【Steel】Bearish Sentiment Heats Up—Will Steel Prices Face Further Declines?

Graphite electrodes are essential components in electric arc furnace steelmaking. They play a vital role in arc heating, offering excellent electrical conductivity and high-temperature resistance, and are crucial for enhancing the efficiency and quality of EAF steel production.

【Steel】Bearish Sentiment Heats Up—Will Steel Prices Face Further Declines?

The last week of May kicked off with a "Black Monday." The main rebar futures contract fell below RMB 3,000/ton, and coking coal dropped below RMB 800/ton, hitting an 8-year low. Spot prices of all steel products fell by RMB 20–50/ton across the board that day. With bearish sentiment spreading again, is the steel market at risk of a further sharp decline?

There are three main bearish arguments in the market:

(1) The impact of favorable policies is limited and unlikely to reverse the market trend.

(2) Expectations of declining demand in the off-season are intensifying, and a supply-demand imbalance is just a matter of time.

(3) With coking coal and coke prices still falling, steel mills' improving profits make production cuts unlikely.

Let's examine these three points in detail.

"Limited Policy Support Unlikely to Reverse Market Trend"

Given the background of strong supply and weak demand in the steel market, achieving a market-driven supply-demand balance will take time. Market participants are pinning their hopes on macro policy boosts, but conventional policies are unlikely to resolve the deep-rooted contradictions in the steel industry.

(1) First, the demand gap caused by the downturn in real estate has not yet been filled.

(2) Second, monetary easing has failed to create a smooth capital flow; liquidity is trapped within the financial system, creating a liquidity trap.

Recent developments, such as tariff negotiations and interest rate cuts, illustrate these points well. Tariff talks initially boosted steel prices but were quickly followed by a downturn. This is essentially a correction of the previously anticipated negative impact from increased tariffs. Tariffs mainly affect exports, and in recent years, booming exports have only served to offset weak domestic demand.

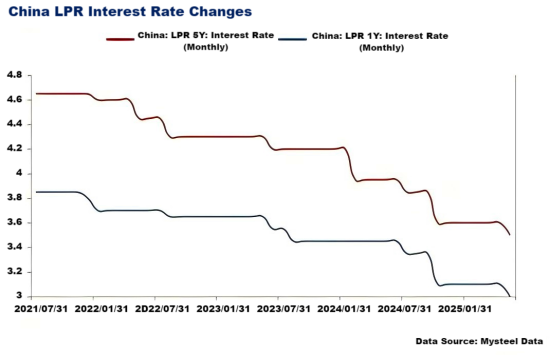

On May 7, 2025, the People's Bank of China announced a 0.5 percentage point reduction in the reserve requirement ratio and a 0.1 percentage point cut in the policy rate. Then, on May 20, the LPR was lowered by 0.1 percentage point—its first cut in 7 months since October 2024. However, the market remained largely unresponsive and the downtrend continued.

That said, it doesn't mean future macro policies will be ineffective. What the steel market needs now is targeted and appropriate industrial and fiscal policies.

"Expectations of Weaker Demand During the Off-Season Are Increasing—Supply-Demand Imbalance Is Inevitable"

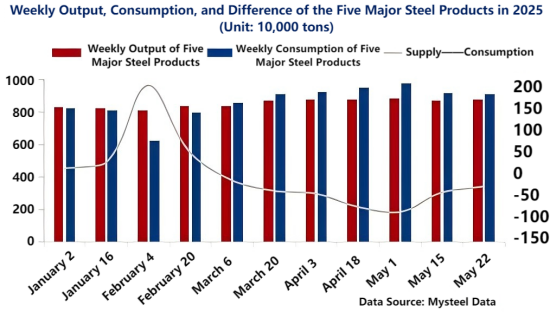

As seasonal patterns emerge, a drop in demand during the off-season is expected. Weekly steel consumption data for May confirms this trend. Due to multiple failures of peak season expectations in recent years, the market is now setting the bar very low for the off-season. This isn't just an overreaction—it reflects how deeply market confidence has eroded.

That said, actual demand is not as poor as perceived. Weekly production and consumption data for the five major steel products show that, while production is rising and consumption falling, weekly production remains lower than weekly consumption. Inventories are not yet building up.

So, the current market is primarily trading on "weak seasonal expectations." The accumulation of actual supply-demand contradictions is a process. Under low expectations, the market's self-discipline may be stronger than in previous years.

Another notable point is the increasingly apparent structural divergence within the steel market. This divergence is seen across the supply chain, between product categories, and among producers, resulting in varying degrees of demand and profitability. This explains why some stakeholders' experiences seem inconsistent with the data. It also indicates the steel industry's overall resilience remains intact, and a rapid, broad-based supply-demand imbalance is less likely in the short term.

"Coke and Coking Coal Slumps Continue—Profit Expansion Makes Output Cuts Unlikely"

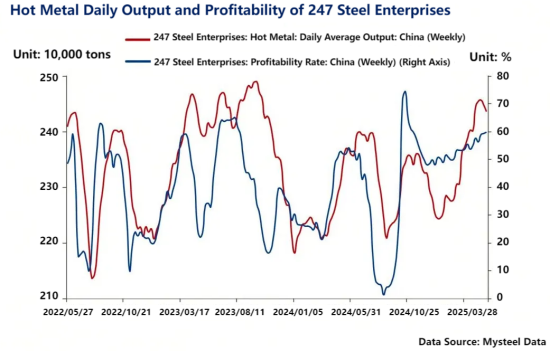

On May 26, coking coal futures fell below RMB 800/ton, hitting an 8-year low. There's no clear bottom yet, and the second round of coke price cuts has already begun. With oversupply dominating, further declines are expected. This continued drop in coke and coking coal prices has expanded steel mill profits.

This year's market logic differs from previous years. In the past, steel mills and downstream players saw profits squeezed by rising raw material costs, leading to frequent production cuts and maintenance. But this year, falling coke and coking coal prices have allowed steel mills to regain margins and maintain stable production. Also, recent strategic shifts—such as output control and inventory reduction—have made steel mills more proactive. The profit redistribution within the supply chain, thanks to cheaper raw materials, is complete.

Historically, large-scale voluntary production cuts only occur when the proportion of profitable steel mills drops below 40%. Therefore, amid expected demand decline, the continued drop in coke and coal and the mills' reluctance to cut output may push the market further downward.

Summary

The current steel market situation reflects a transition from "weak expectations" to reality. However, low inventory levels, cautious sentiment, and supportive policies provide some cushion for steel prices. Unless unexpected bearish shocks emerge, prices are more likely to decline gradually rather than collapse sharply.

Still, the market must remain vigilant against short-term emotional trading and focus on the implementation of follow-up policies and marginal changes in off-season demand.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies