【Petroleum Coke】2023 Port Inventory Overview

【Petroleum Coke】2023 Port Inventory Overview

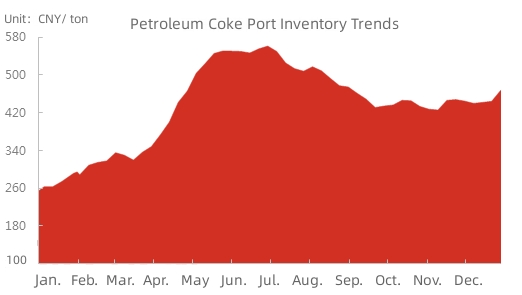

The overall trading activity in the imported petroleum coke market in 2023 remained weak, with a continuous influx of long-term contracts from international traders throughout the year. The situation of oversupply persisted, as the domestic supply of imported petroleum coke exceeded demand. With the continuous decline in the domestic price of petroleum coke, and the specifications of graphitized petroleum coke for your reference, a significant price inversion was evident in imported coke, leading to a surge in spot inventory at ports to near-record highs in recent years.

Source: Oilchem

According to market research, the spot inventory of imported petroleum coke at ports has consistently increased, reaching a historical high of 4.674 million tons by December 2023, representing a year-on-year increase of 2.183 million tons or 87.64%.

In the first half of 2023, a substantial amount of imported petroleum coke continued to arrive in the domestic market, with a total import volume of 9.6854 million tons, a year-on-year increase of 2.8502 million tons or 41.7%. During the first half of the year, as imported coke gradually entered the domestic market and mostly constituted high-priced long-term contract orders, the slow pace of delivery, coupled with the reluctance of traders to sell, resulted in spot inventory exceeding 5.5 million tons.

In the second half of the year, due to cautious market entry by domestic demand and the fluctuation of domestic coke prices at a low level, the overall delivery of imported petroleum coke was unsatisfactory, and port inventories were maintained at over 4.3 million tons. In the fourth quarter, the severe cost inversion of newly arrived imported coke due to high external prices, coupled with the reluctance of traders to sell, led to another increase in port spot inventory to around 4.6 million tons. The demand support for imported sponge coke in the market was weak, and the slowdown in shipment speed at northern ports, affected by domestic resources, further highlighted the contradiction of oversupply in the petroleum coke market. The market operated at a high level for an extended period.

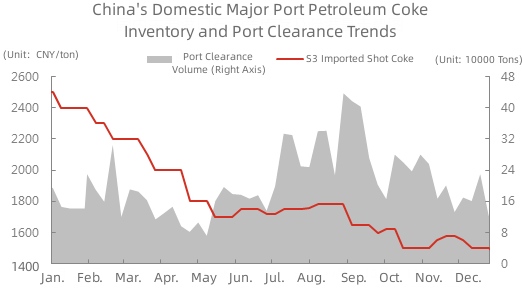

Source: Oilchem

The imported petroleum coke market traded weakly in 2023. In the first half of the year, the price of imported shot coke dropped from CNY 2500/ton at the beginning of the year to CNY 1700/ton. With the continuous decline in the domestic coke price, the petroleum coke market operated sluggishly. The overall delivery speed of spot petroleum coke at ports slowed down, with weekly port discharging volumes ranging from 100,000 to 300,000 tons. In the second half of the year, as low-cost imported coke gradually arrived in the domestic market, the spot price at ports offset the positive outlook for shipments. The weekly discharging volume of petroleum coke at major ports increased to around 420,000 tons. However, the price increase of imported petroleum coke was weak, and the overall price remained fluctuating at CNY 1500/ton.

Future Forecast:

In January, the domestic petroleum coke market saw improved trading, and the positive trend in transaction prices favored the signing and volume of spot petroleum coke at ports. By mid-January, the weekly port discharging volume of petroleum coke reached around 310,000 tons, and the inventory decreased to around 4.5 million tons. It is expected that the arrival of petroleum coke at ports in late January will be significantly reduced, and additional costs such as freight and insurance for some routes will increase due to the impact of international events, contributing to a further increase in the external cost of petroleum coke.

It is anticipated that in late January, the spot petroleum coke at ports will mostly be driven by the execution of contract orders, and with the decrease in the arrival volume of imported petroleum coke, spot inventory at ports may continue to decline slowly. Any inquires of graphitized petroleum coke, feel free to contact us.

No related results found

0 Replies