【Anode】Lithium Battery Materials: The Anode

【Anode】Lithium Battery Materials: The Anode

The cost composition of a lithium battery is as follows: Cathode 45% + Anode 15% + Electrolyte 20% + Separator 10% + Others 10%.

Key Conclusion: From a technological perspective, graphite is currently the mainstream material for power battery anodes. The market for anode materials is highly homogeneous with low technical barriers and transparent technology pathways, where the competition is centered on cost-effectiveness.

The cost of synthetic graphite primarily derives from graphitization and raw materials. The cost difference among anode material companies depends on the self-sufficiency rate of graphitization and raw materials(i.e. graphitized petroleum coke), with companies generally adopting an integrated business approach to extend upstream.

The years 2023-2024 mark a period of capacity release for anode materials. Since 2023, due to capacity release, battery clients reducing inventory, and the digestion of high-cost inventory, the profitability of anode material companies has significantly deteriorated (especially in Q3 2023).

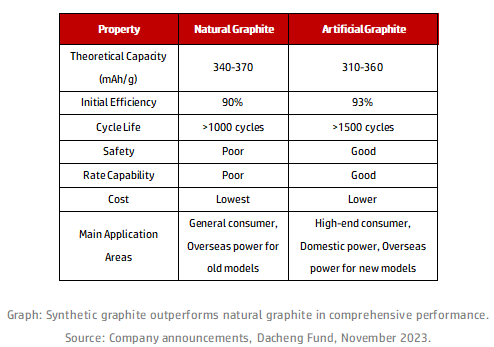

Currently, synthetic graphite is the primary material for battery anodes, accounting for over 80% of the market, with the remaining majority being natural graphite. Due to its advantages such as high rate capability, long cycle life, and low expansion, synthetic graphite is mainly used in large-capacity automotive power batteries and mid-to-high-end consumer batteries, while natural graphite is primarily used in small lithium-ion batteries and general-purpose consumer batteries.

Hard carbon anodes are the first choice for sodium batteries. Unless cycle life issues are resolved (which is difficult), it's challenging to break into the energy storage market, limiting its application to two-wheel vehicles and some A00 class vehicles with low demand. Hard carbon can't be widely used in lithium batteries due to its low initial efficiency, poor low-potential lithium storage performance, tendency for lithium plating at full charge state, and low tap density.

The main cost differences arise from the self-sufficiency rates of graphitization and raw materials.

The bottleneck for the energy density of power batteries lies in the cathode, with the theoretical specific capacity of lithium iron phosphate being 170mAh/g and ternary materials 280mAh/g, significantly lower than that of the anode at 360mAh/g. Therefore, battery manufacturers prioritize cost-effectiveness over performance for anode materials, favoring low to mid-end anode materials, with over 70% being low-end products and 20% mid-end products.

Automotive power batteries mainly use synthetic graphite, whose production processes include crushing, granulating, baking, high-temperature graphitization, carbonization, and product processing, with the main costs being graphitization and raw materials. For example, Shangtai Technology (with a 100% self-sufficiency rate in graphitization) reports that graphitization and raw materials account for 40% and 20% of the costs, respectively.

There are two graphitization processes and three furnace types.

Acheson furnaces and box furnaces can be converted through technological upgrades. Box furnaces have lower energy consumption, while Acheson furnaces provide better graphitization effects. Each has its advantages and disadvantages, and box furnaces cannot completely replace Acheson furnaces. Continuous graphitization processes face technological bottlenecks, including the challenge of finding suitable high-temperature resistant materials, cooling issues, and poor equipment stability.

There are no significant differences in furnace process technologies among anode material companies. The cost differences mainly arise from the self-sufficiency rates of graphitization and raw materials. Anode material companies generally reduce costs through vertical integration in the supply chain, extending upstream to the graphitization process to increase self-sufficiency and locating production in areas with relatively low electricity costs; they also invest in chemical companies to increase the self-sufficiency of raw materials (petroleum coke, needle coke, etc.). For more related reports, please contact us.

No related results found

0 Replies