Graphitized petroleum coke is widely used in producing high-end graphite electrodes, lithium battery anode materials, and carbon products. Its high conductivity, purity, and graphitization make it a vital raw material in metallurgy, energy, and advanced materials industries.

【Petroleum Coke】at 2854 RMB/t! Refinery Maintenance Surge—Where Are Prices Headed?

【Petroleum Coke】at 2854 RMB/t! Refinery Maintenance Surge—Where Are Prices Headed?

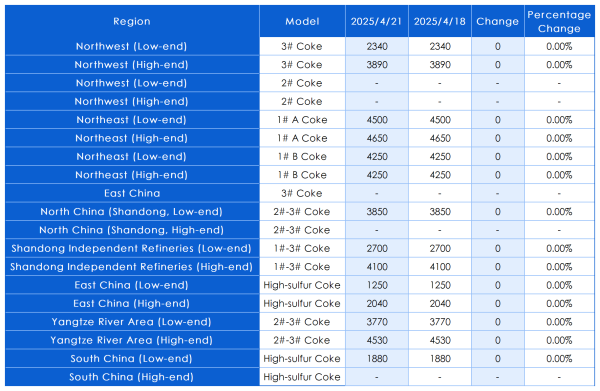

As of April 21, in China, the average market price of petroleum coke stood at RMB 2,854/ton, unchanged from the previous working day. Trading activity remained moderate. During the current maintenance season, production halts have increased at major refineries, tightening supply and stabilizing overall prices. Local refineries saw average sales, with prices either holding steady or declining slightly.

Regional Market Highlights

Sinopec-affiliated refineries: Operated on-demand. In the Yangtze River region, Hunan Petrochemical began a two-month shutdown for maintenance today. Anqing Petrochemical primarily supplies anode materials. Jiujiang Petrochemical remains under maintenance, while other refineries are running normally. In East China, one unit at Shanghai Petrochemical has resumed normal production. In North China, the shutdown duration for Tianjin Petrochemical's large coke unit remains undetermined.

PetroChina-affiliated refineries: Maintained stable pricing and shipments. Daqing Petrochemical and Jinxi Petrochemical continue to undergo maintenance. Supply remains tight, providing mild support to the market. In Northwest China, most refineries supply carbon materials for aluminum production, and demand is relatively stable.

CNOOC-affiliated refineries: Delivered petroleum coke based on existing orders.

Local refineries: From the weekend through today, overall transaction levels remained moderate. Most refinery prices either declined or remained flat. Cautious sentiment dominated among downstream carbon enterprises, leading to restrained procurement activity. Some refinery prices dropped by RMB 20–300/ton under pressure, while others successfully raised prices by RMB 30–110/ton due to smooth sales and low inventory levels. Dongming Petrochemical's new refinery reported a sulfur content increase to 6.1% and shot coke content to 7%, with a latest price quote of RMB 1,200/ton. Jingbo Petrochemical reported a reduced sulfur content to 1.5%, raising its price by RMB 51/ton.

Imported coke: Recent arrivals at ports have been relatively concentrated. While traders were active in selling, market demand remained cautious, leading to lower actual transaction prices for some imported petroleum coke.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies