【Negative Electrode Materials】The Onset of "Internal Competition" in 2024

【Negative Electrode Materials】The Onset of "Internal Competition"

for Negative Electrode Material Manufacturers in 2024

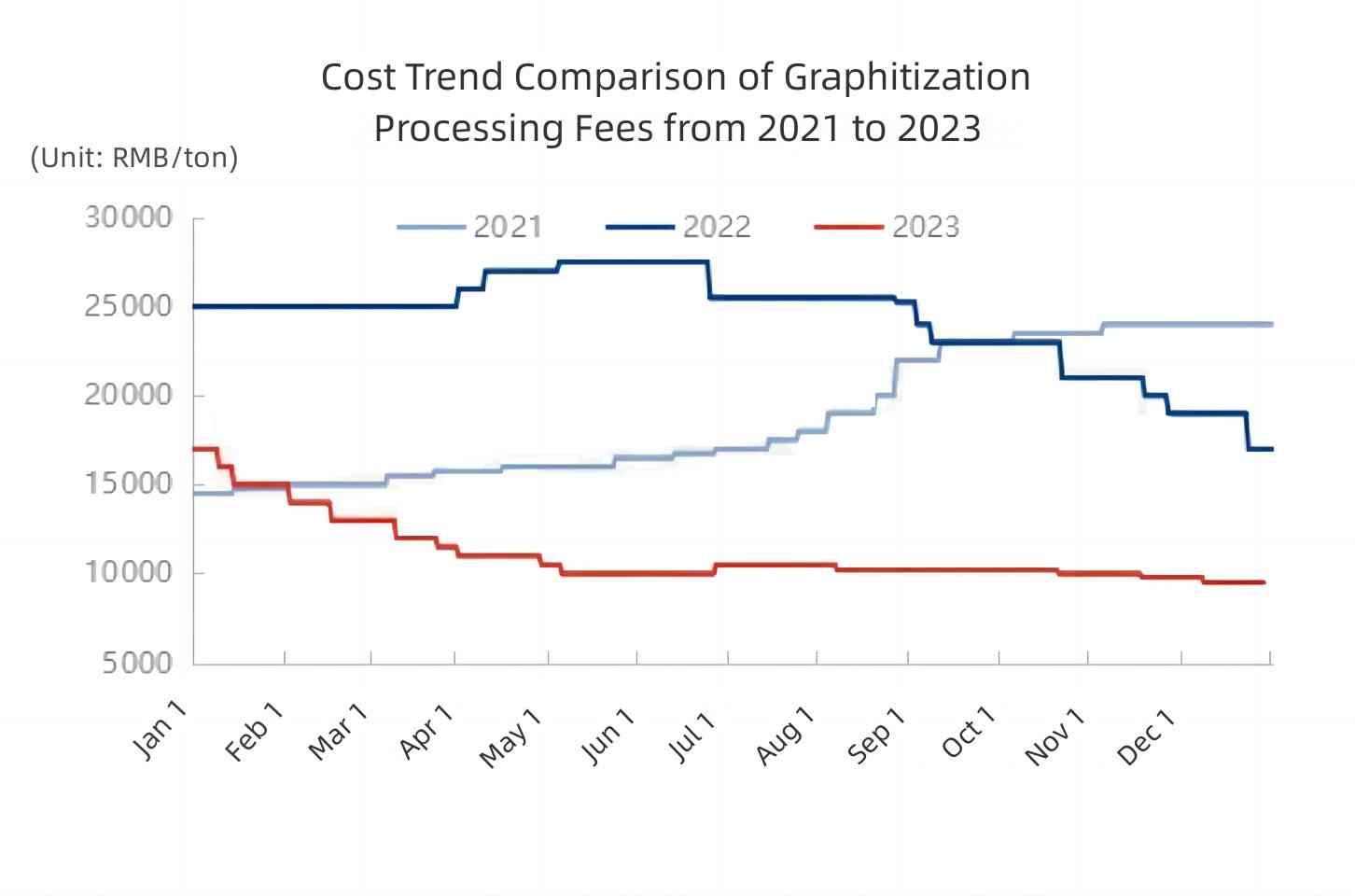

In terms of graphitization, in 2023, the average price of graphitization dropped from 16,000 yuan/ton at the beginning of the year to 9,500 yuan/ton, a decrease of 40.63%. The overall market for graphitization shows an oversupply, and the gradual layout of integrated capacity by leading companies has significantly reduced outsourced graphitization volume, and the specifications of graphitized petroleum coke products. Graphitization profits continue to narrow, with some manufacturers bidding for orders for the coming year, leading to a trend of price competition, and certain graphitization processing entering a loss-making state.

Data Source: Oilchem

From a profit perspective, the profit decreased from 138.06 million yuan in January 2023 to 37.88 million yuan/ton in December, a decrease of 72.56%. The decline in profit is mainly due to the continuous decline in the finished product prices of negative electrode materials, leading to a continuous narrowing of gross profit margins. In December, according to feedback from negative electrode material manufacturers, some product production entered a loss phase, and the industry's profit performance was poor.

2024 has also become the beginning of "internal competition" for negative electrode material manufacturers. Various companies are reducing costs through competition in integrated processes, technological updates, and resource integration.

However, uncertainties in downstream demand, adverse effects of overseas policies, coupled with the structural oversupply in the negative electrode market itself, continue to revolve around "low cost, high performance, new technology, new direction, and industrial integration" for sustained development. The development of the inherent advantages of graphite and the mass production of new negative electrodes remain the driving forces for fast charging, continuity, integration, and more. Despite structural oversupply and the industry entering a reshuffling period, the negative electrode materials market still has significant growth potential in the long term. Market information on lithium battery negative electrode materials, welcome to follow our subsequent reports.

No related results found

0 Replies