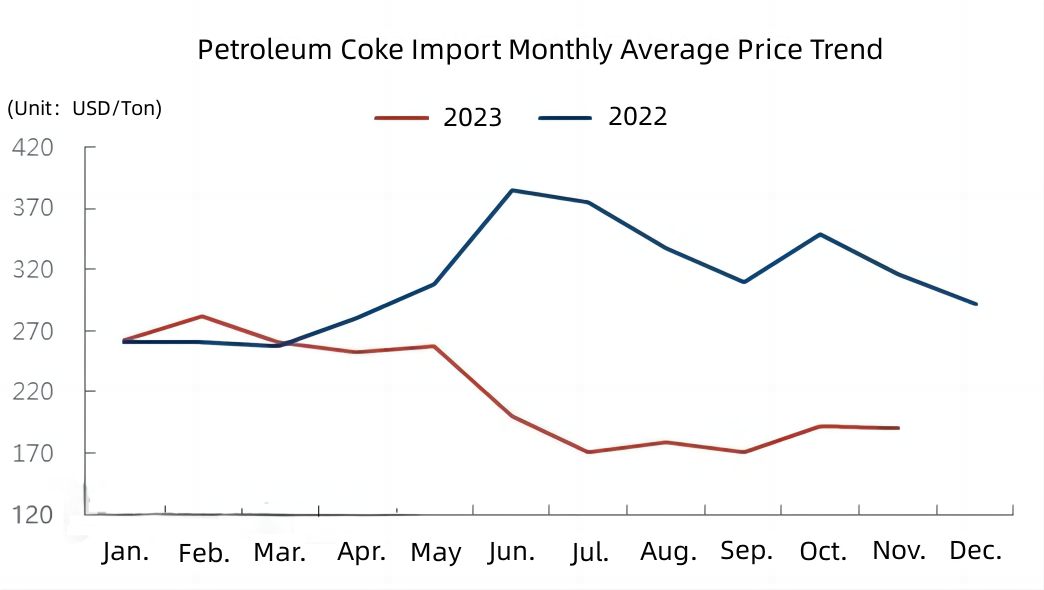

Data Source: General Administration of Customs

Looking at the monthly average price of imported petroleum coke, the prices in 2023 have experienced a high-level decline. In the fourth quarter, the cost price of imported coke remained above $190 per ton, but domestic coke prices entered a downward trend, eroding the price advantage of imported sources. As high-cost sources gradually reach the domestic market, the mentality of import traders remains cautious, and port inventories are slowly rising again.

As the year-end approaches, the enthusiasm for downstream enterprises to stock up has slightly increased. Additionally, the difficulties in raw material procurement and logistics caused by heavy snow in some areas have led to an expectation that the demand for restocking before the holiday season will accelerate the delivery of domestic petroleum coke, providing positive support for domestic coke prices. To learn more about the petroleum coke market, feel free to contact us.

No related results found

0 Replies