【Petroleum Coke】Market Situation Briefing for March 13, 2024

【Petroleum Coke】Market Situation Briefing for March 13, 2024

1. Petroleum Coke

Slight uptrend in coke prices, improved market shipments

The overall price of petroleum coke remains stable, with slight fluctuations in prices at some refineries. The main coke price remains stable at an average of 2113 yuan/ton, an increase of 1 yuan/ton compared to yesterday, while the local refinery price averages 1766 yuan/ton, up 4 yuan/ton from yesterday. Specifically, in terms of main operations: Sinopec refineries are executing more order contracts, resulting in good shipments, while CNPC refineries maintain stable trading, and CNOOC refineries are relatively active in shipments. In terms of local refineries: today's coke prices have remained stable with minor adjustments, with slight increases being the main trend, with price fluctuations ranging from 10 to 100 yuan/ton. Refineries are actively clearing inventory and shipping, leading to improved market shipments. Recently, there has been an increase in delayed coking unit maintenance, resulting in a reduction in the supply of petroleum coke in the market, which is favorable for market shipments. It is expected that coke prices will remain stable in the short term, with some refineries adjusting prices according to their own circumstances.

2. Calcined Petroleum Coke

Limited downstream demand, stable price operation

The price of calcined petroleumcoke(cpc) remains stable, with an average price of 2793 yuan/ton. Petroleum coke prices at the cost end remain stable with minor adjustments, providing general support to the calcined coke market. Shipments of low-sulfur calcined coke remain stable, with most transactions based on existing contracts, while trading for medium to high-sulfur calcined coke remains stable with acceptable shipments. Downstream stocking remains at a just-in-time procurement level, providing weak support for calcined coke. The operation of anodes for aluminum smelting and cathode enterprises remains stable, with slow progress in the resumption of operations for negative electrode enterprises. Overall, market performance is weak, with insufficient demand in the graphite electrode market, and no significant changes in transaction focus by enterprises. Prices in Northeast China are around 3700 yuan/ton, in Shandong around 2350 yuan/ton, in Jiangsu around 2250 yuan/ton, and in Northwest China around 2200 yuan/ton. It is expected that the calcined coke market will remain weak and stable in the short term.

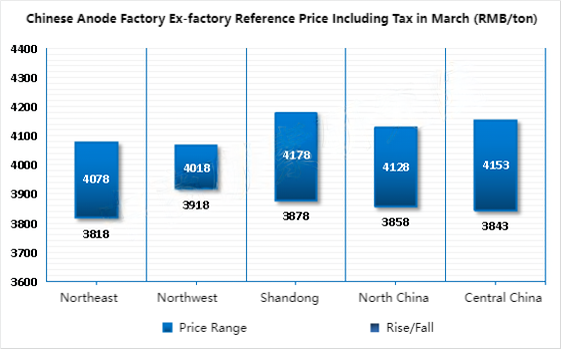

3. Prebaked Anodes

Pressure on costs remains, profits of some anode companies under pressure

Market trading is stable, and anode prices remain stable. Petroleum coke prices at the cost end are stable with minor adjustments, with stable shipments from main operations and active shipments from local refineries. Supply of coal tar pitch has increased in the market, but new transactions are being observed cautiously. Fluctuations in raw material prices for anodes are putting pressure on costs, resulting in profit pressures for some companies. Demand-side aluminum smelting prices have made minor adjustments, with slower destocking speeds, and sufficient spot supply in the market, leading to stable demand for anodes. Anode company production is stable, with some companies operating at full capacity, and stable demand with good supply in the market. It is expected that anode prices will remain stable this month. Prebaked anode market transaction prices range from 4090 to 4590 yuan/ton at the low end and from 4490 to 4990 yuan/ton at the high end.

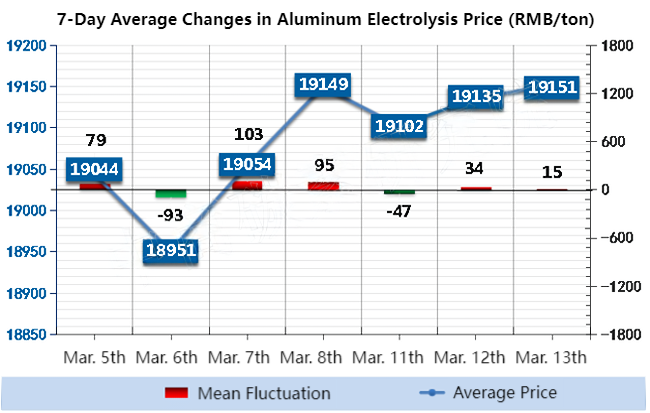

4. Electrolytic Aluminum

Slight fluctuations in aluminum prices, cautious market procurement

Prices in East China have increased by 20 yuan/ton compared to the previous trading day, while prices in South China have decreased by 10 yuan/ton. The receiving parties in East China are showing bearish sentiment, with low purchasing enthusiasm in the market, while in South China, there are more shipments than receipts, resulting in overall average transactions. In terms of macro factors, there have been fluctuations in market sentiment due to repeated expectations of interest rate cuts by the Federal Reserve, while domestic policies continue to be favorable, leading to positive market sentiment expectations. In terms of fundamentals, there has been a trend of accumulating stocks in the aluminum social warehouses, with peak values lower than in previous years. Overall, there have been no significant changes in the supply side, but rumors have circulated about the expected resumption of production capacity by aluminum smelters in Yunnan Province, which may reach 650,000 tons. It is expected that aluminum prices will undergo oscillating adjustments in the short term, with spot prices for aluminum running between 18870 and 19220 yuan/ton. For more information on the upstream and downstream markets of petroleum coke, feel free to contact us at any time.

No related results found

0 Replies